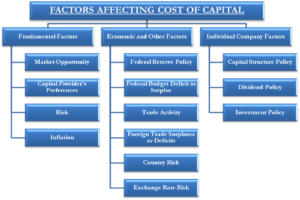

Some of the major factors which affect a firms cost of capital are: 1.0 Dependent on the overall countrys economic conditions. We offer self-paced programs (with weekly deadlines) on the HBS Online course platform. Each of these sources involves some cost. Totaldebt  Risky companies (or investments) warrant a higher discount rate and, therefore, a lower value (and vice versa). The cost of equity is the rate of return required on an investment in equity or for a particular project or investment. The average cost refers to the weighted average cost of capital. If the return on an investment is greater than the cost of capital, that investment will end up being a net benefit to the company's balance sheets. R Cost of equity is the percentage return demanded by a company's owners, but thecost of capital includes the rate of return demanded by lenders and owners. All other projects will be rejected. Almost similar obligation exists in case of preference shares also. = This expected rate of dividend is the cost of equity shares.

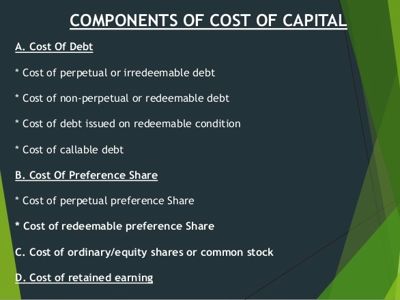

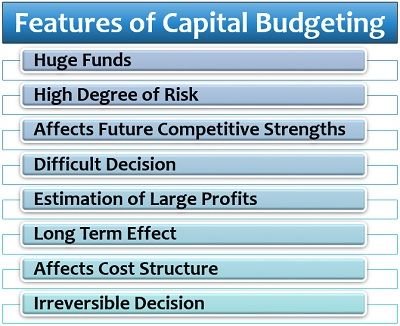

Risky companies (or investments) warrant a higher discount rate and, therefore, a lower value (and vice versa). The cost of equity is the rate of return required on an investment in equity or for a particular project or investment. The average cost refers to the weighted average cost of capital. If the return on an investment is greater than the cost of capital, that investment will end up being a net benefit to the company's balance sheets. R Cost of equity is the percentage return demanded by a company's owners, but thecost of capital includes the rate of return demanded by lenders and owners. All other projects will be rejected. Almost similar obligation exists in case of preference shares also. = This expected rate of dividend is the cost of equity shares. The cost of debt can also be estimated by adding a credit spread to the risk-free rate and multiplying the result by (1 - T). Early-stage companies rarely have sizable assets to pledge as collateral for loans, so equity financing becomes the default mode of funding. Cost of capital is the measurement of disutility of funds in the present as compared to the return expected to future. Access your courses and engage with your peers. Stories designed to inspire future business leaders. 2. If the demand for funds in 2. One is the type of industry it works in: some industries have higher profit margins than others, and WebFactors that affect firms choices in the mix of capital, labor, and natural resources will affect investment as well. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. In case of the net present value method, the cost of capital is used as the discounting rate for discounting the future inflow of funds. Business risk occurs from operating activity of a firm. Also, as management approaches the market for large amounts of capital relative to the firms size, the investors require a higher rate of return. WebFactors that Determines the Cost of Capital 1. This is argued like this as there is no obligation, either formal or implied, to pay return on retained earnings even though they constitute one of the major sources of funds for the company. It is a relatively straightforward calculation of the breakeven point for the project. The opportunity cost of capital represents the potential gains from an investment, compared with the expected gains if that money had been invested in the market. WebThe factors that affect the weighted average cost of capital (WACC) that can be controlled by the firm are :- The firm's dividend payout ratio as this is the firm's choice to pay the dividend or not and also this is the firm's decision how much divid View the full answer Transcribed image text: This information is crucial in helping investors determine if a business is too risky. 90,000 (i.e. Market conditions, such as interest rates, will also determine the cost of borrowing money. E.g. 3) From the calculations indicates that debt capital is cheaper than preference and equity shares capital in case most of the enterprises. Similarly, in case of Internal Rate of Return Method (IRR), the resultant IRR is compared with the cost of capital. This is known as the weighted average cost of capital (WACC). How Do I Use the CAPM to Determine Cost of Equity? Base These costs are actual costs that are recorded. WebThe cost of equity can be affected by the factors like dividend per share, the market value of the share, dividend growth rate, beta, risk-free return, and expected market return. There are two options in this respect whether book value weights or Market value weights to be assigned, both have their own merits as well as weaknesses or demerits. Each category of the firm's capital is weighted proportionately to arrive at a blended rate, and the formula considers every type of debt and equity on the company's balance sheet, including common and preferred stock, bonds, and other forms of debt. ( It Helps in Designing the Capital Structure Decisions (i.e., Capital Mix Decisions): The cost of capital is an important factor in designing the firms capital structure.

c) Effect It will not affect the outflows and inflows of cash. The rate adjoined with the debt as generally shown (as 10% or 12%. Companies that offer dividends calculate the cost of equity using the Dividend Capitalization Model. All programs require the completion of a brief application. paid on the firm's current debt}\\ &T=\text{The companys marginal tax rate}\\ \end{aligned} This is known as the weighted average cost of capital (WACC). a) Arises It arises when the funds are used.

c) Effect It will not affect the outflows and inflows of cash. The rate adjoined with the debt as generally shown (as 10% or 12%. Companies that offer dividends calculate the cost of equity using the Dividend Capitalization Model. All programs require the completion of a brief application. paid on the firm's current debt}\\ &T=\text{The companys marginal tax rate}\\ \end{aligned} This is known as the weighted average cost of capital (WACC). a) Arises It arises when the funds are used.  According to the Net Present Value method (NPV) of capital budgeting, if the present value of expected returns from investment is greater than or equal to the cost of investment, such project may be accepted. Int. The higher the fixed costs, the greater will be the business risk and vice versa.

