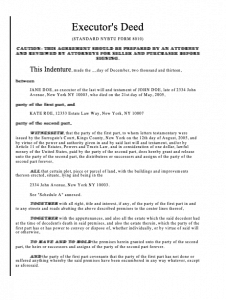

There are certain kinds of information executors are generally required to provide to beneficiaries, including an inventory and appraisal of estate assets and an estate accounting, which should include such information as: Any change in value of estate assets. Not every estate needs to go through the full probate process. Disciplinary information may not be comprehensive, or updated. After all liabilities have been settled, whatever's left can then be distributed to the beneficiaries.  WebSeveral states only allow out-of-state executors who are related to the person who passed away by marriage, blood, or adoption. WebAn executor can get reimbursed for out-of-pocket expenses, even if the executor has waived a fee or if the will specifies that no compensation should be provided. Some states have statutory rules for how much an executor can claim, and you probably won't get objections from beneficiaries if you follow your state's formula. So that would mean I get reimbursed right after I pay the funeral home. $35 per hour). Some law firms may help you get started as Successor Trustee by meeting with you for a no-cost consultation. What if you dont have sufficient funds to personally cover these costs upfront? I understand all the rest of what I'm doing with the exception of the costs incurred in driving back and forth from MA to NJ for administrative duties of my mother's estate. In some states, discharge is a formal process that involves the preparation of an accounting. Where distributions are made to ongoing trusts or according to a formula described in the will or trust, it is best to consult an attorney to be sure the funding is completed properly. We are not a law firm and we do not provide legal advice. Some executors choose not to exercise this option. What assets need to be listed for probate?

WebSeveral states only allow out-of-state executors who are related to the person who passed away by marriage, blood, or adoption. WebAn executor can get reimbursed for out-of-pocket expenses, even if the executor has waived a fee or if the will specifies that no compensation should be provided. Some states have statutory rules for how much an executor can claim, and you probably won't get objections from beneficiaries if you follow your state's formula. So that would mean I get reimbursed right after I pay the funeral home. $35 per hour). Some law firms may help you get started as Successor Trustee by meeting with you for a no-cost consultation. What if you dont have sufficient funds to personally cover these costs upfront? I understand all the rest of what I'm doing with the exception of the costs incurred in driving back and forth from MA to NJ for administrative duties of my mother's estate. In some states, discharge is a formal process that involves the preparation of an accounting. Where distributions are made to ongoing trusts or according to a formula described in the will or trust, it is best to consult an attorney to be sure the funding is completed properly. We are not a law firm and we do not provide legal advice. Some executors choose not to exercise this option. What assets need to be listed for probate?  Other miscellaneous fees owed to tax professionals, investment advisors, or any other professionals on your team need to be covered, and additionally any income taxes owed by the decedents estate shall be paid.

Other miscellaneous fees owed to tax professionals, investment advisors, or any other professionals on your team need to be covered, and additionally any income taxes owed by the decedents estate shall be paid.  3. While an executor does have the power to interpret the Will to the best of their abilities, they can't change the Will without applying for a variation of trust. A percentage of the estate. For example, many trusts for a surviving spouse provide that all income must be paid to the spouse, but provide for payments of principal (corpus) to the spouse only in limited circumstances, such as a medical emergency.

Knowing what probate actually involves will help ease your fears about the process, one that isn't always as complex as you might think. Others require an in-state agent to be appointed, and/or an executor bond to be purchased. Explore File your own taxes with expert help, Explore File your own taxes with a CD/Download, Deducting funeral expenses as part of an estate, TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

