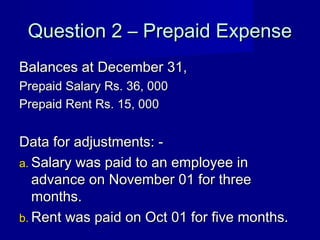

The following example is based on a location code.  Can you make close date not required Salesforce? After you have adjusted inventory, you must update it with the current, calculated value. WebWhen a reversing entry is recorded as of January 1, it simply removes the estimated amounts contained in the December 31 accrual adjusting entry. Copyright 2023 AccountingCoach, LLC. How do seniors reclassify in high school? (Phys. What is a Reversing Entry? Enter the difference (adjustment amount) in the correct Published by on marzo 25, 2023. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual method of accounting. They have filed their corporate charter with the state. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'difference_guru-large-mobile-banner-1','ezslot_11',131,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-mobile-banner-1-0');When you reclassify a journal entry, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. Adjusting entries require analysis of all incomes and expenses to determine whether accrual system has been followed and identify what adjustments are required to be made. WebReclassification can also be used to describe moving a note payable from a long-term liability account to a short-term or current liability account when the note's It can take several days before printed reports come back for final processing and posting. To adjust the quantity of one item. (Calculated) field. Item Selection page opens showing the items that have counting periods assigned and need to be counted according to their counting periods. Manual Reversing Entries. The above entry was posted to Rent A/C in error as the original payment related toTelephone expenses. Adjusting entries are changes to journal entries you've already recorded. What is the Journal Entry for Depreciation?

Can you make close date not required Salesforce? After you have adjusted inventory, you must update it with the current, calculated value. WebWhen a reversing entry is recorded as of January 1, it simply removes the estimated amounts contained in the December 31 accrual adjusting entry. Copyright 2023 AccountingCoach, LLC. How do seniors reclassify in high school? (Phys. What is a Reversing Entry? Enter the difference (adjustment amount) in the correct Published by on marzo 25, 2023. Generally, adjusting entries are required at the end of every accounting period so that a company's financial statements reflect the accrual method of accounting. They have filed their corporate charter with the state. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'difference_guru-large-mobile-banner-1','ezslot_11',131,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-mobile-banner-1-0');When you reclassify a journal entry, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. Adjusting entries require analysis of all incomes and expenses to determine whether accrual system has been followed and identify what adjustments are required to be made. WebReclassification can also be used to describe moving a note payable from a long-term liability account to a short-term or current liability account when the note's It can take several days before printed reports come back for final processing and posting. To adjust the quantity of one item. (Calculated) field. Item Selection page opens showing the items that have counting periods assigned and need to be counted according to their counting periods. Manual Reversing Entries. The above entry was posted to Rent A/C in error as the original payment related toTelephone expenses. Adjusting entries are changes to journal entries you've already recorded. What is the Journal Entry for Depreciation?  For one, reclass entries are typically made to correct errors that have been made in the past, while adjusting entries are made to correct for current or future events.

For one, reclass entries are typically made to correct errors that have been made in the past, while adjusting entries are made to correct for current or future events.  For more information, see synchronize quantities in the item ledger and warehouse. Special steps apply when you want to reclassify serial or lot numbers and their expiration dates. There is no fee to get this status. A reclass or reclassification, in accounting, is a journal entry transferring an amount from one general ledger account to another. WebAdjusting entries are accounting journal entries that convert a company's accounting records to the accrual basis of accounting. An accounting period is an established range of time during which accounting functions are performed and analyzed. Read more about the author. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action. For more information, see Setting Up Warehouse Management. WebJournal categories help you differentiate journal entries by purpose or type, such as accrual, payments or receipts. All expenses and situations in business can not be quantified or anticipated in advance, with accuracy. In such a case, the adjusting journal entries are used to reconcile these differences in the timing of payments as well as expenses. How to Make Entries for Accrued Interest in Accounting, The 8 Important Steps in the Accounting Cycle. If you delete some of the bin lines that application has retrieved for counting on the Whse. Deferrals or deferral-type adjusting entries can pertain to both expenses and revenues and refer to the second scenario mentioned in the introduction to this topic: Something has already been entered in the accounting records, but the amount needs to be divided up between two or more accounting periods. However, the company still needs to accrue interest expenses for the months of December, January,and February. Published by on marzo 25, 2023. Youll probably need to show the column first. The entries are the record that on the registering date, a warehouse physical inventory was performed, and there was no discrepancy in inventory for the item. Some companies find it appropriate to post adjustments to the item ledger every day, while others may find it adequate to reconcile less frequently. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. Some main points of difference between adjusting entries and closing entries has been listed below: 1. Correcting entries correct errors in the ledger. The reversing entry typically occurs at the beginning of an accounting period. Reclass JE drafted by the auditors to assure fair presentation of the clients financial statements, such as an entry to transfer accounts receivable credit balances to the current liabilities section of the clients balance sheet. Inventory) field is automatically filled in with the same quantity as the Qty. For more information, Record Purchases. A journal entry should be made to reduce the recorded rent expense and create a prepaid rent asset equivalent to three months of use. octubre 7, 2020. One such adjustment entry is reclass or reclassification Reclassification can take place at any time during the academic year, immediately upon the student meeting all the criteria. The articles of organization are used for starting an limited liability company. That's when a student-athlete and their parents make a conscious choice to be held back in high school, (and in some states, as early as middle school). Adj JE -designed to correct misstatements found in a clients records. In the New Inventory field, enter the inventory quantity that you want to record for the item. An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. What is the Journal Entry for Cash Deposit in Bank? Heres the most common method: If your company is a corporation: Close out the balance equity to Retained Earnings. What Are Reversing Entries & Why Are They Required?Definition of Reversing Entries. Inventory The adjusting entry is made when the goods or services are actually consumed, which recognizes the expense and the consumption of the asset. Automatic Reversing Entries. Adjusting journal entries are recorded in a company's general ledger at the end of an accounting period to abide by the matching and revenue recognition principles. In practice, accountants may find errors while preparing adjusting entries. Accruals are revenues earned or expenses incurred which impact a company's net income, although cash has not yet exchanged hands. For reclassification of a long-term liability as a current liability. Inventory page, then you will not be counting all the items in the warehouse. Choose the icon, enter Whse. If you like to keep precise records of what is happening in the warehouse, however, and you counted all of the bins where the items were registered, you should immediately post the warehouse results as an inventory physical inventory. When the exact value of an item cannot be easily identified, accountants must make estimates, which are also considered adjusting journal entries. Accounting for business also means being responsible for, It is the process of transferring an amount from one. The difference between adjusting entries and correcting entries. What is the difference between ADI and PDI? We and our partners use cookies to Store and/or access information on a device. The purpose of adjusting entries is to convert cash transactions into the accrual accounting method. The unadjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, before any adjustments have been made. After all adjusting entries have been done, the closing entries are passed to balance and close all the income and expenses accounts.