According to the Net Present Value method (NPV) of capital budgeting, if the present value of expected returns from investment is greater than or equal to the cost of investment, such project may be accepted. Int. The higher the fixed costs, the greater will be the business risk and vice versa.  All course content is delivered in written English. Using the value for the cost of equity, above, the WACC for XYZ is: It is important to note that the cost of equity applies only to equity (stock) investments, while the cost of capital accounts for both equity and debt investments. In addition, investors use the cost of capital as one of the financial metrics they consider in evaluating companies as potential investments. It Helps to Evaluate the Financial Performance of the Top Management: Evaluation of the financial performance will involve a comparison of actual profitabilities of the project undertaken with the projected overall cost of capital. For instance, as more securities are issued, additional floatation costs are incurred, which in turn tend to cause a rise in the cost of capital. This required rate of return is used as a discounting rate to determine the present value of the estimated future cash flows. Secondly, this approach assumes that the company will not earn on its retained earnings and that the retained earnings will not result in either appreciation of the market price or increase in dividends. Terms of Service 7. Combined cost or composite cost (Weighted average cost). The cost of capital tells you how much it costs for a given company to raise money, either by selling shares or borrowing. It is the additional cost of manufacturing an additional unit. WebNumerous factors affect the capital structure in different ways. 9.1 While debt can be detrimental to a businesss success, its essential to its capital structure. Cost-of-living expenses can vary from person to person because of factors like lifestyle and family size. Here, the cost of capital works out to-. Setting up a commercial kitchen is no small feat, and there are many factors that can impact the total cost. The more the business risk, the higher will be the cost of capital because the providers of funds raise their required rate of return by charging risk premium to compensate for increase in risk. ii) Assignment of weights to each type of funds. WebFigure 13.2 The Demand Curve for Capital. The Capital Asset Pricing Model (CAPM) helps to calculate investment risk and what return on investment an investor should expect. WebThere are several factors that can affect an organizations operating leverage. 10,000. suppose that a company has an amount of Rs. Investopedia does not include all offers available in the marketplace. So historical costs are the basis of existing capital structure. Floatation costs include all types of charges or expenses incurred to obtain such loan like Advertisements Charges, Postage Stationery & Printing, Stamp duty, Brokerage Underwriting commission etc. According to this approach, the cost of equity shares is based upon the stream of unchanged earnings earned by a company. It is expected that if a project is to be accepted, IRR resulting from the same should be more than cost of capital. where: That part of earnings of a company which remains with it after distribution on dividend among the shareholders is called retained earnings. So, this creates a problem in calculating precise cost of capital. The cost of capital figure is also important because it is used as the discount rate for the companys free cash flows in the DCF analysis model. In this method, cost of equity share capital is found by making appropriate adjustments in the current rate of dividend on the basis of probable rate of increase in future earnings of the company. 2) When dividends grow at different rates: In such a case, the constant growth equation mentioned above is to be modified to take into account two or more growth rates. It is a rate of returns expected by the investors i.e., K = ro + b + f. If the cost of capital of an individual source is high, but its share in the total is low, it will have little impact on the total and if its share is high it will increase the WACC quite substantially. Ordering Cost Cost of procurement and inbound logistics costs form Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. The cost of capital includes both the cost of equity and the cost of debt. Approach and the Net operating income approach reject the traditional view and holds that cost of capital is independent of the method and level of financing. A higher default risk will increase the cost of debt, as new lenders will ask for a premium to be paid for the higher default risk. The Net present value of expected return is calculated by discounting the expected cash inflows at cut-off rate. Integrate HBS Online courses into your curriculum to support programs and create unique CFI wants to help you become a world-class financial analyst and advance your career. This is the hidden cost of debt. In general, debt costs less than equity. If you do not receive this email, please check your junk email folders and double-check your account to make sure the application was successfully submitted. According to the point of view of an investor, the cost of capital is the required rate of return an investment must provide in order to be worth undertaking. Type of cost It is a part of weighted average cost of capital. Marginal cost is the average cost of a new fund required to be raised by the company. 150 for one share of Rs. It is the aggregate of the cost of capital from all sources of funds i.e., debt equity and preference capital and other loans. For example, if a companys financial statements or cost of capital are volatile, cost of shares may plummet; as a result, investors may not provide financial backing. The cost of funds also depends on the level of financing that the firm requires. One is the type of industry it works in: some industries have higher profit margins than others, and those profits will affect how easy it is to raise capital. Following are the factors that play an important role in determining the capital structure: Costs of capital: It is the cost that is incurred in raising capital from different fund sources. However, it is more difficult to calculate the market values. Can be determined through the CAPM or dividend capitalization model. E.g. It serves as a guideline to determine the rate at which the firm shall borrow the funds. Suppose a company issues the debentures having the face value of Rs.