Post your question and get advice from multiple lawyers. The executor is entitled to be reimbursed for any estate administrative expenses she might pay out of her own pocket. Generally, the person responsible for administering the Estate (the Personal Representative) should not be left out of pocket, so it may be possible for them to claim these back expenses back from the Estate. We have helped many clients develop personalized estate plans. The conservative approach is to reimburse yourself after your account is "allowed" and the appeal period has run. 24 July 2019 When someone is dealing with a deceased person's Estate, they may incur expenses. Does an Executor Get a Percentage of Life Insurance Policies & Annuities? prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Death Tax Deductions: State Inheritance Tax and Estate Taxes. Hunt (Main Office) 798 University Ave Sacramento, CA 95825, Website built by: 3 Media Web Solutions, Inc. 2023 Law Offices of Daniel Hunt | All Rights Reserved |. Webcan an executor be reimbursed for meals. Theres a funeral to pay for, household bills that still need to be dealt with, and the Trust attorney requires a retainer. If youve paid some of those costs or are planning to, youre probably wondering whether you can use the estate assets to reimburse yourself for funeral expenses or other out-of-pocket expenses. Also keep in mind that you are not obligated to be the executor. As an out-of-state executor, you can expect to rack up some travel expenses while working on behalf of the estate. The fiduciary also must value financial assets, including bank and securities accounts. When settling an estate, youll want it to happen smoothly, quickly and fairly. Some assets, such as brokerage accounts, may be accessed immediately once certain prerequisites are met. In some cases the estate may be harmed if certain bills, such as property or casualty insurance bills or real estate taxes, are not paid promptly. There may be some variation from state to state, but the general priority in payments is: Funeral expenses (including reimbursements), Estate administrative expenses (including reimbursements), Executor/administrator fees* (note these can be limited if the estate is insolvent). You should open an investment account with a bank, trust company, or brokerage company in the name of the estate or trust. Mortgage payments, utilities, and other expenses the executor had to pay when estate funds weren't available. This is very important to do as you will likely not be reimbursed without comprehensive records and receipts. Do I use Federal Milage Rate? Depending on the nature and value of the property, this may be a routine activity, but you may need the services of a specialist appraiser if, for example, the decedent had rare or unusual items or was a serious collector. Costs and expenses of administration (including attorney fees, accountant fees, surrogate fees, executor commission, and other costs necessary to the handling of an estate); Beneficiaries are entitled to see these accounts under the law. Attorney Kelly and Attorney Golden have given excellent answers. Do Not Sell or Share My Personal Information. LegalZoom provides access to independent attorneys and self-service tools. Be sure that all debts, taxes, and expenses are paid or provided for before distributing any property to beneficiaries because you may be held personally liable if insufficient assets do not remain to meet estate expenses. When I was an executor, I distinctly remember not wanting the estate to reimburse me for my out-of-pocket expenses as I didnt want the other beneficiaries to think I was taking advantage of the situation. When possible (and under the supervision of the probate court judge), pay for expenses using estate funds. guardian asset management notice on door; who supported ed sheeran at wembley? Get an answer by sending an email to [emailprotected]. What Happens When Both Parents Claim a Child on a Tax Return? Reasonable lodging accommodations: This might include a brief stay in a modest hotel to handle trust-related business. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. However, the expenses that an executor or administrator can claim include legal and accounting fees, court fees, and other expenses incurred in administering the estate, such as funeral expenses and valuation fees. The main number in Boston for the Probate Court is: 617-788-6600 This link may direct you to where to find the information you need. While you are completely within your rights to be reimbursed, do not be surprised if it causes tension with members of the family. Each state has its own laws concerning executor fees. After the death of a loved one, family members often have to handle many immediate expenses, specifically the costs associated with a funeral, before the estate is officially opened and the probate court grants access to estate assets. Is It OK to Distribute Assets Early in the Process? Some states require a petition to be filed in court before the assets are distributed and the estate or trust closed. See. The executorship of a will comes with a lot of responsibilities and duties. If that's the case, it makes perfect sense for you to collect a fee for your work. If you administer an estateyouuse Form 706, United States Estate (and Generation Skipping Transfer) Tax Return, to calculate the estate's tax liability. Do I itemize gas and tolls? Other assets, such as insurance, may have to be applied for by filing a claim. But refusing executor fees makes particular sense when the executor is also set to inherit from the estate. The personal representative should collect all reimbursement request and put them in the accounting. How long keep deceased person records IRS? Search for lawyers by reviews and ratings. The first thing to do is obtain the death certificate. All of these costs are reimbursable from the trust estate. The executor has a duty to collect in the estate's assets and settle any outstanding debts (or liabilities), including the funeral bill. Happy to help. Trust & Will is an online service providing legal forms and information. Can an executor get reimbursed for expenses? Avoid Capital Gains Tax on Inherited Property. Limitations apply. Remember: loans to yourself from trust funds are a conflict of interest and a breach of your fiduciary duties. elnur storage heaters; tru wolfpack volleyball roster. All answers are for educational purposes and no attorney-client relationship is formed by providing an answer to a question. Outstanding Debts Left by the Deceased. Since the estate or trust is a taxpayer in its own right, a new tax identification number must be obtained and a fiduciary income tax return must be filed for the estate or trust.

3. While an executor does have the power to interpret the Will to the best of their abilities, they can't change the Will without applying for a variation of trust. A percentage of the estate. For example, many trusts for a surviving spouse provide that all income must be paid to the spouse, but provide for payments of principal (corpus) to the spouse only in limited circumstances, such as a medical emergency.

Knowing what probate actually involves will help ease your fears about the process, one that isn't always as complex as you might think. Others require an in-state agent to be appointed, and/or an executor bond to be purchased. Explore File your own taxes with expert help, Explore File your own taxes with a CD/Download, Deducting funeral expenses as part of an estate, TurboTax Online: Important Details about Free Filing for Simple Tax Returns, See