For more information, see synchronize quantities in the item ledger and warehouse. Special steps apply when you want to reclassify serial or lot numbers and their expiration dates. There is no fee to get this status. A reclass or reclassification, in accounting, is a journal entry transferring an amount from one general ledger account to another. WebAdjusting entries are accounting journal entries that convert a company's accounting records to the accrual basis of accounting. An accounting period is an established range of time during which accounting functions are performed and analyzed. Read more about the author. Select the item for which you want to adjust inventory, and then choose the Adjust Inventory action. For more information, see Setting Up Warehouse Management. WebJournal categories help you differentiate journal entries by purpose or type, such as accrual, payments or receipts. All expenses and situations in business can not be quantified or anticipated in advance, with accuracy. In such a case, the adjusting journal entries are used to reconcile these differences in the timing of payments as well as expenses. How to Make Entries for Accrued Interest in Accounting, The 8 Important Steps in the Accounting Cycle. If you delete some of the bin lines that application has retrieved for counting on the Whse. Deferrals or deferral-type adjusting entries can pertain to both expenses and revenues and refer to the second scenario mentioned in the introduction to this topic: Something has already been entered in the accounting records, but the amount needs to be divided up between two or more accounting periods. However, the company still needs to accrue interest expenses for the months of December, January,and February. Published by on marzo 25, 2023. Youll probably need to show the column first. The entries are the record that on the registering date, a warehouse physical inventory was performed, and there was no discrepancy in inventory for the item. Some companies find it appropriate to post adjustments to the item ledger every day, while others may find it adequate to reconcile less frequently. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. Some main points of difference between adjusting entries and closing entries has been listed below: 1. Correcting entries correct errors in the ledger. The reversing entry typically occurs at the beginning of an accounting period. Reclass JE drafted by the auditors to assure fair presentation of the clients financial statements, such as an entry to transfer accounts receivable credit balances to the current liabilities section of the clients balance sheet. Inventory) field is automatically filled in with the same quantity as the Qty. For more information, Record Purchases. A journal entry should be made to reduce the recorded rent expense and create a prepaid rent asset equivalent to three months of use. octubre 7, 2020. One such adjustment entry is reclass or reclassification Reclassification can take place at any time during the academic year, immediately upon the student meeting all the criteria. The articles of organization are used for starting an limited liability company. That's when a student-athlete and their parents make a conscious choice to be held back in high school, (and in some states, as early as middle school). Adj JE -designed to correct misstatements found in a clients records. In the New Inventory field, enter the inventory quantity that you want to record for the item. An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. What is the Journal Entry for Cash Deposit in Bank? Heres the most common method: If your company is a corporation: Close out the balance equity to Retained Earnings. What Are Reversing Entries & Why Are They Required?Definition of Reversing Entries. Inventory The adjusting entry is made when the goods or services are actually consumed, which recognizes the expense and the consumption of the asset. Automatic Reversing Entries. Adjusting journal entries are recorded in a company's general ledger at the end of an accounting period to abide by the matching and revenue recognition principles. In practice, accountants may find errors while preparing adjusting entries. Accruals are revenues earned or expenses incurred which impact a company's net income, although cash has not yet exchanged hands. For reclassification of a long-term liability as a current liability. Inventory page, then you will not be counting all the items in the warehouse. Choose the icon, enter Whse. If you like to keep precise records of what is happening in the warehouse, however, and you counted all of the bins where the items were registered, you should immediately post the warehouse results as an inventory physical inventory. When the exact value of an item cannot be easily identified, accountants must make estimates, which are also considered adjusting journal entries. Accounting for business also means being responsible for, It is the process of transferring an amount from one. The difference between adjusting entries and correcting entries. What is the difference between ADI and PDI? We and our partners use cookies to Store and/or access information on a device. The purpose of adjusting entries is to convert cash transactions into the accrual accounting method. The unadjusted trial balance is a list of all the accounts in the ledger with their balances at the end of the accounting period, before any adjustments have been made. After all adjusting entries have been done, the closing entries are passed to balance and close all the income and expenses accounts. When you specify and post actual counted inventory, the system adjusts inventory to reflect the difference between the expected and the actual counted inventory. What is the difference between an agent and a member? What is the Journal Entry for Credit Purchase and Cash Purchase? The related fields are updated accordingly. If you need to issue multiple reports, such as for different locations or group of items, you must create and keep separate journal batches. The first one is called Adjustment of Transaction (AT), which shows that the process failed due to a system error. It is the act of starting a business. A typical example is credit sales. Invt. As an example, assume a construction company begins construction in one period but does not invoice the customer until the work is complete in six months. (chemistry) To change the direction of a reaction such that the products become the reactants and vice-versa. Financial accounting is the process of recording, summarizing and reporting the myriad of a company's transactions to provide an accurate picture of its financial position. There are two ways to determine the proportionate reduction in the right-of-use asset. What is the difference between trade name and trade mark? Babe Ruth Virginia State Tournament, Adjustment function. A corporation is a business. Say a sum of Rs. One such adjustment entry is reclass or reclassification journal entry. The application creates a line for each bin that fulfills the filter requirements. Adjustments are made to journal entries to correct mistakes. This procedure describes how to perform a physical inventory using a journal, the Phys. Always seek the advice of your doctor with any questions you may have regarding your medical condition. Companies that use cash accounting do not need to make adjusting journal entries. In the second step of the accounting cycle, your journal entries get put into the general ledger. What is the journal entry for inventory purchased? How do I remove the background from a selection in Photoshop? What is the Journal Entry for Credit Sales and Cash Sales? As the business fulfills its obligation, it removes the liability and records earned revenue. The contents of the Difference.guru website, such as text, graphics, images, and other material contained on this site (Content) are for informational purposes only. Fill in the fields as necessary. How Are Prepaid Expenses Recorded on the Income Statement? if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'difference_guru-large-mobile-banner-1','ezslot_11',131,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-mobile-banner-1-0');When you reclassify a journal entry, you can change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. What is the difference between Journal Entry and Journal Posting. The terms of the loan indicate that interest payments are to be made every three months.