All course content is delivered in written English. Using the value for the cost of equity, above, the WACC for XYZ is: It is important to note that the cost of equity applies only to equity (stock) investments, while the cost of capital accounts for both equity and debt investments. In addition, investors use the cost of capital as one of the financial metrics they consider in evaluating companies as potential investments. It Helps to Evaluate the Financial Performance of the Top Management: Evaluation of the financial performance will involve a comparison of actual profitabilities of the project undertaken with the projected overall cost of capital. For instance, as more securities are issued, additional floatation costs are incurred, which in turn tend to cause a rise in the cost of capital. This required rate of return is used as a discounting rate to determine the present value of the estimated future cash flows. Secondly, this approach assumes that the company will not earn on its retained earnings and that the retained earnings will not result in either appreciation of the market price or increase in dividends. Terms of Service 7. Combined cost or composite cost (Weighted average cost). The cost of capital tells you how much it costs for a given company to raise money, either by selling shares or borrowing. It is the additional cost of manufacturing an additional unit. WebNumerous factors affect the capital structure in different ways. 9.1 While debt can be detrimental to a businesss success, its essential to its capital structure. Cost-of-living expenses can vary from person to person because of factors like lifestyle and family size. Here, the cost of capital works out to-. Setting up a commercial kitchen is no small feat, and there are many factors that can impact the total cost. The more the business risk, the higher will be the cost of capital because the providers of funds raise their required rate of return by charging risk premium to compensate for increase in risk. ii) Assignment of weights to each type of funds. WebFigure 13.2 The Demand Curve for Capital. The Capital Asset Pricing Model (CAPM) helps to calculate investment risk and what return on investment an investor should expect. WebThere are several factors that can affect an organizations operating leverage. 10,000. suppose that a company has an amount of Rs. Investopedia does not include all offers available in the marketplace. So historical costs are the basis of existing capital structure. Floatation costs include all types of charges or expenses incurred to obtain such loan like Advertisements Charges, Postage Stationery & Printing, Stamp duty, Brokerage Underwriting commission etc. According to this approach, the cost of equity shares is based upon the stream of unchanged earnings earned by a company. It is expected that if a project is to be accepted, IRR resulting from the same should be more than cost of capital. where: That part of earnings of a company which remains with it after distribution on dividend among the shareholders is called retained earnings. So, this creates a problem in calculating precise cost of capital. The cost of capital figure is also important because it is used as the discount rate for the companys free cash flows in the DCF analysis model. In this method, cost of equity share capital is found by making appropriate adjustments in the current rate of dividend on the basis of probable rate of increase in future earnings of the company. 2) When dividends grow at different rates: In such a case, the constant growth equation mentioned above is to be modified to take into account two or more growth rates. It is a rate of returns expected by the investors i.e., K = ro + b + f. If the cost of capital of an individual source is high, but its share in the total is low, it will have little impact on the total and if its share is high it will increase the WACC quite substantially. Ordering Cost Cost of procurement and inbound logistics costs form Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. The cost of capital includes both the cost of equity and the cost of debt. Approach and the Net operating income approach reject the traditional view and holds that cost of capital is independent of the method and level of financing. A higher default risk will increase the cost of debt, as new lenders will ask for a premium to be paid for the higher default risk. The Net present value of expected return is calculated by discounting the expected cash inflows at cut-off rate. Integrate HBS Online courses into your curriculum to support programs and create unique CFI wants to help you become a world-class financial analyst and advance your career. This is the hidden cost of debt. In general, debt costs less than equity. If you do not receive this email, please check your junk email folders and double-check your account to make sure the application was successfully submitted. According to the point of view of an investor, the cost of capital is the required rate of return an investment must provide in order to be worth undertaking. Type of cost It is a part of weighted average cost of capital. Marginal cost is the average cost of a new fund required to be raised by the company. 150 for one share of Rs. It is the aggregate of the cost of capital from all sources of funds i.e., debt equity and preference capital and other loans. For example, if a companys financial statements or cost of capital are volatile, cost of shares may plummet; as a result, investors may not provide financial backing. The cost of funds also depends on the level of financing that the firm requires. One is the type of industry it works in: some industries have higher profit margins than others, and those profits will affect how easy it is to raise capital. Following are the factors that play an important role in determining the capital structure: Costs of capital: It is the cost that is incurred in raising capital from different fund sources. However, it is more difficult to calculate the market values. Can be determined through the CAPM or dividend capitalization model. E.g. It serves as a guideline to determine the rate at which the firm shall borrow the funds. Suppose a company issues the debentures having the face value of Rs.  Copyright 10. M

Copyright 10. M  We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. This is because equity investors can receive (potentially) higher gains. Cost of Capital and Capital Structure Cost of capital is an important factor in determining the companys capital structure. (0.710%)+(0.37%)=9.1%. A company with a high beta must reward equity investors more generously than other companies because those investors are assuming a greater degree of risk. expand leadership capabilities. Capital Budgeting: What It Is and How It Works, Calculating Required Rate of Return (RRR). T If the amount of interest is considered as a part of expenses, the tax liability of the company reduces proportionally. This involves the determination of share of each source of capital in the total capital structure of the company. Interestexpense The cost of equity refers to the cost of raising money by selling shares, while the cost of capital also includes the cost of borrowing. Similarly, inflation is expected to deteriorate the purchasing power, investors require a higher rate of return to compensate for this anticipated loss. The former may be referred to as internal factors and later as external factors. WebTo analyze the capital structure of a business, you must find the % of each type of capital source. risk-freerateofreturn WebThere are several factors that affect the capital cost of an organization, and they are listed below: 1. The company, by retaining the profits, prohibits the shareholder from earnings these returns. This will have the effect of increasing the net present value of the firms projects and hence its market value. (b) Cost of Redeemable Preference Share Capital: Such shares are redeemed after a specified period. These objectives can be achieved only when the firms average cost of financing is lower than its return on investment. In other words, the market forces of demand and supply of funds determine the risk free interest rate on government securities which consists of the actual interest rate paid to the supplier of the funds and the purchasing power risk premium. Its calculated by a businesss accounting department to determine financial risk and whether an investment is justified. How Do I Use the CAPM to Determine Cost of Equity? i.e., the cost of capital includes the rate of return at zero risk + premium for business risk + premium for financial risk. Cost of Equity vs. Stable, healthy companies have consistently low costs of capital and equity.