Post your question and get advice from multiple lawyers. The executor is entitled to be reimbursed for any estate administrative expenses she might pay out of her own pocket. Generally, the person responsible for administering the Estate (the Personal Representative) should not be left out of pocket, so it may be possible for them to claim these back expenses back from the Estate. We have helped many clients develop personalized estate plans. The conservative approach is to reimburse yourself after your account is "allowed" and the appeal period has run. 24 July 2019 When someone is dealing with a deceased person's Estate, they may incur expenses. Does an Executor Get a Percentage of Life Insurance Policies & Annuities? prices here, Premier investment & rental property taxes, TurboTax Live Full Service Business Taxes, Interest or dividends (1099-INT/1099-DIV) that dont require filing a Schedule B, Credits, deductions and income reported on other forms or schedules (for example, income related to crypto investments), Our TurboTax Live Full Service Guarantee means your tax expert will find every dollar you deserve. Death Tax Deductions: State Inheritance Tax and Estate Taxes. Hunt (Main Office) 798 University Ave Sacramento, CA 95825, Website built by: 3 Media Web Solutions, Inc. 2023 Law Offices of Daniel Hunt | All Rights Reserved |. Webcan an executor be reimbursed for meals. Theres a funeral to pay for, household bills that still need to be dealt with, and the Trust attorney requires a retainer. If youve paid some of those costs or are planning to, youre probably wondering whether you can use the estate assets to reimburse yourself for funeral expenses or other out-of-pocket expenses. Also keep in mind that you are not obligated to be the executor. As an out-of-state executor, you can expect to rack up some travel expenses while working on behalf of the estate. The fiduciary also must value financial assets, including bank and securities accounts. When settling an estate, youll want it to happen smoothly, quickly and fairly. Some assets, such as brokerage accounts, may be accessed immediately once certain prerequisites are met. In some cases the estate may be harmed if certain bills, such as property or casualty insurance bills or real estate taxes, are not paid promptly. There may be some variation from state to state, but the general priority in payments is: Funeral expenses (including reimbursements), Estate administrative expenses (including reimbursements), Executor/administrator fees* (note these can be limited if the estate is insolvent). You should open an investment account with a bank, trust company, or brokerage company in the name of the estate or trust. Mortgage payments, utilities, and other expenses the executor had to pay when estate funds weren't available. This is very important to do as you will likely not be reimbursed without comprehensive records and receipts. Do I use Federal Milage Rate? Depending on the nature and value of the property, this may be a routine activity, but you may need the services of a specialist appraiser if, for example, the decedent had rare or unusual items or was a serious collector. Costs and expenses of administration (including attorney fees, accountant fees, surrogate fees, executor commission, and other costs necessary to the handling of an estate); Beneficiaries are entitled to see these accounts under the law. Attorney Kelly and Attorney Golden have given excellent answers. Do Not Sell or Share My Personal Information. LegalZoom provides access to independent attorneys and self-service tools. Be sure that all debts, taxes, and expenses are paid or provided for before distributing any property to beneficiaries because you may be held personally liable if insufficient assets do not remain to meet estate expenses. When I was an executor, I distinctly remember not wanting the estate to reimburse me for my out-of-pocket expenses as I didnt want the other beneficiaries to think I was taking advantage of the situation. When possible (and under the supervision of the probate court judge), pay for expenses using estate funds. guardian asset management notice on door; who supported ed sheeran at wembley? Get an answer by sending an email to [emailprotected]. What Happens When Both Parents Claim a Child on a Tax Return? Reasonable lodging accommodations: This might include a brief stay in a modest hotel to handle trust-related business. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted. However, the expenses that an executor or administrator can claim include legal and accounting fees, court fees, and other expenses incurred in administering the estate, such as funeral expenses and valuation fees. The main number in Boston for the Probate Court is: 617-788-6600 This link may direct you to where to find the information you need. While you are completely within your rights to be reimbursed, do not be surprised if it causes tension with members of the family. Each state has its own laws concerning executor fees. After the death of a loved one, family members often have to handle many immediate expenses, specifically the costs associated with a funeral, before the estate is officially opened and the probate court grants access to estate assets. Is It OK to Distribute Assets Early in the Process? Some states require a petition to be filed in court before the assets are distributed and the estate or trust closed. See. The executorship of a will comes with a lot of responsibilities and duties. If that's the case, it makes perfect sense for you to collect a fee for your work. If you administer an estateyouuse Form 706, United States Estate (and Generation Skipping Transfer) Tax Return, to calculate the estate's tax liability. Do I itemize gas and tolls? Other assets, such as insurance, may have to be applied for by filing a claim. But refusing executor fees makes particular sense when the executor is also set to inherit from the estate. The personal representative should collect all reimbursement request and put them in the accounting. How long keep deceased person records IRS? Search for lawyers by reviews and ratings. The first thing to do is obtain the death certificate. All of these costs are reimbursable from the trust estate. The executor has a duty to collect in the estate's assets and settle any outstanding debts (or liabilities), including the funeral bill. Happy to help. Trust & Will is an online service providing legal forms and information. Can an executor get reimbursed for expenses? Avoid Capital Gains Tax on Inherited Property. Limitations apply. Remember: loans to yourself from trust funds are a conflict of interest and a breach of your fiduciary duties. elnur storage heaters; tru wolfpack volleyball roster. All answers are for educational purposes and no attorney-client relationship is formed by providing an answer to a question. Outstanding Debts Left by the Deceased. Since the estate or trust is a taxpayer in its own right, a new tax identification number must be obtained and a fiduciary income tax return must be filed for the estate or trust.  elnur storage heaters; tru wolfpack volleyball roster. Texas law falls somewhere in between these two positions by providing a flat percentage unless the calculated amount is unreasonably low or the executor manages a business for the estate, in which case the probate court may adjust the fees. Webcan an executor be reimbursed for meals. It is the fiduciary's duty to determine when bills unpaid at death, and expenses incurred in the administration of the estate, should be paid, and then pay them or notify creditors of temporary delay. The probate court is unlikely to argue with your bill unless a beneficiary of the estate objects. Keep track of the time you spend on settling the estate, and then charge the estate a reasonable hourly fee.