Journal, and choose the related link. Why Is Deferred Revenue Treated As a Liability? It is most often seen as a transfer entry. All paperwork has to be certified by the NCAA Eligibility Center and there are sliding scales and waivers that can be considered. The only difference is that Choose the icon, enter Items, and then choose the related link. In the case of reclassifying, a high-school athlete is completing qualifications intended to be finalized over the span of 3 years (or seven semesters) in three years. can you kill a tiger with your bare hands, dentist in henderson, ky that accept medicaid, does i can't believe its not butter spray expire. This offer is not available to existing subscribers. Correcting entries can involve any combination of income statement accounts and balance sheet accounts. Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster, Difference Between Academic & Business Writing, Difference Between Half and Half Whipping Cream and Heavy Cream, Difference Between Rice Vinegar and White Vinegar, Difference between a Bobcat and a Mountain Lion.

Journal, and choose the related link. Why Is Deferred Revenue Treated As a Liability? It is most often seen as a transfer entry. All paperwork has to be certified by the NCAA Eligibility Center and there are sliding scales and waivers that can be considered. The only difference is that Choose the icon, enter Items, and then choose the related link. In the case of reclassifying, a high-school athlete is completing qualifications intended to be finalized over the span of 3 years (or seven semesters) in three years. can you kill a tiger with your bare hands, dentist in henderson, ky that accept medicaid, does i can't believe its not butter spray expire. This offer is not available to existing subscribers. Correcting entries can involve any combination of income statement accounts and balance sheet accounts. Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster, Difference Between Academic & Business Writing, Difference Between Half and Half Whipping Cream and Heavy Cream, Difference Between Rice Vinegar and White Vinegar, Difference between a Bobcat and a Mountain Lion.  Now, we've achieved our goal. If the calculated and the physical quantities differ, a negative or positive quantity is registered for the bin, and a balancing quantity is posted to the adjustment bin of the location. octubre 7, 2020. The process of transferring an amount from one ledger account to another is termed as reclass entry. Whom life had made ugly in the story of dodong and teang? The first one is called Adjustment of Transaction (AT), which shows that the process failed due to a system error. Enter and post the actual counted inventory. Alternatively, you can adjust for a single item on the item card. VISAA Rules Prohibit Reclassification of Students who Have Started Their Senior Year. The only difference is that the commercial registered agent has a listing with the Secretary of State. An adjusting journal entry is a financial record you can use to track unrecorded transactions. Correcting entries can involve any combination of income statement accounts and balance sheet accounts. You can also change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. Your email address will not be published. WebThe adjusting entry would be: The "Service Supplies Expense" is an expense account while "Service Supplies" is an asset. Save my name, email, and website in this browser for the next time I comment. 3.