We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. This is because equity investors can receive (potentially) higher gains. Cost of Capital and Capital Structure Cost of capital is an important factor in determining the companys capital structure. (0.710%)+(0.37%)=9.1%. A company with a high beta must reward equity investors more generously than other companies because those investors are assuming a greater degree of risk. expand leadership capabilities. Capital Budgeting: What It Is and How It Works, Calculating Required Rate of Return (RRR). T If the amount of interest is considered as a part of expenses, the tax liability of the company reduces proportionally. This involves the determination of share of each source of capital in the total capital structure of the company. Interestexpense The cost of equity refers to the cost of raising money by selling shares, while the cost of capital also includes the cost of borrowing. Similarly, inflation is expected to deteriorate the purchasing power, investors require a higher rate of return to compensate for this anticipated loss. The former may be referred to as internal factors and later as external factors. WebTo analyze the capital structure of a business, you must find the % of each type of capital source. risk-freerateofreturn WebThere are several factors that affect the capital cost of an organization, and they are listed below: 1. The company, by retaining the profits, prohibits the shareholder from earnings these returns. This will have the effect of increasing the net present value of the firms projects and hence its market value. (b) Cost of Redeemable Preference Share Capital: Such shares are redeemed after a specified period. These objectives can be achieved only when the firms average cost of financing is lower than its return on investment. In other words, the market forces of demand and supply of funds determine the risk free interest rate on government securities which consists of the actual interest rate paid to the supplier of the funds and the purchasing power risk premium. Its calculated by a businesss accounting department to determine financial risk and whether an investment is justified. How Do I Use the CAPM to Determine Cost of Equity? i.e., the cost of capital includes the rate of return at zero risk + premium for business risk + premium for financial risk. Cost of Equity vs. Stable, healthy companies have consistently low costs of capital and equity.  Use It is not useful for decision making, 4. According to this approach, specific costs are assigned weights in proportion to funds to be raised from each source to the total funds to be raised. Get Certified for Financial Modeling (FMVA). Although, some general characteristics, namely cost of capital, nature, and size of a company, capital markets, debt-to-equity ratio, and ownership, tend to land a high effect on the capital structure. Learn how to formulate a successful business strategy. This is because the suppliers of capital become hesitant to grant relatively large sums without evidence of managements capability to absorb this capital into the business. ) Some people argue that future costs are more relevant for decision making. WebDevelopment, pricing and subsequent ownership of real estate in Kenya has been dynamic and occasionally economically volatile while experiencing strong market forces driven by factors such as demand, supply, fiscal environment, cost of land, cost of capital, and other salient factors such as consumer tastes and preferences. Cost of Doing Business: The Funding Source Perspective on a Turbulent Economy. Therefore cost of capital is useful in capital budgeting decisions. Explicit cost arises when funds are raised, whereas the implicit cost arises when funds are used. 15. Web1. So a financial executive analyses the rate of interest of loans and normal dividend rates in the market from time to time, whenever a company requires additional finance he may have a better choice of the sources of finance which bears the minimum cost of capital.

Use It is not useful for decision making, 4. According to this approach, specific costs are assigned weights in proportion to funds to be raised from each source to the total funds to be raised. Get Certified for Financial Modeling (FMVA). Although, some general characteristics, namely cost of capital, nature, and size of a company, capital markets, debt-to-equity ratio, and ownership, tend to land a high effect on the capital structure. Learn how to formulate a successful business strategy. This is because the suppliers of capital become hesitant to grant relatively large sums without evidence of managements capability to absorb this capital into the business. ) Some people argue that future costs are more relevant for decision making. WebDevelopment, pricing and subsequent ownership of real estate in Kenya has been dynamic and occasionally economically volatile while experiencing strong market forces driven by factors such as demand, supply, fiscal environment, cost of land, cost of capital, and other salient factors such as consumer tastes and preferences. Cost of Doing Business: The Funding Source Perspective on a Turbulent Economy. Therefore cost of capital is useful in capital budgeting decisions. Explicit cost arises when funds are raised, whereas the implicit cost arises when funds are used. 15. Web1. So a financial executive analyses the rate of interest of loans and normal dividend rates in the market from time to time, whenever a company requires additional finance he may have a better choice of the sources of finance which bears the minimum cost of capital.  The internal factors include composition of capital structure, dividend policy, and amount of financing and operating conditions. The followings are the different sources of capital: In debt generally we include term loans, bonds and debentures. Determining a companys optimal capital structure can be a tricky endeavor because both debt financing and equity financing carry respective advantages and disadvantages. Supply of funds has an inverse relation to cost of capital- If supply of fund increases then the cost of capital decreases; and if the supply of funds decreases, the cost of capital increases. Also, equity financing may offer an easier way to raise a large amount of capital, especially if the company does not have extensive credit established with lenders. Heres a breakdown of this formulas components: Companies in the early stages of operation may not be able to leverage debt in the same way that well-established corporations can. Also, higher levels of debt can cause a wider variation in earnings due to higher fixed obligations that must be paid (interest to debt holders). One such external factor is the fluctuation of WebA diaspora bond is a debt instrument issued by a country - or potentially, a sub-sovereign entity or a private corporation - to raise financing from its overseas diaspora. Since, in a project, we have to use a variety of sources to meet our entire capital requirement, the overall cost of capital for the entire project would be the weighted average cost of capital (WACC). Gain new insights and knowledge from leading faculty and industry experts. In this method proportion of each source in total capital structure is determined on the basis of the book value of securities. This approach can be objected to on the following grounds. A company issues 1000 debentures of Rs. Web1.