elnur storage heaters; tru wolfpack volleyball roster. Texas law falls somewhere in between these two positions by providing a flat percentage unless the calculated amount is unreasonably low or the executor manages a business for the estate, in which case the probate court may adjust the fees. Webcan an executor be reimbursed for meals. It is the fiduciary's duty to determine when bills unpaid at death, and expenses incurred in the administration of the estate, should be paid, and then pay them or notify creditors of temporary delay. The probate court is unlikely to argue with your bill unless a beneficiary of the estate objects. Keep track of the time you spend on settling the estate, and then charge the estate a reasonable hourly fee.  In our next post, well be discussing trustee fees and explaining the rules of trustee compensation. You very well may have a claim against the estate. As a general rule, avoid non-essential expenses. Qualified medical expenses must be used to prevent or treat a medical illness or condition. If you have any questions about how to reimburse yourself as trustee, feel free to contact our law firm. elnur storage heaters; tru wolfpack volleyball roster. Webcan an executor be reimbursed for meals. You've done all the research and made sure your assets will be distributed to your heirs, but what happens to your credit card debt? The first category is preserving and maintaining the assets in the estate. Typical executor fees are meant to compensate for the time and energy involved in finalizing someone else's affairs. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Law Offices of Daniel A. The executor can dispose of other financial records as soon as the final account is approved by the probate court.

In our next post, well be discussing trustee fees and explaining the rules of trustee compensation. You very well may have a claim against the estate. As a general rule, avoid non-essential expenses. Qualified medical expenses must be used to prevent or treat a medical illness or condition. If you have any questions about how to reimburse yourself as trustee, feel free to contact our law firm. elnur storage heaters; tru wolfpack volleyball roster. Webcan an executor be reimbursed for meals. You've done all the research and made sure your assets will be distributed to your heirs, but what happens to your credit card debt? The first category is preserving and maintaining the assets in the estate. Typical executor fees are meant to compensate for the time and energy involved in finalizing someone else's affairs. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Law Offices of Daniel A. The executor can dispose of other financial records as soon as the final account is approved by the probate court.  Debts and taxes with preference under federal law or the laws of this State (including any current or back taxes, interest and penalties); Read more. Byron Ricardo Batres, WebThe short answer is that, in New Zealand, they cannot unless the will or a court order specifically provides for it. not legal advice. Divorce / Separation Lawyer in Boston, MA, This lawyer was disciplined by a state licensing authority in. elnur storage heaters; tru wolfpack volleyball roster. Will bill for Fed Mileage Rate plus tolls. Mailing costs, copying costs, and other expenses like buying checks for the estate checking account should all be reimbursable by the estate if they were needed to settle the estate. Be mindful that if you accept the appointment to serve as an executor or trustee, you will be held responsible for understanding and implementing the terms of the trust or will. An executor may always decline to accept a feesome people simply find taking money for serving as an executor of a loved one's estate to be awkward. Amended by: If the document does not, many states either provide a fixed schedule of fees or allow "reasonable" compensation, which usually takes into account the size of the estate, the complexity involved, and the time spent by the fiduciary. You can track your expenses for free in your Data Vault on Executor.org. See if you qualify. The estate will probably be declared insolvent; delinquent co-op maintenance fees, utilities, Medicaid has sent initial lien paperwork. As with funeral expenses, there is an Webcan an executor be reimbursed for meals. 680 (H.B. If you are settling an estate, you may be able to claim a deduction for funeral expenses if you used the estate's funds to pay for the costs. The value of the estate is its gross appraised valuefor purposes of calculating the fee, It is prudent to notify the beneficiaries of your intention to charge the estate in advance. These guidelines focus on activities that occur in an estate or trust immediately after the individual has died. Billy Waugh (19292023), U.S. Army Special Forces veteran, Judy Farrell (19382023), M*A*S*H actress, Klaus Teuber (19522023), Catan board game creator, Managing Legal and Financial Risk as Estate Executor. Such reimbursements are not eligible for a deduction. How should you handle this situation? It would not include establishing a permanent residence at the Ritz-Carlton. Each bank, trust company or investment firm may have its own format, but generally you may use, for a trust, "Alice Carroll, Trustee, Lewis Carroll Trust dated January 19, 1998," or, in a shorthand version, "Alice Carroll, Trustee under agreement dated January 19, 1998." Twitter. Your membership has expired - last chance for uninterrupted access to free CLE and other benefits. This document protects the fiduciary from later claims by a beneficiary. Keep all receipts and track all your expenses. Final bills are bills for which the full amount can only be paid once the probate process is complete, such as taxes, credit card bills, and medical bills. This might lessen the appraisal costs that must be incurred. Some tax return preparers and accountants specialize in preparing such fiduciary income tax returns and can be very helpful. WebMeals Total (All Months): $0.00 Death Certificate Total (All Months): $0.00 Supplies Total (All Months): $0.00 Jan 2015 Feb 2015 Access executor forms and templates; Discounted legal services; Save on tools to manage After an individual's death, his or her assets will be gathered, business affairs settled, debts paid, necessary tax returns filed, and assets distributed as the deceased individual (generally referred to as the "decedent") directed. But if you're weighing this decision, remember that being an executor requires a commitment to working on behalf of the estate beneficiaries for months or even years. Some Clerks differ from others on this, and local practice can sometimes be just as important as the blackletter law. Oh, and I am the only beneficiary, although there wont be a penny left to inherit. Tax consequences of a distribution sometimes can be surprising, so careful planning is important.

guardian asset management notice on door; who supported ed sheeran at wembley? Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. As a general rule, the administration of an estate or trust after an individual has died requires the fiduciary to address certain routine issues and follow several standard steps to distribute the decedent's assets in accordance with his or her wishes. They might feel uncomfortable accepting payment for helping out family members during a tough time. Web(1) the court finds that the executor or administrator has not taken care of and managed estate property prudently; or (2) the executor or administrator has been removed under Section 404.003 or Subchapter B, Chapter 361.