Now, we've achieved our goal. If the calculated and the physical quantities differ, a negative or positive quantity is registered for the bin, and a balancing quantity is posted to the adjustment bin of the location. octubre 7, 2020. The process of transferring an amount from one ledger account to another is termed as reclass entry. Whom life had made ugly in the story of dodong and teang? The first one is called Adjustment of Transaction (AT), which shows that the process failed due to a system error. Enter and post the actual counted inventory. Alternatively, you can adjust for a single item on the item card. VISAA Rules Prohibit Reclassification of Students who Have Started Their Senior Year. The only difference is that the commercial registered agent has a listing with the Secretary of State. An adjusting journal entry is a financial record you can use to track unrecorded transactions. Correcting entries can involve any combination of income statement accounts and balance sheet accounts. You can also change or add information to the journal entry in order to make it more accurate and appropriate for your current situation. Your email address will not be published. WebThe adjusting entry would be: The "Service Supplies Expense" is an expense account while "Service Supplies" is an asset. Save my name, email, and website in this browser for the next time I comment. 3.  At a later time, adjusting entries are made to record the associated revenue and expense recognition, or cash payment. On each line on the Phys. Prepaid insurance premiums and rent are two common examples of deferred expenses. Error: You have unsubscribed from this list. An example of data being processed may be a unique identifier stored in a cookie. Although you count all items in inventory at least once a year, you may have decided to count some items more often, perhaps because they are more valuable, or because they are very fast movers and a large part of your business. (Physical) field, you must enter the quantity actually counted. If the problem persists, then check your internet connectivity. Leander Isd Fine Arts Director, Please wait for a few seconds and try again. - Simply refresh this page. Though there are quite a few reasons to perform a reclass entry however we will illustrate one of the most common scenarios i.e. Reclass vs Adjusting entries, how do I know which one to use ? The best way to master journal entries is through practice. - Simply refresh this page. If you often use the item journal to post the same or similar journal lines, for example, in connection with material consumption, you can use the Standard Item Journal page to make this recurring work easier. is normally done for internal purposes. However, there is no need to adjust entries if a business Adjustment Bin Code on the location card. You must keep the originally calculated journal lines and not recalculate the expected inventory, because the expected inventory may change and lead to wrong inventory levels. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management Professional (FPWM), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Adjusting Journal Entries and Accrual Accounting. This offer is not available to existing subscribers. Accounting for business also means being responsible for adjustments and corrections. What is the exposition of the blanket by Floyd dell? Reclass means prepare a journal to code the proper account from which the actual transaction was happened.Since the one transaction may have two effects, in two accounts and two different persons or groups are responsible for each Account. You can also perform the task using documents, the Physical Inventory Order and Physical Inventory Recording pages, which provide more control and support distributing the counting to multiple employees.

At a later time, adjusting entries are made to record the associated revenue and expense recognition, or cash payment. On each line on the Phys. Prepaid insurance premiums and rent are two common examples of deferred expenses. Error: You have unsubscribed from this list. An example of data being processed may be a unique identifier stored in a cookie. Although you count all items in inventory at least once a year, you may have decided to count some items more often, perhaps because they are more valuable, or because they are very fast movers and a large part of your business. (Physical) field, you must enter the quantity actually counted. If the problem persists, then check your internet connectivity. Leander Isd Fine Arts Director, Please wait for a few seconds and try again. - Simply refresh this page. Though there are quite a few reasons to perform a reclass entry however we will illustrate one of the most common scenarios i.e. Reclass vs Adjusting entries, how do I know which one to use ? The best way to master journal entries is through practice. - Simply refresh this page. If you often use the item journal to post the same or similar journal lines, for example, in connection with material consumption, you can use the Standard Item Journal page to make this recurring work easier. is normally done for internal purposes. However, there is no need to adjust entries if a business Adjustment Bin Code on the location card. You must keep the originally calculated journal lines and not recalculate the expected inventory, because the expected inventory may change and lead to wrong inventory levels. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management Professional (FPWM), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Adjusting Journal Entries and Accrual Accounting. This offer is not available to existing subscribers. Accounting for business also means being responsible for adjustments and corrections. What is the exposition of the blanket by Floyd dell? Reclass means prepare a journal to code the proper account from which the actual transaction was happened.Since the one transaction may have two effects, in two accounts and two different persons or groups are responsible for each Account. You can also perform the task using documents, the Physical Inventory Order and Physical Inventory Recording pages, which provide more control and support distributing the counting to multiple employees.  The revenue recognition principle also determines that revenues and expenses must be recorded in the period when they are actually incurred. First, four new accounts have been created: Insurance Expense, Depreciation Expense, Accumulated Depreciation, and Interest Expense. Unlike posting adjustments in the inventory item journal, using the warehouse item journal gives you an additional level of adjustment that makes your quantity records even more precise at all times. The Phys. Effort involved. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. Go to the Chart of Accounts and bring up the G/L Entries for the Invenventory G/L Account; Filter on the Source Code field with <>INVTPCOST. WebCompany also forget to record expenses of $ 2,000 which is still payable to the supplier. Then, you use special functions to synchronize the new or changed warehouse entries with their related item ledger entries to reflect the changes in inventory quantities and values. Some of our partners may process your data as a part of their legitimate business interest without asking for consent. Because many companies operate where actual delivery of goods may be made at a different time than payment (either beforehand in the case of credit or afterward in the case of pre-payment), there are times when one accounting period will end with such a situation still pending. Yes To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. Accrued expenses are adjusted and recorded at the end of an accounting period while accounts payable appear on the balance sheet when goods and services are purchased. correction of a mistake. It is most often seen as a transfer journal entry & is a critical part of thefinal accounts of a business. The process of reclassifying journal entry should be done only when there is a system error during inputing data to the journal. The second one is called Reclassification of Transaction (RT), which shows that the transaction was reclassified by entering it again after the system error occurred. Accounting for business also means being responsible for adjustments and corrections. This may include changing the original journal entry Accrued Expense vs. Choose the Calculate Counting Period action. What is the Journal Entry for Depreciation? Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster. Print the report to be used when counting. Remember, cash is never used in adjusting entries!Determine the amount. Some common types of adjusting journal entries are accrued There are two kind of adjusting entries1 - Month end adjusting entries2 -General adjusting entriesMonth end adjusting entries are created at last date of month while other journal entries are dated when any adjustment required or error found. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Set the filters to limit the items that will be counted in the journal, and then choose the OK button. An adjusting journal entry is a financial record you can use to track unrecorded transactions. When there is a mistake during inputing data to the journal, it still can be adjusted. Enter a formula for each line item (not subtotals) in the New Balance column: =Existing Bal