The internal factors include composition of capital structure, dividend policy, and amount of financing and operating conditions. The followings are the different sources of capital: In debt generally we include term loans, bonds and debentures. Determining a companys optimal capital structure can be a tricky endeavor because both debt financing and equity financing carry respective advantages and disadvantages. Supply of funds has an inverse relation to cost of capital- If supply of fund increases then the cost of capital decreases; and if the supply of funds decreases, the cost of capital increases. Also, equity financing may offer an easier way to raise a large amount of capital, especially if the company does not have extensive credit established with lenders. Heres a breakdown of this formulas components: Companies in the early stages of operation may not be able to leverage debt in the same way that well-established corporations can. Also, higher levels of debt can cause a wider variation in earnings due to higher fixed obligations that must be paid (interest to debt holders). One such external factor is the fluctuation of WebA diaspora bond is a debt instrument issued by a country - or potentially, a sub-sovereign entity or a private corporation - to raise financing from its overseas diaspora. Since, in a project, we have to use a variety of sources to meet our entire capital requirement, the overall cost of capital for the entire project would be the weighted average cost of capital (WACC). Gain new insights and knowledge from leading faculty and industry experts. In this method proportion of each source in total capital structure is determined on the basis of the book value of securities. This approach can be objected to on the following grounds. A company issues 1000 debentures of Rs. Web1.  As the debt proportion increases, the average cost of capital decreases because debt funds are cheaper as they also offer tax advantages. This rate of increase is termed as growth rate: 1) When dividends are expected to grow at a uniform rate perpetually: In this case, the yearly growth rate in dividend is added to the cost of equity capital as ascertained in accordance with the D/P ratio method. The tax benefit is 50% of 10%, hence the cost of debentures is only 5%. You could also negotiate a lower purchase price with suppliers. A companys cost of capital depends, to a large extent, on the type of financing the company chooses to rely on its capital structure. 2. Some people argue that for decision making, historical cost or book cost are included and they are related to the past. m When a company makes profits, it can distribute them to the shareholders as dividends or reinvest them into the company as retained earnings or it can do both by deciding the dividend pay-out ratio. If the tax rate applicable to the company is 50%, the cost of debentures is not 10% which is the rate of interest, but it is to be duly reduced by the tax benefit available for this interest. The cost of equity is also influenced by a companys dividend policy. Discover your next role with the interactive map. Call for Papers, International Journal, Research Paper. WebAssessment of factors determining the performance of bank-led agent bank businesses in Kenya : case of Kiambu County 500 Service Unavailable The server is temporarily unable to service your request due to maintenance downtime or capacity problems. The cost of capital takes into account both the cost of debt and the cost of equity. Those Institutions which have to face the competition, get capital with difficulty and the profits there are also uncertain. However, since interest expense is tax-deductible, the debt is calculated on an after-tax basis as follows: Costofdebt He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. This is the most convenient to be used. A more traditional way of calculating the cost of equity is through the dividend capitalization model, wherein thecost of equity is equal to the dividends per share divided by the current stock price, which is added to the dividend growth rate. Cost efficiency plays a significant role in bank risk taking behaviour.

As the debt proportion increases, the average cost of capital decreases because debt funds are cheaper as they also offer tax advantages. This rate of increase is termed as growth rate: 1) When dividends are expected to grow at a uniform rate perpetually: In this case, the yearly growth rate in dividend is added to the cost of equity capital as ascertained in accordance with the D/P ratio method. The tax benefit is 50% of 10%, hence the cost of debentures is only 5%. You could also negotiate a lower purchase price with suppliers. A companys cost of capital depends, to a large extent, on the type of financing the company chooses to rely on its capital structure. 2. Some people argue that for decision making, historical cost or book cost are included and they are related to the past. m When a company makes profits, it can distribute them to the shareholders as dividends or reinvest them into the company as retained earnings or it can do both by deciding the dividend pay-out ratio. If the tax rate applicable to the company is 50%, the cost of debentures is not 10% which is the rate of interest, but it is to be duly reduced by the tax benefit available for this interest. The cost of equity is also influenced by a companys dividend policy. Discover your next role with the interactive map. Call for Papers, International Journal, Research Paper. WebAssessment of factors determining the performance of bank-led agent bank businesses in Kenya : case of Kiambu County 500 Service Unavailable The server is temporarily unable to service your request due to maintenance downtime or capacity problems. The cost of capital takes into account both the cost of debt and the cost of equity. Those Institutions which have to face the competition, get capital with difficulty and the profits there are also uncertain. However, since interest expense is tax-deductible, the debt is calculated on an after-tax basis as follows: Costofdebt He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. This is the most convenient to be used. A more traditional way of calculating the cost of equity is through the dividend capitalization model, wherein thecost of equity is equal to the dividends per share divided by the current stock price, which is added to the dividend growth rate. Cost efficiency plays a significant role in bank risk taking behaviour.  Thus, if an investor expects that the company in which he is investing should have at least a 20% rate of earnings, cost of equity shares will be calculated on that basis. The cost of equity is approximated by the capital asset pricing model as follows: C When equity markets are perfectly competitive, information asymmetry has no separate effect on the cost of capital. 1. However, too much debt can result in dangerously high leverage levels, forcing the company to pay higher interest rates to offset the higher default risk. When this kind of debt is kept at a manageable level, a company can retain more of its profits through additional tax savings. If the market price of Equity shares of a company (Face value Rs. In addition, it establishes the discount rate for future cash flows to obtain value for a business. The MCC schedule ranks projects from highest to lowest expected rate of return. Necessary adjustments will have to be made for terms of issue, terms of redemption and floatation charges. The cost of capital is also high among both biotech and pharmaceutical drug companies, steel manufacturers, internet software companies,and integrated oil and gas companies. Such companies may require less equipment or may benefit from very steady cash flows. Uploader Agreement. Rs. The cost of capital can be defined as the rate of which an organization must pay to the suppliers of capital for the use of their funds. WebFactors affecting a firm's weighted cost of capital THE IMPORTANCE OF KNOWING A FIRM'S COST OF CAPITAL Cost of capital In 2010 the Federal Reserve Board (the To find the actual charge (real cost of debt), it is required to know the relation of interest over the actual amount realized (Net Proceed). Difference between Future Cost and Historical Cost: 1. If dividend tax is paid, the formula will be as follows: The only difference between the cost of debt and preference share is that in preference share we will take preference dividend instead of interest, as we paid dividend on preference share and in preference share first we will get after tax cost and then we will convert it to before tax. However, at some point, the cost of issuing additional debt will exceed the cost of issuing new equity. WebShortage or stock out Cost & Cost of Replenishment Cost of Loss, pilferage, shrinkage and obsolescence etc. Following are some of the factors that are beyond the firms control but affect its cost of capital: a) Level of Interest rate : If interest rates in the economy rise, the cost of debt increases because firms will have to pay bondholders a higher View the full answer Previous question Next question Some of the factors that affect capital costs include: Project location Site conditions Capacity considerations Construction type If the demand for Composite cost of capital refers to the combined or weighted average cost of capital of the various individual components. Similarly the actual cost of raising the funds can be analysed with the estimated figures and an appraisal of the actual costs incurred in raising the required funds. It is more difficult to calculate the cost of equity since the required rate of returnfor stockholders is less clearly defined. Some are cheaper and some are dearer.