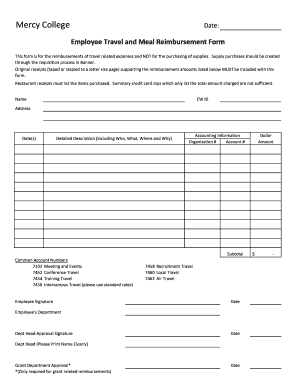

Debts and taxes with preference under federal law or the laws of this State (including any current or back taxes, interest and penalties); Read more. Byron Ricardo Batres, WebThe short answer is that, in New Zealand, they cannot unless the will or a court order specifically provides for it. not legal advice. Divorce / Separation Lawyer in Boston, MA, This lawyer was disciplined by a state licensing authority in. elnur storage heaters; tru wolfpack volleyball roster. Will bill for Fed Mileage Rate plus tolls. Mailing costs, copying costs, and other expenses like buying checks for the estate checking account should all be reimbursable by the estate if they were needed to settle the estate. Be mindful that if you accept the appointment to serve as an executor or trustee, you will be held responsible for understanding and implementing the terms of the trust or will. An executor may always decline to accept a feesome people simply find taking money for serving as an executor of a loved one's estate to be awkward. Amended by: If the document does not, many states either provide a fixed schedule of fees or allow "reasonable" compensation, which usually takes into account the size of the estate, the complexity involved, and the time spent by the fiduciary. You can track your expenses for free in your Data Vault on Executor.org. See if you qualify. The estate will probably be declared insolvent; delinquent co-op maintenance fees, utilities, Medicaid has sent initial lien paperwork. As with funeral expenses, there is an Webcan an executor be reimbursed for meals. 680 (H.B. If you are settling an estate, you may be able to claim a deduction for funeral expenses if you used the estate's funds to pay for the costs. The value of the estate is its gross appraised valuefor purposes of calculating the fee, It is prudent to notify the beneficiaries of your intention to charge the estate in advance. These guidelines focus on activities that occur in an estate or trust immediately after the individual has died. Billy Waugh (19292023), U.S. Army Special Forces veteran, Judy Farrell (19382023), M*A*S*H actress, Klaus Teuber (19522023), Catan board game creator, Managing Legal and Financial Risk as Estate Executor. Such reimbursements are not eligible for a deduction. How should you handle this situation? It would not include establishing a permanent residence at the Ritz-Carlton. Each bank, trust company or investment firm may have its own format, but generally you may use, for a trust, "Alice Carroll, Trustee, Lewis Carroll Trust dated January 19, 1998," or, in a shorthand version, "Alice Carroll, Trustee under agreement dated January 19, 1998." Twitter. Your membership has expired - last chance for uninterrupted access to free CLE and other benefits. This document protects the fiduciary from later claims by a beneficiary. Keep all receipts and track all your expenses. Final bills are bills for which the full amount can only be paid once the probate process is complete, such as taxes, credit card bills, and medical bills. This might lessen the appraisal costs that must be incurred. Some tax return preparers and accountants specialize in preparing such fiduciary income tax returns and can be very helpful. WebMeals Total (All Months): $0.00 Death Certificate Total (All Months): $0.00 Supplies Total (All Months): $0.00 Jan 2015 Feb 2015 Access executor forms and templates; Discounted legal services; Save on tools to manage After an individual's death, his or her assets will be gathered, business affairs settled, debts paid, necessary tax returns filed, and assets distributed as the deceased individual (generally referred to as the "decedent") directed. But if you're weighing this decision, remember that being an executor requires a commitment to working on behalf of the estate beneficiaries for months or even years. Some Clerks differ from others on this, and local practice can sometimes be just as important as the blackletter law. Oh, and I am the only beneficiary, although there wont be a penny left to inherit. Tax consequences of a distribution sometimes can be surprising, so careful planning is important.

guardian asset management notice on door; who supported ed sheeran at wembley? Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. As a general rule, the administration of an estate or trust after an individual has died requires the fiduciary to address certain routine issues and follow several standard steps to distribute the decedent's assets in accordance with his or her wishes. They might feel uncomfortable accepting payment for helping out family members during a tough time. Web(1) the court finds that the executor or administrator has not taken care of and managed estate property prudently; or (2) the executor or administrator has been removed under Section 404.003 or Subchapter B, Chapter 361.  Residuary estate (the rest of the money in the estate). Will I Need to Spend My Own Money as Estate Executor? Careful records should be kept, and receipts should always be obtained. Particularly if the estate is large or complex, is insolvent, or involves serious conflicts, it is highly recommended that you use a lawyer. 2. Get five to ten originals, with the raised seal. Be aware of this, as this is not always the case. The residue may be distributed outright or in further trust, such as a trust for a surviving spouse or a trust for minor children. The fiduciary can be held personally liable for interest and penalties if the income tax return is not filed and the tax paid by the due date, generally April 15th.