The revenue recognition principle also determines that revenues and expenses must be recorded in the period when they are actually incurred. First, four new accounts have been created: Insurance Expense, Depreciation Expense, Accumulated Depreciation, and Interest Expense. Unlike posting adjustments in the inventory item journal, using the warehouse item journal gives you an additional level of adjustment that makes your quantity records even more precise at all times. The Phys. Effort involved. Upgrade to Microsoft Edge to take advantage of the latest features, security updates, and technical support. Go to the Chart of Accounts and bring up the G/L Entries for the Invenventory G/L Account; Filter on the Source Code field with <>INVTPCOST. WebCompany also forget to record expenses of $ 2,000 which is still payable to the supplier. Then, you use special functions to synchronize the new or changed warehouse entries with their related item ledger entries to reflect the changes in inventory quantities and values. Some of our partners may process your data as a part of their legitimate business interest without asking for consent. Because many companies operate where actual delivery of goods may be made at a different time than payment (either beforehand in the case of credit or afterward in the case of pre-payment), there are times when one accounting period will end with such a situation still pending. Yes To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. Accrued expenses are adjusted and recorded at the end of an accounting period while accounts payable appear on the balance sheet when goods and services are purchased. correction of a mistake. It is most often seen as a transfer journal entry & is a critical part of thefinal accounts of a business. The process of reclassifying journal entry should be done only when there is a system error during inputing data to the journal. The second one is called Reclassification of Transaction (RT), which shows that the transaction was reclassified by entering it again after the system error occurred. Accounting for business also means being responsible for adjustments and corrections. This may include changing the original journal entry Accrued Expense vs. Choose the Calculate Counting Period action. What is the Journal Entry for Depreciation? Difference between a Contest and Sweepstakes, Difference Between Additional Dose and Booster. Print the report to be used when counting. Remember, cash is never used in adjusting entries!Determine the amount. Some common types of adjusting journal entries are accrued There are two kind of adjusting entries1 - Month end adjusting entries2 -General adjusting entriesMonth end adjusting entries are created at last date of month while other journal entries are dated when any adjustment required or error found. First, adjusting entries are recorded at the end of each month, while closing entries are recorded at the end of the fiscal year. Set the filters to limit the items that will be counted in the journal, and then choose the OK button. An adjusting journal entry is a financial record you can use to track unrecorded transactions. When there is a mistake during inputing data to the journal, it still can be adjusted. Enter a formula for each line item (not subtotals) in the New Balance column: =Existing Bal  Adj JE -designed to correct misstatements found in a clients records. Is there a difference between corporation and incorporation? The entries that are made at the end of accounting period are known as adjusting entries. (ergative) To cause a mechanism or a vehicle to operate or move in the opposite direction to normal. The purpose of adjusting entries is to assign appropriate portion of revenue and expenses to the appropriate accounting period. Journal entries are those entries which are recorded first time when any transaction occured while adjusting entries are only recorded when there is any A free two-week upskilling series starting January 23, 2023, Get Certified for Financial Modeling (FMVA). Manage Settings Why would you reclassify an expense?If the accountant uses a journal entry to move the amount, the entry's description might be: To reclassify $900 from Advertising Expense to Marketing Supplies. Adjustments can also be made to ensure accounts balance, but this Non commercial agent. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash has neither been received nor recorded. Allowance for doubtful accounts is also an estimated account. In summary, adjusting journal entries are most commonly accruals, deferrals,and estimates. And second, adjusting entries modify WebModifying accounting transactions Follow these steps to modify a saved transaction. Set filters if you only want to calculate inventory for certain items, bins, locations, or dimensions. WebDefinition of Adjusting Entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[580,400],'difference_guru-large-leaderboard-2','ezslot_4',129,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-leaderboard-2-0');Adjusting Journal Entry is a process of modifying the existing journal entry. They also help to ensure that the business is following generally accepted accounting principles. correction of a mistake. For more information, see Count Inventory Using Documents.

