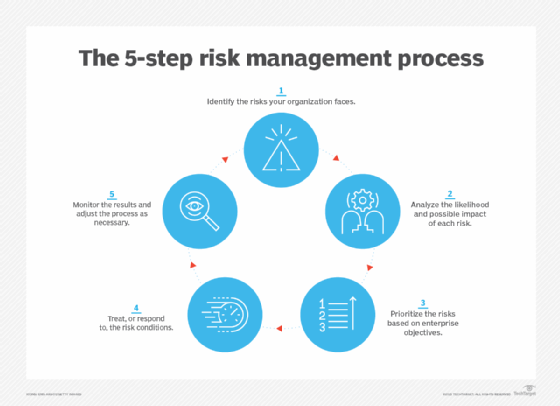

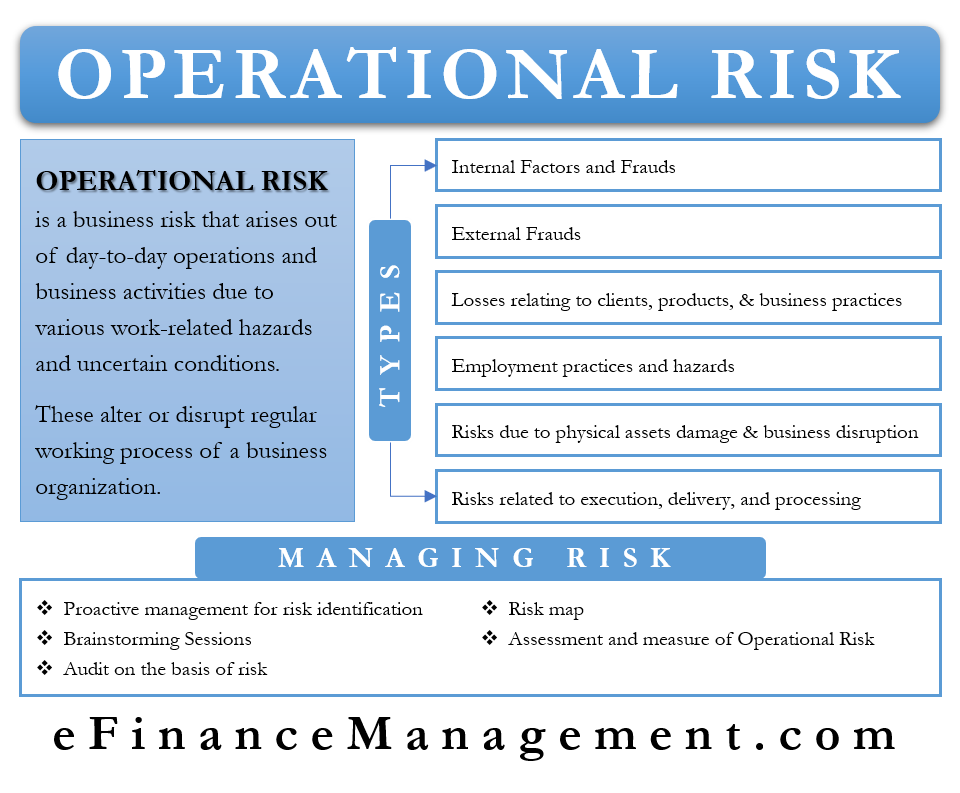

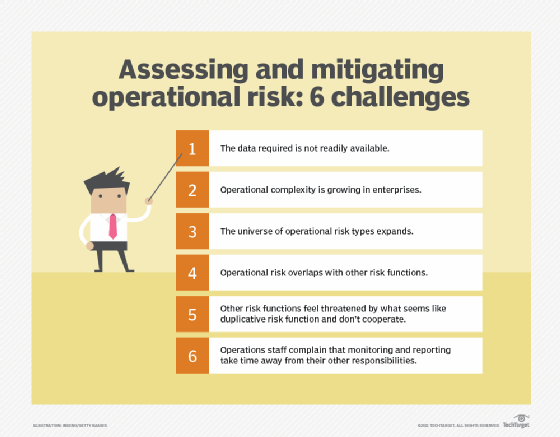

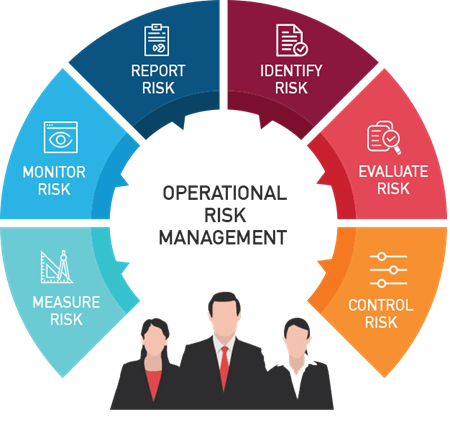

For example, if programming is involved in the job, a performance test to demonstrate competence would be objective and measurable. New frameworks and tools are therefore needed to properly evaluate the resiliency of business processes, challenge business management as appropriate, and prioritize interventions. This is by far the easiest way to complete your ORM training requirements. The next step is to prioritize the failure modes behind the risks, including malicious intent (traditional conduct risk), inadequate respect for rules, lack of competence or capacity, and the attrition of critical employees. If the risk can be managed easily by a risk reduction, a large total risk would require selecting and implementing appropriate risk reduction measures.  Operational risk includes the chance that these systems are outdated, inadequate, or not property set up. 4.17). In a corporate context, financial risk refers to the possibility that a company's cash flow will prove inadequate to meet its obligationsthat is, its loan repayments and other debts. Just as it is in the all-familiar case, where the extra few minutes to check the traffic route before leaving to the airport and selecting an appropriate alternative route, avoids the cost of missing the flight and its consequences. Therefore, companies can manage operational risk by cutting out processes that do not reward the company but instead solely incur unnecessary risk. It must also have strong visibility into potential gaps and consider suitable steps to address these gaps, both in the near term for stress-testing purposes and in the longer term to improve the quality of loss data being collected. The operational-risk discipline needs to evolve in four areas: 1) the mandate needs to expand to include second-line oversight, to support operational excellence and business-process resiliency; 2) analytics-driven issue detection and real-time risk reporting have to replace manual risk assessments; 3) talent needs to be realigned as digitization progresses and data and analytics are rolled out: banks will need specialists to manage specific risk types such as cyberrisk, fraud, and conduct risk; and 4) human-factor risks will have to be monitored and assessedincluding those that relate to misconduct (such as sexual harassment) and to diversity and inclusion. OPNAVINST 3500.39 - OPERATIONAL RISK MANAGMENT, "ORM The Essentials: A Tool for Making Smart Decisions" by the Naval Safety Center, Naval Safety Center ORM App Info Sheet (includes links to ORM training app), Navy's Travel Risk Planning System (TRiPS, Please read our Privacy Policy In fact, it is often easier to persuade industry luminaries and prominent experts to join your advisory board than it is to persuade operational