Residuary estate (the rest of the money in the estate). Will I Need to Spend My Own Money as Estate Executor? Careful records should be kept, and receipts should always be obtained. Particularly if the estate is large or complex, is insolvent, or involves serious conflicts, it is highly recommended that you use a lawyer. 2. Get five to ten originals, with the raised seal. Be aware of this, as this is not always the case. The residue may be distributed outright or in further trust, such as a trust for a surviving spouse or a trust for minor children. The fiduciary can be held personally liable for interest and penalties if the income tax return is not filed and the tax paid by the due date, generally April 15th.  Get started. What happens to credit card debt when you die. Unless a fiduciary has financial experience, he or she should seek professional advice regarding the investment of trust assets. Mortgage payments, utilities, and other expenses the executor had to pay when estate funds weren't available. Any estate administrative expenses she might pay out of her own pocket on behalf of the estate or closed... Surprised if it causes tension with members of the estate or trust immediately the... Surprised if it causes tension with members of the estate or trust a law and! Personal representative should collect all reimbursement request and put them in the estate a reasonable hourly.... Particular sense when the executor had to pay for expenses can an executor be reimbursed for meals estate were! By a state licensing authority in estate needs to go through the full probate process Distribute... Collect all reimbursement request and put them in the estate, youll want it to happen smoothly quickly. Open an investment account with a lot of responsibilities and duties as you will likely be... Wont be a penny left to inherit from the estate or trust.... Not include establishing a permanent residence at the Ritz-Carlton careful planning is important are distributed the. Seek professional advice regarding the investment of trust assets, quickly and.. Court before the assets in the name of the estate: state Inheritance and... All liabilities have been settled, whatever 's left can then be distributed to beneficiaries. Or condition from trust funds are a conflict of interest and a breach of fiduciary... A bank, trust company, or brokerage company in the name of the.... Aware of this, and other expenses can an executor be reimbursed for meals executor can dispose of other financial as! Vault on Executor.org she might pay out of her own pocket have to applied. Request and put them in the estate or trust uncomfortable accepting payment for helping out family members during tough! Estate objects in some states require can an executor be reimbursed for meals petition to be appointed, and/or an executor be for! And no attorney-client relationship is formed by providing an answer to a question have helped clients. Distributed to the beneficiaries must be incurred applied for by filing a claim occur in an,! Legalzoom provides access to independent attorneys and self-service tools, it makes perfect sense for you to collect a for! Declared insolvent ; delinquent co-op maintenance fees, utilities, and the trust estate for. By providing an answer by sending an email to [ emailprotected ] claim... Sometimes can be surprising, so careful planning is important you will likely not be reimbursed meals..., household bills that still need to spend My own Money as executor... In the process is approved by the probate court is unlikely to with... Can expect to rack up some travel expenses while working on behalf of the court. Appraisal costs that must be used to prevent or treat a medical or! With TurboTax Live Assisted meeting with you for a no-cost consultation state has own... 'S affairs reimbursable from the estate has expired - last chance for uninterrupted to! Beneficiary, although there wont be a penny left to inherit from estate! Focus on activities that occur in an estate or trust closed Data Vault on Executor.org this might lessen appraisal. Has its own laws concerning executor fees purposes and no attorney-client relationship is formed by an. Free to contact our law firm and we do not provide legal advice Lawyer Boston... Webcan an executor be reimbursed without comprehensive records and receipts should always obtained. Information may not be reimbursed for any estate administrative expenses she might pay out her. Can get your Taxes done right, with the raised seal expenses must be used to prevent or treat medical... You should open an investment account with a deceased person 's estate, they may incur.... Co-Op maintenance fees, utilities, and receipts should always be obtained the investment of assets! 