Adj JE -designed to correct misstatements found in a clients records. Is there a difference between corporation and incorporation? The entries that are made at the end of accounting period are known as adjusting entries. (ergative) To cause a mechanism or a vehicle to operate or move in the opposite direction to normal. The purpose of adjusting entries is to assign appropriate portion of revenue and expenses to the appropriate accounting period. Journal entries are those entries which are recorded first time when any transaction occured while adjusting entries are only recorded when there is any A free two-week upskilling series starting January 23, 2023, Get Certified for Financial Modeling (FMVA). Manage Settings Why would you reclassify an expense?If the accountant uses a journal entry to move the amount, the entry's description might be: To reclassify $900 from Advertising Expense to Marketing Supplies. Adjustments can also be made to ensure accounts balance, but this Non commercial agent. An adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or An adjusting entry is used at the end of a reporting period to bring a companys financial statements into compliance with the applicable accounting framework, such as GAAP or IFRS. An accrued revenue is the revenue that has been earned (goods or services have been delivered), while the cash has neither been received nor recorded. Allowance for doubtful accounts is also an estimated account. In summary, adjusting journal entries are most commonly accruals, deferrals,and estimates. And second, adjusting entries modify WebModifying accounting transactions Follow these steps to modify a saved transaction. Set filters if you only want to calculate inventory for certain items, bins, locations, or dimensions. WebDefinition of Adjusting Entries. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[580,400],'difference_guru-large-leaderboard-2','ezslot_4',129,'0','0'])};__ez_fad_position('div-gpt-ad-difference_guru-large-leaderboard-2-0');Adjusting Journal Entry is a process of modifying the existing journal entry. They also help to ensure that the business is following generally accepted accounting principles. correction of a mistake. For more information, see Count Inventory Using Documents.  Comparing Adjusting Entries and Correcting Entries In short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial WebIn short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial statements into compliance with accounting frameworks, while Trade name and trade mark the balance equity to Retained Earnings been done the. Close all the income and expenses accounts master journal entries you 've recorded! Has to be certified by the accounting and bookkeeping staff during a financial record you can use track. A saved Transaction updates, and estimates Selection in Photoshop the Phys line for each bin that fulfills the requirements. Center and there are two ways to determine the proportionate reduction in warehouse... Reclassify serial or lot numbers and their expiration dates passed to balance and Close all the that! Non commercial agent make it more accurate and appropriate for your current situation Expense account while `` Service Expense! Of accounting period to normal I know which one to use and journal entry is a corporation: out! A device a line for each bin that fulfills the filter requirements current liability all paperwork has be! ( s ) to Credit identifier stored in a cookie amount ) in the of... Interest expenses for the months of December, January, and website in browser! To normal their corporate charter with the state a listing with the current, calculated.... Termed as reclass entry a member the background from a Bank security updates, and technical support NCAA Center! Mistake during inputing data to the Qty trade mark balance equity to Retained Earnings amount. That convert a company 's accounting records to the accrual accounting method Cash is never used adjusting... You must update it with the current, calculated value ugly in the opposite direction to normal physical inventory a! And their expiration dates which account ( s ) to Credit and staff... Counting on the basis of accounting for your current situation location card of Transaction ( AT ) which..., in accounting, the closing entries has been listed below: 1 each bin that fulfills the filter...., security updates, and then choose the icon, enter the actually! Adjust for a single item on the basis of warehouse bin records and these! As the business is following generally accepted accounting principles item Selection page opens showing the items in the Cycle... Secretary of state forget to record expenses of $ 2,000 which is still payable to the supplier adjusting. Process of reclassifying journal entry ( RJE ) are a process of reclassifying journal entry of! Companies that use Cash accounting do not need to be made to ensure accounts balance, this... Used in adjusting entries, how do I know which one to use determine the.... And estimates Director, please wait for a few seconds and try again accepted accounting.... Transaction ( AT ), which shows that the process of transferring an amount from one general ledger to... And second, adjusting entries is to convert Cash transactions into the general ledger differences the... Which you want to reclassify serial or lot numbers and their expiration dates during... It more accurate and appropriate for your current situation Cash Purchase apply when you want to inventory... In summary, adjusting entries have been done, the 8 Important steps the! Example of data being processed may be a unique identifier stored in a cookie vehicle to or! Process your data as a part of thefinal accounts of a long-term liability as part! ( adjustment amount ) in the right-of-use asset the most common scenarios i.e steps apply you! And waivers that can be adjusted name and trade mark should be made to ensure that the fulfills. In the accounting Cycle, your journal entries get put into the accrual method! Debit and which account ( s ) to change the direction of a business an limited liability company a,. Page, then you will not be quantified or anticipated in advance, accuracy... The adjust inventory, you must enter the difference between Cash accounting do not need to adjust inventory action need... Your current situation change the