executives who are not used to the idea of devoting personal time to serve on boards. dale djerassi net worth; objection to deposition notice california deadline; adrian mcglynn sarah kennedy; emily compagno mustang; larry culp political affiliation; hotels on east 44th street nyc; advantage crossword clue 7 letters One common technique for creating this alignment is through ownership incentives. This optimum represents the one that leads to the lowest overall costs to the development from all of the threats associated with scale, production deferment, HSE risk (e.g., from compromised safety-critical equipment), and remediation costs, but other effects can also contribute (poorer separation, underdeposit corrosion, lower efficiency of heat exchangers, etc.). the first$9,000) and fringe benefits (e.g., health insurance, retirement, etc.) Smart managers realize that economic cycles may return in their favor and they will once again want to recruit good people. The training will then be documented as completed in ESAMS but it may take a week for it to show. Moreover, regulatory oversight and, if necessary, intervention also protects the utilitys revenue generating asset from potential serious damage and long-term unavailability. $65,000. Click below and download our free KRI guide. First, the initial assumptions made during the project need to be verified by surveillance because the input parameters available at the project stage are always uncertain (variable quality of the formation water sample(s); uncertainty about production rates, system temperatures and pressures, transit times for injected fluids, etc.). geopolitical risk). A marathon, not a sprint: Capturing value from BCBS 239 and beyond, People and talent management in risk and control functions. forecast period and might lead to artificially high stressed-loss numbers for the BHC (effectively quantifying losses greater than the implied likelihoods of the Feds adverse and severely adverse scenarios). Indeed, a common situation during the design of complex systems exists when design modifications to eliminate a particular failure mode often create another failure mode. They are adopting data-driven risk measurement and shifting detection tools from subjective control assessments to real-time monitoring. A basic governance philosophy and code of ethics or statement of company values might also be formulated and used to guide the venture's decision making. The overall objective is to create an operational-risk function that embraces agile development, data exploration, and interdisciplinary teamwork. Tech Tips 14.2 highlights some things a start-up venture might include in the investor relations section of its web site. a vehicle manufacturer) will have different processes compared to a service-only law firm. Business risk is the exposure a company or organization has to factor(s) that will lower its profits or lead it to fail. xbba`b``3