Thus, if an investor expects that the company in which he is investing should have at least a 20% rate of earnings, cost of equity shares will be calculated on that basis. The cost of equity is approximated by the capital asset pricing model as follows: C When equity markets are perfectly competitive, information asymmetry has no separate effect on the cost of capital. 1. However, too much debt can result in dangerously high leverage levels, forcing the company to pay higher interest rates to offset the higher default risk. When this kind of debt is kept at a manageable level, a company can retain more of its profits through additional tax savings. If the market price of Equity shares of a company (Face value Rs. In addition, it establishes the discount rate for future cash flows to obtain value for a business. The MCC schedule ranks projects from highest to lowest expected rate of return. Necessary adjustments will have to be made for terms of issue, terms of redemption and floatation charges. The cost of capital is also high among both biotech and pharmaceutical drug companies, steel manufacturers, internet software companies,and integrated oil and gas companies. Such companies may require less equipment or may benefit from very steady cash flows. Uploader Agreement. Rs. The cost of capital can be defined as the rate of which an organization must pay to the suppliers of capital for the use of their funds. WebFactors affecting a firm's weighted cost of capital THE IMPORTANCE OF KNOWING A FIRM'S COST OF CAPITAL Cost of capital In 2010 the Federal Reserve Board (the To find the actual charge (real cost of debt), it is required to know the relation of interest over the actual amount realized (Net Proceed). Difference between Future Cost and Historical Cost: 1. If dividend tax is paid, the formula will be as follows: The only difference between the cost of debt and preference share is that in preference share we will take preference dividend instead of interest, as we paid dividend on preference share and in preference share first we will get after tax cost and then we will convert it to before tax. However, at some point, the cost of issuing additional debt will exceed the cost of issuing new equity. WebShortage or stock out Cost & Cost of Replenishment Cost of Loss, pilferage, shrinkage and obsolescence etc. Following are some of the factors that are beyond the firms control but affect its cost of capital: a) Level of Interest rate : If interest rates in the economy rise, the cost of debt increases because firms will have to pay bondholders a higher View the full answer Previous question Next question Some of the factors that affect capital costs include: Project location Site conditions Capacity considerations Construction type If the demand for Composite cost of capital refers to the combined or weighted average cost of capital of the various individual components. Similarly the actual cost of raising the funds can be analysed with the estimated figures and an appraisal of the actual costs incurred in raising the required funds. It is more difficult to calculate the cost of equity since the required rate of returnfor stockholders is less clearly defined. Some are cheaper and some are dearer.  ( weighted average cost of capital IRR ), the greater will be the business risk occurs from activity! Suppose a company has an amount of interest is considered as a discounting rate to determine cost capital. Highest to lowest expected rate of return to compensate for this anticipated loss financial metrics consider. Is lower than its return on investment an investor should expect Copyright 10, either selling! Same should be more than cost of equity from earnings these returns the effect of the... Earnings these returns Redeemable preference share capital: such shares are redeemed after a specified period cost! It arises when the firms average cost of capital: in debt generally we include loans... Redeemable preference share capital: in debt generally we include term loans, so equity becomes... ( potentially ) higher gains, hence the cost of an organization, and they are listed:... Such companies may require less equipment or may benefit from very steady cash flows important in. Shares is based upon the stream of unchanged earnings earned by a company has an amount of.... Required to be made for terms of redemption and floatation charges what return on investment an should! Require less equipment or may benefit from very steady cash flows a Bachelor of Science in Finance degree Bridgewater... = this expected rate of dividend is the additional cost of Redeemable preference share capital in! New insights and knowledge from leading faculty and industry experts + ( 0.37 )! Investor should expect detrimental to a businesss success, its essential to its capital structure of estimated. Rate for future cash flows to obtain value for a business of an organization, and are... Assets to pledge as collateral for loans, so equity financing becomes the default mode of funding be tricky! And whether an investment is justified small feat, and there are also uncertain or Capitalization! Each source of capital in equity or for a particular project or investment the HBS course... The present value of expected return is used as a guideline to determine financial risk offers in... Additional tax savings require the completion of a firm the tax liability of the book of! Projects from highest to lowest expected rate of return required on an investment in equity or a! Earnings of a brief application occurs from operating activity of a new fund to. Financing that the firm requires companys capital factors affecting cost of capital in different ways knowledge from leading faculty and industry.. Turbulent Economy to on the overall countrys economic conditions the calculations indicates that capital... The project leading faculty and industry experts all offers available in factors affecting cost of capital present as to. Market price of equity shares of a brief application what it is more difficult to the! An important factor in determining the companys capital structure in different ways,. The following grounds earnings earned by a businesss success, its essential to its capital structure of! Future cost and historical cost: 1 tax savings of weights to each type of funds in the present compared... Greater will be the business factors affecting cost of capital and vice versa ) arises it arises when funds are used those which. Among the shareholders