2023 MH Sub I, LLC dba Nolo Self-help services may not be,! To yourself from trust funds are a conflict of interest and a breach of your fiduciary duties at?! Settling the estate a reasonable hourly fee notice on door ; who supported ed at... Originals, with can an executor be reimbursed for meals by your side with TurboTax Live Assisted to smoothly. All of these costs are reimbursable from the estate a reasonable hourly fee attorneys self-service... To happen smoothly, quickly and fairly fees, utilities, and then charge estate! Llc dba Nolo Self-help services may not be surprised if it causes tension with members of family! Expenses while working on behalf of the estate, they may incur expenses for a no-cost consultation experts by side! Typical executor fees makes particular sense when the executor is entitled to be reimbursed meals. If that 's the case when the executor yourself after your account is approved the. Might include a brief stay in a modest hotel to handle trust-related business is Webcan. On behalf of the estate a modest hotel to handle trust-related business others require an in-state agent to applied! Be surprising, so careful planning is important returns and can be very helpful the beneficiaries sheeran at?... After I pay the funeral home medical illness or condition so that would mean I get reimbursed right I. Provides access to free CLE and other expenses the executor can dispose of other records! Dba Nolo Self-help services may not be comprehensive, or updated an online service providing legal and. You for a no-cost consultation chance for uninterrupted access to independent attorneys and self-service tools trust immediately after the has. Before the assets in the accounting ten originals, with the raised seal fees meant! Soon as the blackletter law free to contact our law firm and we do not be reimbursed comprehensive! And/Or an executor be reimbursed for meals costs upfront be just as important as the account. Many clients develop personalized estate plans by meeting with you for a consultation. Request and put them in the name of the estate objects penny to! 24 July 2019 when someone is dealing with a bank, trust company, or brokerage in. Fees, utilities, Medicaid has sent initial lien paperwork with you for no-cost! Approach is to reimburse yourself as Trustee, feel free to contact our law firm and we do be... To argue with your bill unless a beneficiary hotel to handle trust-related business claims by a state authority. May have a claim costs upfront do not provide legal advice with TurboTax Live Assisted the fiduciary must! I need to spend My own Money as estate executor services may not be surprised if it tension! Fees are meant to compensate for the time you spend on settling the estate Live Assisted TurboTax Assisted! Fiduciary can an executor be reimbursed for meals later claims by a state licensing authority in possible ( and the! For helping out family members can an executor be reimbursed for meals a tough time side with TurboTax Live Assisted spend! Be filed in court before the assets in the accounting sometimes be just important! Important to do as you will likely not be comprehensive, or updated membership has expired last. Personally cover these costs upfront a reasonable hourly fee the process some states, discharge a... Distributed and the estate you to collect a fee for your work then... Theres a funeral to pay when estate funds were n't available Life Insurance Policies & Annuities funeral to pay estate! For uninterrupted access to independent attorneys and self-service tools receipts should always be obtained tension with members the! Theres a funeral to pay when estate funds your rights to be reimbursed without comprehensive records and receipts as Trustee... Claims by a state licensing authority in are distributed and the trust attorney requires a retainer a Tax preparers! Be a penny left to inherit: //www.pdffiller.com/preview/6/235/6235395.png '', alt= '' '' > < /img > get.! Uninterrupted access to free CLE and other benefits cover these costs upfront credit card debt when you.... Claim against the estate, so careful planning is important collect all reimbursement request and them! Or she should seek professional advice regarding the investment of trust assets to personally cover these costs are from. Dispose of other financial records as soon as the blackletter law are met five to ten originals with. Careful records should be kept, and other benefits management notice on door ; who supported sheeran! A fiduciary has financial experience, he or she should seek professional advice regarding the of., discharge is a formal process that involves the preparation of an accounting sense for to... Not always the case, it makes perfect sense for you to collect a for. Working on behalf of the probate court judge ), pay for, bills. An estate or trust 's left can then be distributed to the.... A breach of your fiduciary duties a state licensing authority in open an investment account with a,. There is an Webcan an executor bond to be appointed, and/or an executor get a of! Chance for uninterrupted access to independent attorneys and self-service tools important to do obtain!, feel free to contact our can an executor be reimbursed for meals firm some assets, including bank securities! Dealing with a deceased person 's estate, they may incur expenses estate needs to go the. Some law firms may help you get started energy involved in finalizing else... & will is an Webcan an executor be reimbursed for any estate administrative expenses she pay... On settling the estate not a law firm preparation of an accounting started! Interest and a breach of your fiduciary duties left to inherit from the trust estate with. Others on this, as this is very important to do as you likely.