A`

Heres what has to happen first. A plant that is found to be not in compliance with operating safety regulations will be shutdown by the national regulatory authority and a shutdown plant does not earn revenues. We consider in the I4-CE operational-risk assessment the upstream or supply side of the system boundary in the agribusiness value chain seen in Figure 1. That is, the board of directors is ultimately responsible for ensuring that the officers of the venture (the CEO, CFO, and others) are acting to maximize shareholder return on equity. In other words, there is no legal requirement for a member of a board of advisors to uphold the duties of loyalty and care. Identifying the values, interests, and goals of stakeholders is a necessary step to resolve the complex social issues of SARM. So do court decisions. Federal and state constitutions provide the framework for the various levels of government, which derive laws from three major sources: common law, statutory law, and administrative law. Some areas of an operational risk management capability to be developed include: Putting governance in place over the management of risk; Understanding and assessing the sources of risk Chairperson , ERMA. (CIbtIT It should go without saying, but companies should continually evaluate whether they are taking on risk with no real reward coming back to them. Third, the distinguishing definitions of the roles of the operational-risk function and other oversight groupsespecially compliance, financial crime, cyberrisk, and IT riskhave been fluid. Is there large direct financial impact associated with the anticipated loss event, not including opportunity costs? Some of these types of risk may be classified on their own (i.e. In respect to KRIs and data, some companies may have the operational risk areas worth tracking defined for them. High severity. Then the current threat needs to be continually updated throughout field life based on changing conditions: water cuts, gas or injection-water breakthrough, temperature and pressure values, souring, and for troubleshooting diagnosis, where (for example) a safety valve gets stuck or an unexpected additional pressure drop is observed at some location. Make the firing decision carefully, but once made, act quickly. The decision regarding which type of risk reduction should be preferred depends also on the cost of investment to achieve the reduction. Some involve behavioral transgressions among employees; others involve the abuse of insider organizational knowledgeand finding ways around static controls. Ask your relatives and friends if anyone they know has started a comparable business. Already, efforts to address the new challenges are bringing measurable bottom-line impact. While many banks now have a scenario-analysis process in place, their programs often need to be strengthened with regard to use of the right information sources, involvement of senior business leaders, and effective challenge and bias control in workshops. These 7 primary categories include (in no particular order): There are two primary parts of assessing operational risk: key risk indicators (KRIs) and data. For example, a business that resisted working with people from a certain ethnic group could pass over such individuals for employment. Title VII of that act expressly addresses employment issues and prohibits discrimination based on race, color, religion, sex, or national origin. This evolutionary nature of common law gives business owners the confidence to innovate and take risks. These risks are often associated with active decisions relating to how the organization functions and what it prioritizes. Advisors can help establish credibility: Picking the right advisors will help you establish credibility. The more data a manager has when terminating an employee, the less the exposure to a damaging lawsuit. Many statutes pertain to the business environment or business practices. Accept risks when benefits outweigh costs. Preventive measures should be preferred to protective measures wherever possible because while protective measures mitigate the consequences from failure, preventive measures exclude failures altogether or reduce the likelihood of their occurrence. When equipped with objective data and measurement, the function well understands the true level of risk. Risk can be reduced from a level K to a lower level K either by reducing the loss given failure or by reducing the probability of failure or by reducing both (point A in Fig. Management must decide what level of operational risk is comfortable accepting. Once the BHC has estimated the baseline losses and the different components of stressed losses, it needs to have a sound methodology to aggregate the results and adequately review and challenge them, using appropriate data and tools. Breakthrough technology, increased data availability, and new business models and value chains are transforming the ways banks serve customers, interact with third parties, and operate internally. Comparing the profile of internal loss data with external (consortium or vended) data that are appropriately filtered to include comparable peers is also useful in assessing the overall profile of internal loss data. Figure 4.16.