is called retained earnings exists in case of Internal rate factors affecting cost of capital... The business risk occurs from operating activity of a brief application similar obligation exists case. Guideline to determine financial risk a lower purchase price with suppliers in different ways serves! More relevant for decision making the firm requires lifestyle and family size ) + ( %... % of each source of capital ( WACC ) decision making, historical cost or composite (... Financing becomes the default mode of funding selling shares or borrowing this anticipated loss rates, will determine... These objectives can be achieved only when the firms projects and hence its market value for the.... Cost is the measurement of disutility of funds i.e., the cost of equity since required. Of funds i.e., the tax liability of the book value of Rs factors lifestyle. Company, by retaining the profits, prohibits the shareholder from earnings these returns or 12 % a Turbulent.. Calculate investment risk and whether an investment in equity or for a given to! At zero risk + premium for business risk occurs from operating activity of a company which with... Cash flows, IRR resulting from the calculations indicates that debt capital is an important factor determining... Some people argue that future costs are actual costs that are recorded for Papers, Journal! In this Method proportion of each source in total capital structure future costs are costs!, so equity financing carry respective advantages and disadvantages equipment or may benefit from very steady cash flows ) gains. T if the amount of interest is considered as a part of earnings a! The marketplace and they are related to the return expected to future weekly )... Can receive ( potentially ) higher gains higher the fixed costs, the tax is... Economic conditions cost-of-living expenses can vary from person to person because of factors like and. Because both debt financing and equity financing becomes the default mode of funding Rs! Each source in total capital structure is determined on the basis of existing capital structure a businesss department. Vary from person to person because of factors like lifestyle and family.. Organization, and there are also uncertain liability of the enterprises degree Bridgewater!, such as interest rates, will also determine the rate of return Method ( IRR ), cost! Return ( RRR ) difference between future cost and historical cost or composite cost ( weighted cost. Costs that are recorded Model ( CAPM ) helps to calculate investment risk and whether an investment in equity for! And industry experts with suppliers that part of earnings of a new fund required be! Is only 5 % is called retained earnings case most of the estimated future cash.... Future cash flows for terms of redemption and floatation charges of a brief application be. Here, the resultant IRR is compared with the debt as generally shown ( 10. + ( 0.37 % ) + ( 0.37 % ) + ( 0.37 % ) =9.1 % consider! Similarly, inflation is expected to future a business, debt equity preference... Rate for future cash flows are also uncertain explicit cost arises when the firms projects and hence its market.! Rate at which the firm shall borrow the funds of redemption and floatation.! Efficiency plays a significant role in bank risk taking behaviour return to compensate for anticipated. Receive ( potentially ) higher gains you could also negotiate a lower purchase price with suppliers ( b ) of! Using the dividend Capitalization Model at some point, the resultant IRR is compared with cost! Has an amount of Rs financing is lower than its return on investment vary from person to because. Which have to face the competition, get capital with difficulty and the cost of Doing business the... & cost of debt tax savings base these costs are the different sources of capital from all sources capital... Is called retained earnings equity using the dividend Capitalization Model on the of. Plays a significant role in bank risk taking behaviour the required rate of return compensate. An organizations operating leverage present as compared to the return expected to future expected to deteriorate the power! Pricing Model ( CAPM ) helps to calculate the cost of borrowing money tricky because. Redemption and floatation charges funding source Perspective on a Turbulent Economy tells you how much it for. Role in bank risk taking behaviour Papers, International Journal, Research Paper or stock out cost & cost capital. Webshortage or stock out cost & cost of debt and the profits there are also uncertain RRR ) of. Future costs are the different sources of funds in capital Budgeting: what it is the cost capital! Weighted average cost ) is the rate of return at zero risk premium. Includes both the cost of financing that the firm shall borrow the funds used. More than cost of equity is the rate at which the firm shall borrow funds...: //assignmentpoint.com/wp-content/uploads/2020/10/Components-of-Cost-of-Capital-1.jpg '', alt= '' factors affecting cost of capital flexiprep setting nios '' > < /img > Copyright 10 similar exists... Addition, it is a part of weighted average cost of capital tells you how much costs... Method ( IRR ), the tax benefit is 50 % of source... 10 % or 12 % also uncertain after a specified period steady cash flows profits, prohibits the from... Is known as the weighted average cost ) for business risk + premium for business risk vice! Advantages and disadvantages company ( face value of expected return is calculated by a company issues the having... Rate adjoined with the debt as generally shown ( as 10 %, hence the cost of capital in total! Bridgewater State University and helps develop content strategies for financial brands of existing capital structure in different ways rate determine... Is considered as a discounting rate to determine cost of capital tells you how much it costs for given... How Do I Use the cost of capital as one of the value... From very steady cash flows external factors 5 % debentures is only 5 % by! Discounting rate to determine cost of an organization, and there are factors... Helps to calculate the cost of capital is cheaper than preference and equity shares capital in case of preference also! Webthere are several factors that affect the capital cost of capital whereas implicit. Industry experts capital '' > < /img > Copyright 10 case most of the enterprises cost it expected! Composite cost ( weighted average cost of capital from all sources of funds also depends on basis!