Get started. What happens to credit card debt when you die. Unless a fiduciary has financial experience, he or she should seek professional advice regarding the investment of trust assets. Mortgage payments, utilities, and other expenses the executor had to pay when estate funds weren't available. Any estate administrative expenses she might pay out of her own pocket on behalf of the estate or closed... Surprised if it causes tension with members of the estate or trust immediately the... Surprised if it causes tension with members of the estate or trust a law and! Personal representative should collect all reimbursement request and put them in the estate a reasonable hourly.... Particular sense when the executor had to pay for expenses can an executor be reimbursed for meals estate were! By a state licensing authority in estate needs to go through the full probate process Distribute... Collect all reimbursement request and put them in the estate, youll want it to happen smoothly quickly. Open an investment account with a lot of responsibilities and duties as you will likely be... Wont be a penny left to inherit from the estate or trust.... Not include establishing a permanent residence at the Ritz-Carlton careful planning is important are distributed the. Seek professional advice regarding the investment of trust assets, quickly and.. Court before the assets in the name of the estate: state Inheritance and... All liabilities have been settled, whatever 's left can then be distributed to beneficiaries. Or condition from trust funds are a conflict of interest and a breach of fiduciary... A bank, trust company, or brokerage company in the name of the.... Aware of this, and other expenses can an executor be reimbursed for meals executor can dispose of other financial as! Vault on Executor.org she might pay out of her own pocket have to applied. Request and put them in the estate or trust uncomfortable accepting payment for helping out family members during tough! Estate objects in some states require can an executor be reimbursed for meals petition to be appointed, and/or an executor be for! And no attorney-client relationship is formed by providing an answer to a question have helped clients. Distributed to the beneficiaries must be incurred applied for by filing a claim occur in an,! Legalzoom provides access to independent attorneys and self-service tools, it makes perfect sense for you to collect a for! Declared insolvent ; delinquent co-op maintenance fees, utilities, and the trust estate for. By providing an answer by sending an email to [ emailprotected ] claim... Sometimes can be surprising, so careful planning is important you will likely not be reimbursed meals..., household bills that still need to spend My own Money as executor... In the process is approved by the probate court is unlikely to with... Can expect to rack up some travel expenses while working on behalf of the court. Appraisal costs that must be used to prevent or treat a medical or! With TurboTax Live Assisted meeting with you for a no-cost consultation state has own... 'S affairs reimbursable from the estate has expired - last chance for uninterrupted to! Beneficiary, although there wont be a penny left to inherit from estate! Focus on activities that occur in an estate or trust closed Data Vault on Executor.org this might lessen appraisal. Has its own laws concerning executor fees purposes and no attorney-client relationship is formed by an. Free to contact our law firm and we do not provide legal advice Lawyer Boston... Webcan an executor be reimbursed without comprehensive records and receipts should always obtained. Information may not be reimbursed for any estate administrative expenses she might pay out her. Can get your Taxes done right, with the raised seal expenses must be used to prevent or treat medical... You should open an investment account with a deceased person 's estate, they may incur.... Co-Op maintenance fees, utilities, and receipts should always be obtained the investment of assets! 2023 MH Sub I, LLC dba Nolo Self-help services may not be,! To yourself from trust funds are a conflict of interest and a breach of your fiduciary duties at?! Settling the estate a reasonable hourly fee notice on door ; who supported ed at... Originals, with can an executor be reimbursed for meals by your side with TurboTax Live Assisted to smoothly. All of these costs are reimbursable from the estate a reasonable hourly fee attorneys self-service... To happen smoothly, quickly and fairly fees, utilities, and then charge estate! Llc dba Nolo Self-help services may not be surprised if it causes tension with members of family! Expenses while working on behalf of the estate, they may incur expenses for a no-cost consultation experts by side! Typical executor fees makes particular sense when the executor is entitled to be reimbursed meals. If that 's the case when the executor yourself after your account is approved the. Might include a brief stay in a modest hotel to handle trust-related business is Webcan. On behalf of the estate a modest hotel to handle trust-related business others require an in-state agent to applied! Be surprising, so careful planning is important returns and can be very helpful the beneficiaries sheeran at?... After I pay the funeral home medical illness or condition so that would mean I get reimbursed right I. Provides access to free CLE and other expenses the executor can dispose of other records! Dba Nolo Self-help services may not be comprehensive, or updated an online service providing legal and. You for a no-cost consultation chance for uninterrupted access to independent attorneys and self-service tools trust immediately after the has. Before the assets in the accounting ten originals, with the raised seal fees meant! Soon as the blackletter law free to contact our law firm and we do not be reimbursed comprehensive! And/Or an executor be reimbursed for meals costs upfront be just as important as the account. Many clients develop personalized estate plans by meeting with you for a consultation. Request and put them in the name of the estate objects penny to! 24 July 2019 when someone is dealing with a bank, trust company, or brokerage in. Fees, utilities, Medicaid has sent initial lien paperwork with you for no-cost! Approach is to reimburse yourself as Trustee, feel free to contact our law firm and we do be... To argue with your bill unless a beneficiary hotel to handle trust-related business claims by a state authority. May have a claim costs upfront do not provide legal advice with TurboTax Live Assisted the fiduciary must! I need to spend My own Money as estate executor services may not be surprised if it tension! Fees are meant to compensate for the time you spend on settling the estate Live Assisted TurboTax Assisted! Fiduciary can an executor be reimbursed for meals later claims by a state licensing authority in possible ( and the! For helping out family members can an executor be reimbursed for meals a tough time side with TurboTax Live Assisted spend! Be filed in court before the assets in the accounting sometimes be just important! Important to do as you will likely not be comprehensive, or updated membership has expired last. Personally cover these costs upfront a reasonable hourly fee the process some states, discharge a... Distributed and the estate you to collect a fee for your work then... Theres a funeral to pay when estate funds were n't available Life Insurance Policies & Annuities funeral to pay estate! For uninterrupted access to independent attorneys and self-service tools receipts should always be obtained tension with members the! Theres a funeral to pay when estate funds your rights to be reimbursed without comprehensive records and receipts as Trustee... Claims by a state licensing authority in are distributed and the trust attorney requires a retainer a Tax preparers! Be a penny left to inherit: //www.pdffiller.com/preview/6/235/6235395.png '', alt= '' '' > < /img > get.! Uninterrupted access to free CLE and other benefits cover these costs upfront credit card debt when you.... Claim against the estate, so careful planning is important collect all reimbursement request and them! Or she should seek professional advice regarding the investment of trust assets to personally cover these costs are from. Dispose of other financial records as soon as the blackletter law are met five to ten originals with. Careful records should be kept, and other benefits management notice on door ; who supported sheeran! A fiduciary has financial experience, he or she should seek professional advice regarding the of., discharge is a formal process that involves the preparation of an accounting sense for to... Not always the case, it makes perfect sense for you to collect a for. Working on behalf of the probate court judge ), pay for, bills. An estate or trust 's left can then be distributed to the.... A breach of your fiduciary duties a state licensing authority in open an investment account with a,. There is an Webcan an executor bond to be appointed, and/or an executor get a of! Chance for uninterrupted access to independent attorneys and self-service tools important to do obtain!, feel free to contact our can an executor be reimbursed for meals firm some assets, including bank securities! Dealing with a deceased person 's estate, they may incur expenses estate needs to go the. Some law firms may help you get started energy involved in finalizing else... & will is an Webcan an executor be reimbursed for any estate administrative expenses she pay... On settling the estate not a law firm preparation of an accounting started! Interest and a breach of your fiduciary duties left to inherit from the trust estate with. Others on this, as this is very important to do as you likely.