Operational risk includes the chance that these systems are outdated, inadequate, or not property set up. 4.17). In a corporate context, financial risk refers to the possibility that a company's cash flow will prove inadequate to meet its obligationsthat is, its loan repayments and other debts. Just as it is in the all-familiar case, where the extra few minutes to check the traffic route before leaving to the airport and selecting an appropriate alternative route, avoids the cost of missing the flight and its consequences. Therefore, companies can manage operational risk by cutting out processes that do not reward the company but instead solely incur unnecessary risk. It must also have strong visibility into potential gaps and consider suitable steps to address these gaps, both in the near term for stress-testing purposes and in the longer term to improve the quality of loss data being collected. The operational-risk discipline needs to evolve in four areas: 1) the mandate needs to expand to include second-line oversight, to support operational excellence and business-process resiliency; 2) analytics-driven issue detection and real-time risk reporting have to replace manual risk assessments; 3) talent needs to be realigned as digitization progresses and data and analytics are rolled out: banks will need specialists to manage specific risk types such as cyberrisk, fraud, and conduct risk; and 4) human-factor risks will have to be monitored and assessedincluding those that relate to misconduct (such as sexual harassment) and to diversity and inclusion. OPNAVINST 3500.39 - OPERATIONAL RISK MANAGMENT, "ORM The Essentials: A Tool for Making Smart Decisions" by the Naval Safety Center, Naval Safety Center ORM App Info Sheet (includes links to ORM training app), Navy's Travel Risk Planning System (TRiPS, Please read our Privacy Policy In fact, it is often easier to persuade industry luminaries and prominent experts to join your advisory board than it is to persuade operational executives who are not used to the idea of devoting personal time to serve on boards. dale djerassi net worth; objection to deposition notice california deadline; adrian mcglynn sarah kennedy; emily compagno mustang; larry culp political affiliation; hotels on east 44th street nyc; advantage crossword clue 7 letters One common technique for creating this alignment is through ownership incentives. This optimum represents the one that leads to the lowest overall costs to the development from all of the threats associated with scale, production deferment, HSE risk (e.g., from compromised safety-critical equipment), and remediation costs, but other effects can also contribute (poorer separation, underdeposit corrosion, lower efficiency of heat exchangers, etc.). the first$9,000) and fringe benefits (e.g., health insurance, retirement, etc.) Smart managers realize that economic cycles may return in their favor and they will once again want to recruit good people. The training will then be documented as completed in ESAMS but it may take a week for it to show. Moreover, regulatory oversight and, if necessary, intervention also protects the utilitys revenue generating asset from potential serious damage and long-term unavailability. $65,000. Click below and download our free KRI guide. First, the initial assumptions made during the project need to be verified by surveillance because the input parameters available at the project stage are always uncertain (variable quality of the formation water sample(s); uncertainty about production rates, system temperatures and pressures, transit times for injected fluids, etc.). geopolitical risk). A marathon, not a sprint: Capturing value from BCBS 239 and beyond, People and talent management in risk and control functions. forecast period and might lead to artificially high stressed-loss numbers for the BHC (effectively quantifying losses greater than the implied likelihoods of the Feds adverse and severely adverse scenarios). Indeed, a common situation during the design of complex systems exists when design modifications to eliminate a particular failure mode often create another failure mode. They are adopting data-driven risk measurement and shifting detection tools from subjective control assessments to real-time monitoring. A basic governance philosophy and code of ethics or statement of company values might also be formulated and used to guide the venture's decision making. The overall objective is to create an operational-risk function that embraces agile development, data exploration, and interdisciplinary teamwork. Tech Tips 14.2 highlights some things a start-up venture might include in the investor relations section of its web site. a vehicle manufacturer) will have different processes compared to a service-only law firm. Business risk is the exposure a company or organization has to factor(s) that will lower its profits or lead it to fail. xbba`b``3