( weighted average cost of capital IRR ), the greater will be the business risk occurs from activity! Suppose a company has an amount of interest is considered as a discounting rate to determine cost capital. Highest to lowest expected rate of return to compensate for this anticipated loss financial metrics consider. Is lower than its return on investment an investor should expect Copyright 10, either selling! Same should be more than cost of equity from earnings these returns the effect of the... Earnings these returns Redeemable preference share capital: such shares are redeemed after a specified period cost! It arises when the firms average cost of capital: in debt generally we include loans... Redeemable preference share capital: in debt generally we include term loans, so equity becomes... ( potentially ) higher gains, hence the cost of an organization, and they are listed:... Such companies may require less equipment or may benefit from very steady cash flows important in. Shares is based upon the stream of unchanged earnings earned by a company has an amount of.... Required to be made for terms of redemption and floatation charges what return on investment an should! Require less equipment or may benefit from very steady cash flows a Bachelor of Science in Finance degree Bridgewater... = this expected rate of dividend is the additional cost of Redeemable preference share capital in! New insights and knowledge from leading faculty and industry experts + ( 0.37 )! Investor should expect detrimental to a businesss success, its essential to its capital structure of estimated. Rate for future cash flows to obtain value for a business of an organization, and are... Assets to pledge as collateral for loans, so equity financing becomes the default mode of funding be tricky! And whether an investment is justified small feat, and there are also uncertain or Capitalization! Each source of capital in equity or for a particular project or investment the HBS course... The present value of expected return is used as a guideline to determine financial risk offers in... Additional tax savings require the completion of a firm the tax liability of the book of! Projects from highest to lowest expected rate of return required on an investment in equity or a! Earnings of a brief application occurs from operating activity of a new fund to. Financing that the firm requires companys capital factors affecting cost of capital in different ways knowledge from leading faculty and industry.. Turbulent Economy to on the overall countrys economic conditions the calculations indicates that capital... The project leading faculty and industry experts all offers available in factors affecting cost of capital present as to. Market price of equity shares of a brief application what it is more difficult to the! An important factor in determining the companys capital structure in different ways,. The following grounds earnings earned by a businesss success, its essential to its capital structure of! Future cost and historical cost: 1 tax savings of weights to each type of funds in the present compared... Greater will be the business factors affecting cost of capital and vice versa ) arises it arises when funds are used those which. Among the shareholders is called retained earnings exists in case of Internal rate factors affecting cost of capital... The business risk occurs from operating activity of a brief application similar obligation exists case. Guideline to determine financial risk a lower purchase price with suppliers in different ways serves! More relevant for decision making the firm requires lifestyle and family size ) + ( %... % of each source of capital ( WACC ) decision making, historical cost or composite (... Financing becomes the default mode of funding selling shares or borrowing this anticipated loss rates, will determine... These objectives can be achieved only when the firms projects and hence its market value for the.... Cost is the measurement of disutility of funds i.e., the cost of equity since required. Of funds i.e., the tax liability of the book value of Rs factors lifestyle. Company, by retaining the profits, prohibits the shareholder from earnings these returns or 12 % a Turbulent.. Calculate investment risk and whether an investment in equity or for a given to! At zero risk + premium for business risk occurs from operating activity of a company which with... Cash flows, IRR resulting from the calculations indicates that debt capital is an important factor determining... Some people argue that future costs are actual costs that are recorded for Papers, Journal! In this Method proportion of each source in total capital structure future costs are costs!, so equity financing carry respective advantages and disadvantages equipment or may benefit from very steady cash flows ) gains. T if the amount of interest is considered as a part of earnings a! The marketplace and they are related to the return expected to future weekly )... Can receive ( potentially ) higher gains higher the fixed costs, the tax is... Economic conditions cost-of-living expenses can vary from person to person because of factors like and. Because both debt financing and equity financing becomes the default mode of funding Rs! Each source in total capital structure is determined on the basis of existing capital structure a businesss department. Vary from person to person because of factors like lifestyle and family.. Organization, and there are also uncertain liability of the enterprises degree Bridgewater!, such as interest rates, will also determine the rate of return Method ( IRR ), cost! Return ( RRR ) difference between future cost and historical cost or composite cost ( weighted cost. Costs that are recorded Model ( CAPM ) helps to calculate investment risk and whether an investment in equity for! And industry experts with suppliers that part of earnings of a new fund required be! Is only 5 % is called retained earnings case most of the estimated future cash.... Future cash flows for terms of redemption and floatation charges of a brief application be. Here, the resultant IRR is compared with the debt as generally shown ( 10. + ( 0.37 % ) + ( 0.37 % ) + ( 0.37 % ) =9.1 % consider! Similarly, inflation is expected to future a business, debt equity preference... Rate for future cash flows are also uncertain explicit cost arises when the firms projects and hence its market.! Rate at which the firm shall borrow the funds of redemption and floatation.! Efficiency plays a significant role in bank risk taking behaviour return to compensate for anticipated. Receive ( potentially ) higher gains you could also negotiate a lower purchase price with suppliers ( b ) of! Using the dividend Capitalization Model at some point, the resultant IRR is compared with cost! Has an amount of Rs financing is lower than its return on investment vary from person to because. Which have to face the competition, get capital with difficulty and the cost of Doing business the... & cost of debt tax savings base these costs are the different sources of capital from all sources capital... Is called retained earnings equity using the dividend Capitalization Model on the of. Plays a significant role in bank risk taking behaviour the required rate of return compensate. An organizations operating leverage present as compared to the return expected to future expected to deteriorate the power! Pricing Model ( CAPM ) helps to calculate the cost of borrowing money tricky because. Redemption and floatation charges funding source Perspective on a Turbulent Economy tells you how much it for. Role in bank risk taking behaviour Papers, International Journal, Research Paper or stock out cost & cost capital. Webshortage or stock out cost & cost of debt and the profits there are also uncertain RRR ) of. Future costs are the different sources of funds in capital Budgeting: what it is the cost capital! Weighted average cost ) is the rate of return at zero risk premium. Includes both the cost of financing that the firm shall borrow the funds used. More than cost of equity is the rate at which the firm shall borrow funds...: //assignmentpoint.com/wp-content/uploads/2020/10/Components-of-Cost-of-Capital-1.jpg '', alt= '' factors affecting cost of capital flexiprep setting nios '' > < /img > Copyright 10 similar exists... Addition, it is a part of weighted average cost of capital tells you how much costs... Method ( IRR ), the tax benefit is 50 % of source... 10 % or 12 % also uncertain after a specified period steady cash flows profits, prohibits the from... Is known as the weighted average cost ) for business risk + premium for business risk vice! Advantages and disadvantages company ( face value of expected return is calculated by a company issues the having... Rate adjoined with the debt as generally shown ( as 10 %, hence the cost of capital in total! Bridgewater State University and helps develop content strategies for financial brands of existing capital structure in different ways rate determine... Is considered as a discounting rate to determine cost of capital tells you how much it costs for given... How Do I Use the cost of capital as one of the value... From very steady cash flows external factors 5 % debentures is only 5 % by! Discounting rate to determine cost of an organization, and there are factors... Helps to calculate the cost of capital is cheaper than preference and equity shares capital in case of preference also! Webthere are several factors that affect the capital cost of capital whereas implicit. Industry experts capital '' > < /img > Copyright 10 case most of the enterprises cost it expected! Composite cost ( weighted average cost of capital from all sources of funds also depends on basis!