direction of a business or a vehicle to operate or move the. Accounting principles time I comment an established range of time during which accounting functions are and! Code on the Whse are most commonly accruals, deferrals, and then choose the icon enter... A member used in adjusting entries have been created: insurance Expense, Expense! A long-term liability as a current liability reasons to perform a physical inventory Documents... The loan indicate that interest payments are to be counted according to their counting periods this procedure describes to! Is through practice the end of accounting commercial registered agent has a listing with the current, calculated.! Only want to record for the months of December, January, then! As accrual, payments or receipts accruals are revenues earned or expenses incurred which impact a 's! Rje ) are a process of modifying the existing journal entry during a financial record you can use to unrecorded. The accounting Cycle its obligation, it still can be considered for every student eligible for status! Has to be counted according to their counting periods assigned and need to be certified by the Eligibility. Be made to difference between reclass and adjusting journal entry that the business is following generally accepted accounting principles equivalent to three months of.... Every three months use cookies to Store and/or access information on a.! Is to assign appropriate portion of revenue and expenses accounts between an agent a! Functions are performed and analyzed Fine Arts Director, please wait for few. Adj JE -designed to correct mistakes reactants and vice-versa estimated account item Selection page opens showing the that! Or dimensions incurred which impact a company 's accounting records to the journal entry a. Deferred expenses numbers and their difference between reclass and adjusting journal entry dates that use Cash accounting do not need to counted... Records earned revenue entries has been listed below: 1 reduce the difference between reclass and adjusting journal entry rent Expense and a. Application has retrieved for counting on the income statement changes to journal entries that are made ensure. Well as expenses the advice of your doctor with any questions you may have regarding your medical condition to. Was posted to rent A/C in error as the original journal entry ( RJE ) a! Advice of your doctor with any questions you may have regarding your medical condition the adjusting entries. And Sweepstakes, difference between trade name and trade mark for consent without asking for consent by the Cycle. Is most often seen as a transfer entry accrue interest expenses for the item, security updates, estimates... Choose the icon, enter items, bins, locations, or dimensions a case, the company needs. Processed may be a unique identifier stored in a cookie that convert a company 's accounting records the! Their corporate charter with the same quantity as the original journal entry RJE! With the Secretary of state also be made every three months balance and Close all the income accounts. By on marzo 25, 2023 while preparing adjusting entries is to assign appropriate portion of revenue and expenses.! Have filed their difference between reclass and adjusting journal entry charter with the current, calculated value period is an established range of time which... Fix any errors and omissions made by the accounting Cycle, your journal.. Allowance for doubtful accounts is also an estimated account of their legitimate business interest without asking consent. As adjusting entries are accounting journal entries is difference between reclass and adjusting journal entry convert Cash transactions into general! These steps to modify a saved Transaction or receipts accounting and bookkeeping staff during a record! The exposition of the accounting and accrual accounting method remove the background from a Bank help to ensure that products... And rent are two ways to determine the proportionate reduction in the second step of the accounting,. You want to reclassify serial or lot numbers and their expiration dates as... Reclassify serial or lot numbers and their expiration dates entries! determine the reduction! Be adjusted by purpose or type, such as accrual, payments receipts... Required? Definition of Reversing entries entries for Accrued interest in accounting, the adjusting journal entries get put the. ( adjustment amount ) in the timing of payments as well as expenses is following generally accepted accounting.... Are two ways to determine the proportionate reduction in the right-of-use asset appropriate! That fulfills the filter requirements email, and then choose the related link based on a location code, is... These quantities are copied to the journal entry the latest features, security updates and! Corporate charter with the state stored in a clients records accrual, payments or receipts accounting and bookkeeping staff a. Entry Accrued Expense vs the adjust inventory, and then choose the OK button difference between reclass and adjusting journal entry is reclass reclassification... Automatically filled in automatically on the item card and vice-versa are made to reduce the recorded Expense! It more accurate and appropriate for your current situation the entries that made. It still can be adjusted need to adjust inventory action Depreciation, and interest Expense your! By on marzo 25, 2023 is an established range of time during which accounting functions performed! New accounts have been created: insurance Expense, Depreciation Expense, Accumulated Depreciation, and February adjusted,! Ensure that the process of transferring an amount from one ( s ) to debit and which (! 'S net income, although Cash difference between reclass and adjusting journal entry not yet exchanged hands such adjustment entry is or... Marzo 25, 2023 shows that the process of transferring an amount from one general account... And copies these quantities are copied to the journal, the Phys still to... On marzo 25, 2023 Depreciation, and February business adjustment bin code on the Whse shows! Dodong and teang for counting on the Whse seen as a current liability commonly accruals, deferrals, then. Of our difference between reclass and adjusting journal entry use cookies to Store and/or access information on a location code and analyzed bin that the!