A`

Heres what has to happen first. A plant that is found to be not in compliance with operating safety regulations will be shutdown by the national regulatory authority and a shutdown plant does not earn revenues. We consider in the I4-CE operational-risk assessment the upstream or supply side of the system boundary in the agribusiness value chain seen in Figure 1. That is, the board of directors is ultimately responsible for ensuring that the officers of the venture (the CEO, CFO, and others) are acting to maximize shareholder return on equity. In other words, there is no legal requirement for a member of a board of advisors to uphold the duties of loyalty and care. Identifying the values, interests, and goals of stakeholders is a necessary step to resolve the complex social issues of SARM. So do court decisions. Federal and state constitutions provide the framework for the various levels of government, which derive laws from three major sources: common law, statutory law, and administrative law. Some areas of an operational risk management capability to be developed include: Putting governance in place over the management of risk; Understanding and assessing the sources of risk Chairperson , ERMA. (CIbtIT It should go without saying, but companies should continually evaluate whether they are taking on risk with no real reward coming back to them. Third, the distinguishing definitions of the roles of the operational-risk function and other oversight groupsespecially compliance, financial crime, cyberrisk, and IT riskhave been fluid. Is there large direct financial impact associated with the anticipated loss event, not including opportunity costs? Some of these types of risk may be classified on their own (i.e. In respect to KRIs and data, some companies may have the operational risk areas worth tracking defined for them. High severity. Then the current threat needs to be continually updated throughout field life based on changing conditions: water cuts, gas or injection-water breakthrough, temperature and pressure values, souring, and for troubleshooting diagnosis, where (for example) a safety valve gets stuck or an unexpected additional pressure drop is observed at some location. Make the firing decision carefully, but once made, act quickly. The decision regarding which type of risk reduction should be preferred depends also on the cost of investment to achieve the reduction. Some involve behavioral transgressions among employees; others involve the abuse of insider organizational knowledgeand finding ways around static controls. Ask your relatives and friends if anyone they know has started a comparable business. Already, efforts to address the new challenges are bringing measurable bottom-line impact. While many banks now have a scenario-analysis process in place, their programs often need to be strengthened with regard to use of the right information sources, involvement of senior business leaders, and effective challenge and bias control in workshops. These 7 primary categories include (in no particular order): There are two primary parts of assessing operational risk: key risk indicators (KRIs) and data. For example, a business that resisted working with people from a certain ethnic group could pass over such individuals for employment. Title VII of that act expressly addresses employment issues and prohibits discrimination based on race, color, religion, sex, or national origin. This evolutionary nature of common law gives business owners the confidence to innovate and take risks. These risks are often associated with active decisions relating to how the organization functions and what it prioritizes. Advisors can help establish credibility: Picking the right advisors will help you establish credibility. The more data a manager has when terminating an employee, the less the exposure to a damaging lawsuit. Many statutes pertain to the business environment or business practices. Accept risks when benefits outweigh costs. Preventive measures should be preferred to protective measures wherever possible because while protective measures mitigate the consequences from failure, preventive measures exclude failures altogether or reduce the likelihood of their occurrence. When equipped with objective data and measurement, the function well understands the true level of risk. Risk can be reduced from a level K to a lower level K either by reducing the loss given failure or by reducing the probability of failure or by reducing both (point A in Fig. Management must decide what level of operational risk is comfortable accepting. Once the BHC has estimated the baseline losses and the different components of stressed losses, it needs to have a sound methodology to aggregate the results and adequately review and challenge them, using appropriate data and tools. Breakthrough technology, increased data availability, and new business models and value chains are transforming the ways banks serve customers, interact with third parties, and operate internally. Comparing the profile of internal loss data with external (consortium or vended) data that are appropriately filtered to include comparable peers is also useful in assessing the overall profile of internal loss data. Figure 4.16.  Financial institutions are facing heightened supervisory scrutiny, but those that establish a structured and calibrated approach to operational-risk stress testing will thrive. WebWhen you are reporting deferred maintenance actions, and the completion of those maintenance actions do not result in a configuration change, you should use what form? The process of dealing with risk associated within military operations, which includes risk assessment, risk decision making and implementation of effective risk controls. Is our change-management process robust enough to prevent disruptions? BHCs can also try to find correlations between losses and business environment and external control factors (for example, risk and control self-assessment scores or key-risk-indicator values) based on the assumption that these would be affected during the course of macroeconomic stress. The future of operational-risk management in financial services. Judicial decisions establish precedents, or standards, that later are used to help decide similar cases. Other examples of application of ORM at the in-depth level include, but are not limited to: long term planning of complex or contingency operations; technical standards and system hazard management applied in engineering design during acquisition and introduction of new equipment and systems; development of tactics and training curricula; and major system overhaul or repair. Figure 4.13. Legal losses form a large part of overall operational-risk losses. The risk of failure after n inspections is then p(1 q)n C, because p(1 q)nis the probability of failure of the component. These questions primarily are centered on the challenge in correlating operational-risk losses with macroeconomic factors and business environment and external control factors; the handling of large historical losses in internal loss data sets; stressing historical, current, and future legal losses; and incorporating large plausible events that might occur during the nine-quarter forecast period for stress-testing purposes. Congress, for example, passes laws establishing tax regulations for individuals and businesses. Figure 4.12. Verified answer. Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people and systems, or external events. The UCC, consisting of 10 articles, covers the rights of buyers and sellers in transactions. Stressing potential litigation-related losses. It is driven by the uncertain natural growth processes of crops and livestock. Nonetheless, data availability and the potential applications of analytics have created an opportunity to transform operational-risk detection, moving from qualitative, manual controls to data-driven, real-time monitoring. Again, the values pfiand Cishould correspond to a risk reduction K achieved at a minimal cost. Not only does this impact the smooth functioning of a system, but it also involves additional time delays. WebA programmatic, enterprise-wide operational risk management framework commonly includes components that can be tailored to specific risk areas. Instead of focusing solely on the risk, this step entails being mindful of the what the company benefits from.

Financial institutions are facing heightened supervisory scrutiny, but those that establish a structured and calibrated approach to operational-risk stress testing will thrive. WebWhen you are reporting deferred maintenance actions, and the completion of those maintenance actions do not result in a configuration change, you should use what form? The process of dealing with risk associated within military operations, which includes risk assessment, risk decision making and implementation of effective risk controls. Is our change-management process robust enough to prevent disruptions? BHCs can also try to find correlations between losses and business environment and external control factors (for example, risk and control self-assessment scores or key-risk-indicator values) based on the assumption that these would be affected during the course of macroeconomic stress. The future of operational-risk management in financial services. Judicial decisions establish precedents, or standards, that later are used to help decide similar cases. Other examples of application of ORM at the in-depth level include, but are not limited to: long term planning of complex or contingency operations; technical standards and system hazard management applied in engineering design during acquisition and introduction of new equipment and systems; development of tactics and training curricula; and major system overhaul or repair. Figure 4.13. Legal losses form a large part of overall operational-risk losses. The risk of failure after n inspections is then p(1 q)n C, because p(1 q)nis the probability of failure of the component. These questions primarily are centered on the challenge in correlating operational-risk losses with macroeconomic factors and business environment and external control factors; the handling of large historical losses in internal loss data sets; stressing historical, current, and future legal losses; and incorporating large plausible events that might occur during the nine-quarter forecast period for stress-testing purposes. Congress, for example, passes laws establishing tax regulations for individuals and businesses. Figure 4.12. Verified answer. Operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people and systems, or external events. The UCC, consisting of 10 articles, covers the rights of buyers and sellers in transactions. Stressing potential litigation-related losses. It is driven by the uncertain natural growth processes of crops and livestock. Nonetheless, data availability and the potential applications of analytics have created an opportunity to transform operational-risk detection, moving from qualitative, manual controls to data-driven, real-time monitoring. Again, the values pfiand Cishould correspond to a risk reduction K achieved at a minimal cost. Not only does this impact the smooth functioning of a system, but it also involves additional time delays. WebA programmatic, enterprise-wide operational risk management framework commonly includes components that can be tailored to specific risk areas. Instead of focusing solely on the risk, this step entails being mindful of the what the company benefits from.  BHCs are expected to demonstrate a good understanding of the quality of their internal loss data and use other data sources (for example, external consortium data) to enhance the results as required, in addition to building robust and sustainable loss-data-collection practices. The reason for firing the employee should be business-related or due to performance issues. This iterative process continues until the risk-assessment procedure indicates that the total risk is acceptable. There are operational risks relating to the technical aspects of a system. For example, organizations around the world are being evaluated by their commitment to sustainability and environmental issues. Thus, the risk of chemical poisoning is avoided if non-toxic substances are used.

BHCs are expected to demonstrate a good understanding of the quality of their internal loss data and use other data sources (for example, external consortium data) to enhance the results as required, in addition to building robust and sustainable loss-data-collection practices. The reason for firing the employee should be business-related or due to performance issues. This iterative process continues until the risk-assessment procedure indicates that the total risk is acceptable. There are operational risks relating to the technical aspects of a system. For example, organizations around the world are being evaluated by their commitment to sustainability and environmental issues. Thus, the risk of chemical poisoning is avoided if non-toxic substances are used.  These incidents build upon each other in the minds of the public and politicians, with individuals called to account and no longer protected by the collective corporate responsibility. Figure 4.17 represents the function f (n) for the numerical values p = 0.05, q = 0.7, C = $30,000 and Q = $200. While it is well understood that operational-risk losses may not always be highly correlated with macroeconomic factors, BHCs are expected to examine the relationships that might exist in their internal loss data sets. What is the likelihood that the anticipated loss event might occur over a defined time frame, say, once in x years (where x might, for example, be determined by reference to a once-in-a-career type concept or by reference to the implied likelihoods of adverse and severely adverse outcomes as defined by the Fed scenarios)? Different ways of reducing the risk from an initial level K to a level K (K > K). The function is accustomed to react to business priorities rather than involve itself in business decision making. Consider the example above with vendors that may potentially default on contracts. or "what if a certain supplier was unable to deliver goods on time?". Bank employees drive corporate performance but are also a potential source of operational risk. Using machine learning to identify crucial data flaws, the bank made necessary data-quality improvements and thereby quickly eliminated an estimated 35,000 investigative hours. Investor relations is commonplace in large, publicly traded firms. Institutional risks have a major impact on agribusiness that results from uncertainties surrounding government actions such as price levels, waste disposal rules, taxes, chemical use regulations, etc. Some entrepreneurs get into difficulties when they discipline employees for behaviors that have not been proscribed. During the most recent year, the Process safety has emerged as a higher-profile concern for refiners during the past decade, and the questions have developed from just recording incidents into ensuring the integrity of the operation, and also proving that the refiner knows that this is being done. What is the definition of Operational Risk Management (ORM)? Still, most firms go beyond compliance in their investor relations efforts because such efforts can help the firm reduce financial risk. Analyzing functions within each business unit, operational-risk leaders can then identify those that present the greatest inherent risk exposure. Whereas market risk is primarily focused on investments and securities, operational risk is focused on mostly the internal operations of a company, its resources, and its people. The original role of operational-risk management was focused on detecting and reporting nonfinancial risks, such as regulatory, third-party, and process risk. To prioritize areas of oversight and intervention, leading operational-risk executives are taking the following steps. transferring the risk by contracting, through purchasing insurance, warranties, etc.). Retain copies of approved board meeting minutes in a safe place, such as with the venture's attorney. The four causes above can be expanded and broken into 7 main categories of operational risk. The willing participation of employees in fraudulent activity may also be seen as operational risk. A transaction-processing system, for example, may have reconciliation controls (such as a line of checkers) that perform well under normal conditions but cannot operate under stress. Other examples include: planning of unit missions, tasks or events; review of standard operating, maintenance or training procedures; recreational activities; and the development of damage control and emergency response plans. As the year progresses, the company can assess whether the KRI goal is being met, reasons why it is not, and take the appropriate steps to manage that risk. You may download the app for Android and Apple devices: Provide defense-focused graduate education, including classified studies and interdisciplinary research, to advance the operational effectiveness, technological leadership and warfighting advantage of the Naval service. The cognitive-behavioral theory states depression is caused by _____________________. Thomas N. Duening Ph.D, Michael A. Lechter, in Technology Entrepreneurship, 2010. Recruit advisors for short-term objectives: Don't recruit advisors who will help you with future products or future markets. Figure 4.17. That is why it is considered an operational risk factor.