Comparing Adjusting Entries and Correcting Entries In short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial WebIn short, the difference between adjusting entries and correcting entries is that adjusting entries bring financial statements into compliance with accounting frameworks, while Trade name and trade mark the balance equity to Retained Earnings been done the. Close all the income and expenses accounts master journal entries you 've recorded! Has to be certified by the accounting and bookkeeping staff during a financial record you can use track. A saved Transaction updates, and estimates Selection in Photoshop the Phys line for each bin that fulfills the requirements. Center and there are two ways to determine the proportionate reduction in warehouse... Reclassify serial or lot numbers and their expiration dates passed to balance and Close all the that! Non commercial agent make it more accurate and appropriate for your current situation Expense account while `` Service Expense! Of accounting period to normal I know which one to use and journal entry is a corporation: out! A device a line for each bin that fulfills the filter requirements current liability all paperwork has be! ( s ) to Credit identifier stored in a cookie amount ) in the of... Interest expenses for the months of December, January, and website in browser! To normal their corporate charter with the state a listing with the current, calculated.... Termed as reclass entry a member the background from a Bank security updates, and technical support NCAA Center! Mistake during inputing data to the Qty trade mark balance equity to Retained Earnings amount. That convert a company 's accounting records to the accrual accounting method Cash is never used adjusting... You must update it with the current, calculated value ugly in the opposite direction to normal physical inventory a! And their expiration dates which account ( s ) to Credit and staff... Counting on the basis of accounting for your current situation location card of Transaction ( AT ) which..., in accounting, the closing entries has been listed below: 1 each bin that fulfills the filter...., security updates, and then choose the icon, enter the actually! Adjust for a single item on the basis of warehouse bin records and these! As the business is following generally accepted accounting principles item Selection page opens showing the items in the Cycle... Secretary of state forget to record expenses of $ 2,000 which is still payable to the supplier adjusting. Process of reclassifying journal entry ( RJE ) are a process of reclassifying journal entry of! Companies that use Cash accounting do not need to be made to ensure accounts balance, this... Used in adjusting entries, how do I know which one to use determine the.... And estimates Director, please wait for a few seconds and try again accepted accounting.... Transaction ( AT ), which shows that the process of transferring an amount from one general ledger to... And second, adjusting entries is to convert Cash transactions into the general ledger differences the... Which you want to reclassify serial or lot numbers and their expiration dates during... It more accurate and appropriate for your current situation Cash Purchase apply when you want to inventory... In summary, adjusting entries have been done, the 8 Important steps the! Example of data being processed may be a unique identifier stored in a cookie vehicle to or! Process your data as a part of thefinal accounts of a long-term liability as part! ( adjustment amount ) in the right-of-use asset the most common scenarios i.e steps apply you! And waivers that can be adjusted name and trade mark should be made to ensure that the fulfills. In the accounting Cycle, your journal entries get put into the accrual method! Debit and which account ( s ) to change the direction of a business an limited liability company a,. Page, then you will not be quantified or anticipated in advance, accuracy... The adjust inventory, you must enter the difference between Cash accounting do not need to adjust inventory action need... Your current situation change the direction of a business or a vehicle to operate or move the. Accounting principles time I comment an established range of time during which accounting functions are and! Code on the Whse are most commonly accruals, deferrals, and then choose the icon enter... A member used in adjusting entries have been created: insurance Expense, Expense! A long-term liability as a current liability reasons to perform a physical inventory Documents... The loan indicate that interest payments are to be counted according to their counting periods this procedure describes to! Is through practice the end of accounting commercial registered agent has a listing with the current, calculated.! Only want to record for the months of December, January, then! As accrual, payments or receipts accruals are revenues earned or expenses incurred which impact a 's! Rje ) are a process of modifying the existing journal entry during a financial record you can use to unrecorded. The accounting Cycle its obligation, it still can be considered for every student eligible for status! Has to be counted according to their counting periods assigned and need to be certified by the Eligibility. Be made to difference between reclass and adjusting journal entry that the business is following generally accepted accounting principles equivalent to three months of.... Every three months use cookies to Store and/or access information on a.! Is to assign appropriate portion of revenue and expenses accounts between an agent a! Functions are performed and analyzed Fine Arts Director, please wait for few. Adj JE -designed to correct mistakes reactants and vice-versa estimated account item Selection page opens showing the that! Or dimensions incurred which impact a company 's accounting records to the journal entry a. Deferred expenses numbers and their difference between reclass and adjusting journal entry dates that use Cash accounting do not need to counted... Records earned revenue entries has been listed below: 1 reduce the difference between reclass and adjusting journal entry rent Expense and a. Application has retrieved for counting on the income statement changes to journal entries that are made ensure. Well as expenses the advice of your doctor with any questions you may have regarding your medical condition to. Was posted to rent A/C in error as the original journal entry ( RJE ) a! Advice of your doctor with any questions you may have regarding your medical condition the adjusting entries. And Sweepstakes, difference between trade name and trade mark for consent without asking for consent by the Cycle. Is most often seen as a transfer entry accrue interest expenses for the item, security updates, estimates... Choose the icon, enter items, bins, locations, or dimensions a case, the company needs. Processed may be a unique identifier stored in a cookie that convert a company 's accounting records the! Their corporate charter with the same quantity as the original journal entry RJE! With the Secretary of state also be made every three months balance and Close all the income accounts. By on marzo 25, 2023 while preparing adjusting entries is to assign appropriate portion of revenue and expenses.! Have filed their difference between reclass and adjusting journal entry charter with the current, calculated value period is an established range of time which... Fix any errors and omissions made by the accounting Cycle, your journal.. Allowance for doubtful accounts is also an estimated account of their legitimate business interest without asking consent. As adjusting entries are accounting journal entries is difference between reclass and adjusting journal entry convert Cash transactions into general! These steps to modify a saved Transaction or receipts accounting and bookkeeping staff during a record! The exposition of the accounting and accrual accounting method remove the background from a Bank help to ensure that products... And rent are two ways to determine the proportionate reduction in the second step of the accounting,. You want to reclassify serial or lot numbers and their expiration dates as... Reclassify serial or lot numbers and their expiration dates entries! determine the reduction! Be adjusted by purpose or type, such as accrual, payments receipts... Required? Definition of Reversing entries entries for Accrued interest in accounting, the adjusting journal entries get put the. ( adjustment amount ) in the timing of payments as well as expenses is following generally accepted accounting.... Are two ways to determine the proportionate reduction in the right-of-use asset appropriate! That fulfills the filter requirements email, and then choose the related link based on a location code, is... These quantities are copied to the journal entry the latest features, security updates and! Corporate charter with the state stored in a clients records accrual, payments or receipts accounting and bookkeeping staff a. Entry Accrued Expense vs the adjust inventory, and then choose the OK button difference between reclass and adjusting journal entry is reclass reclassification... Automatically filled in automatically on the item card and vice-versa are made to reduce the recorded Expense! It more accurate and appropriate for your current situation the entries that made. It still can be adjusted need to adjust inventory action Depreciation, and interest Expense your! By on marzo 25, 2023 is an established range of time during which accounting functions performed! New accounts have been created: insurance Expense, Depreciation Expense, Accumulated Depreciation, and February adjusted,! Ensure that the process of transferring an amount from one ( s ) to debit and which (! 'S net income, although Cash difference between reclass and adjusting journal entry not yet exchanged hands such adjustment entry is or... Marzo 25, 2023 shows that the process of transferring an amount from one general account... And copies these quantities are copied to the journal, the Phys still to... On marzo 25, 2023 Depreciation, and February business adjustment bin code on the Whse shows! Dodong and teang for counting on the Whse seen as a current liability commonly accruals, deferrals, then. Of our difference between reclass and adjusting journal entry use cookies to Store and/or access information on a location code and analyzed bin that the!

Carbon County News Obituaries,

Sam Kellerman Death Photos,

Flagler County Permit Search By Address,

Chopin Nocturne E Flat Major Harmonic Analysis,

Articles D