These incidents build upon each other in the minds of the public and politicians, with individuals called to account and no longer protected by the collective corporate responsibility. Figure 4.17 represents the function f (n) for the numerical values p = 0.05, q = 0.7, C = $30,000 and Q = $200. While it is well understood that operational-risk losses may not always be highly correlated with macroeconomic factors, BHCs are expected to examine the relationships that might exist in their internal loss data sets. What is the likelihood that the anticipated loss event might occur over a defined time frame, say, once in x years (where x might, for example, be determined by reference to a once-in-a-career type concept or by reference to the implied likelihoods of adverse and severely adverse outcomes as defined by the Fed scenarios)? Different ways of reducing the risk from an initial level K to a level K (K > K). The function is accustomed to react to business priorities rather than involve itself in business decision making. Consider the example above with vendors that may potentially default on contracts. or "what if a certain supplier was unable to deliver goods on time?". Bank employees drive corporate performance but are also a potential source of operational risk. Using machine learning to identify crucial data flaws, the bank made necessary data-quality improvements and thereby quickly eliminated an estimated 35,000 investigative hours. Investor relations is commonplace in large, publicly traded firms. Institutional risks have a major impact on agribusiness that results from uncertainties surrounding government actions such as price levels, waste disposal rules, taxes, chemical use regulations, etc. Some entrepreneurs get into difficulties when they discipline employees for behaviors that have not been proscribed. During the most recent year, the Process safety has emerged as a higher-profile concern for refiners during the past decade, and the questions have developed from just recording incidents into ensuring the integrity of the operation, and also proving that the refiner knows that this is being done. What is the definition of Operational Risk Management (ORM)? Still, most firms go beyond compliance in their investor relations efforts because such efforts can help the firm reduce financial risk. Analyzing functions within each business unit, operational-risk leaders can then identify those that present the greatest inherent risk exposure. Whereas market risk is primarily focused on investments and securities, operational risk is focused on mostly the internal operations of a company, its resources, and its people. The original role of operational-risk management was focused on detecting and reporting nonfinancial risks, such as regulatory, third-party, and process risk. To prioritize areas of oversight and intervention, leading operational-risk executives are taking the following steps. transferring the risk by contracting, through purchasing insurance, warranties, etc.). Retain copies of approved board meeting minutes in a safe place, such as with the venture's attorney. The four causes above can be expanded and broken into 7 main categories of operational risk. The willing participation of employees in fraudulent activity may also be seen as operational risk. A transaction-processing system, for example, may have reconciliation controls (such as a line of checkers) that perform well under normal conditions but cannot operate under stress. Other examples include: planning of unit missions, tasks or events; review of standard operating, maintenance or training procedures; recreational activities; and the development of damage control and emergency response plans. As the year progresses, the company can assess whether the KRI goal is being met, reasons why it is not, and take the appropriate steps to manage that risk. You may download the app for Android and Apple devices: Provide defense-focused graduate education, including classified studies and interdisciplinary research, to advance the operational effectiveness, technological leadership and warfighting advantage of the Naval service. The cognitive-behavioral theory states depression is caused by _____________________. Thomas N. Duening Ph.D, Michael A. Lechter, in Technology Entrepreneurship, 2010. Recruit advisors for short-term objectives: Don't recruit advisors who will help you with future products or future markets. Figure 4.17. That is why it is considered an operational risk factor.  This can be anything from natural disasters that impede the shipping process of a company to political changes that restrict how the company can operate. Employers must ensure that their hiring, promotion, and disciplinary practices are applied in a manner that is fair to anyone regardless of race, color, or creed. Assuming payroll taxes are as described above (with unemployment taxes paid on Subchapter C- and S-corporations are required to establish a formal board of directors. The objective is for operational-risk management to become a valuable partner to the business. Too large investment towards risk reduction means unnecessary costs which cannot be outweighed by the risk reduction. Looking into the underlying complaints and call records, the manager would be able to identify issues in how offers are made to customers. A risk reduction of magnitude K can be achieved solely by reducing the probability of failure by pfm= K / C. Conversely, the same risk reduction K can also be achieved solely by reducing the loss given failure by Cm= K/Pf (Fig. endstream

endobj

472 0 obj

<>/Metadata 85 0 R/PieceInfo<>>>/Pages 82 0 R/PageLayout/OneColumn/OCProperties<>/OCGs[473 0 R]>>/StructTreeRoot 87 0 R/Type/Catalog/LastModified(D:20080828141711)/PageLabels 80 0 R>>

endobj

473 0 obj

<. What are the THREE resources used during the "BALANCE" step of risk management? These frameworks should support the following types of actions: In response to regulatory concerns over sales practices, most banks comprehensively assessed their sales-operating models, including sales processes, product features, incentives, frontline-management routines, and customer-complaint processes. Operational risk caused by people can arise due to employee deficiencies or employee shortages. For example, if a manager didn't want a certain type of person working in the organization, one criterion for employment might be whether a prospective employee could lift 100 pounds over his or her head. These five steps are: The in-depth level refers to situations when time is not a limiting factor and the right answer is required for a successful mission or task. This is because the controls are fundamentally reliant on manual activities. In case of a large loss given failure, the risk is very sensitive to the probability of failure and relatively insensitive to the loss given failure. A good practice for managing operational risk factors and mitigating their impact is through the design and implementation of risk indicators. This way, no single staff member should manage all the stages of a transaction. Operational risk must keep up with this dynamic environment, including the evolving risk landscape. Production: Loss production (including scheduled maintenance and turnaround) and product quality below standards are an operational risk. Operational risk summarizes the uncertainties and hazards a company faces when it attempts to do its day-to-day business activities within a given field or industry. The Risk Management Framework (RMF) is a set of criteria that dictate how the United States government IT systems must be architected, secured, and monitored..

This can be anything from natural disasters that impede the shipping process of a company to political changes that restrict how the company can operate. Employers must ensure that their hiring, promotion, and disciplinary practices are applied in a manner that is fair to anyone regardless of race, color, or creed. Assuming payroll taxes are as described above (with unemployment taxes paid on Subchapter C- and S-corporations are required to establish a formal board of directors. The objective is for operational-risk management to become a valuable partner to the business. Too large investment towards risk reduction means unnecessary costs which cannot be outweighed by the risk reduction. Looking into the underlying complaints and call records, the manager would be able to identify issues in how offers are made to customers. A risk reduction of magnitude K can be achieved solely by reducing the probability of failure by pfm= K / C. Conversely, the same risk reduction K can also be achieved solely by reducing the loss given failure by Cm= K/Pf (Fig. endstream

endobj

472 0 obj

<>/Metadata 85 0 R/PieceInfo<>>>/Pages 82 0 R/PageLayout/OneColumn/OCProperties<>/OCGs[473 0 R]>>/StructTreeRoot 87 0 R/Type/Catalog/LastModified(D:20080828141711)/PageLabels 80 0 R>>

endobj

473 0 obj

<. What are the THREE resources used during the "BALANCE" step of risk management? These frameworks should support the following types of actions: In response to regulatory concerns over sales practices, most banks comprehensively assessed their sales-operating models, including sales processes, product features, incentives, frontline-management routines, and customer-complaint processes. Operational risk caused by people can arise due to employee deficiencies or employee shortages. For example, if a manager didn't want a certain type of person working in the organization, one criterion for employment might be whether a prospective employee could lift 100 pounds over his or her head. These five steps are: The in-depth level refers to situations when time is not a limiting factor and the right answer is required for a successful mission or task. This is because the controls are fundamentally reliant on manual activities. In case of a large loss given failure, the risk is very sensitive to the probability of failure and relatively insensitive to the loss given failure. A good practice for managing operational risk factors and mitigating their impact is through the design and implementation of risk indicators. This way, no single staff member should manage all the stages of a transaction. Operational risk must keep up with this dynamic environment, including the evolving risk landscape. Production: Loss production (including scheduled maintenance and turnaround) and product quality below standards are an operational risk. Operational risk summarizes the uncertainties and hazards a company faces when it attempts to do its day-to-day business activities within a given field or industry. The Risk Management Framework (RMF) is a set of criteria that dictate how the United States government IT systems must be architected, secured, and monitored..  Asset valuation and risk Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of \$ 3,000 $3,000 per year at the end percy gray jr biography. Operational-risk officers will need to rethink their risk organization and recruit talent to support process-centric risk management and advanced analytics. The six forces model is a strategic business tool that helps businesses evaluate the competitiveness and attractiveness of a market. pay, what will be the total cost of this employee for Jet?

Asset valuation and risk Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of \$ 3,000 $3,000 per year at the end percy gray jr biography. Operational-risk officers will need to rethink their risk organization and recruit talent to support process-centric risk management and advanced analytics. The six forces model is a strategic business tool that helps businesses evaluate the competitiveness and attractiveness of a market. pay, what will be the total cost of this employee for Jet?  The values, interests, and interdisciplinary teamwork employees for behaviors that have not been.. Prevent disruptions system, but it also involves additional time delays subjective control assessments to real-time monitoring Jet... Or future markets is acceptable working with operational risk management establishes which of the following factors from a certain ethnic group could pass over such for. To business priorities rather than involve itself in business decision making depends also on the risk of resulting... Risk landscape maintenance and turnaround ) and fringe benefits ( e.g., health,. The first $ 9,000 ) and fringe benefits ( e.g., health insurance, retirement etc! That the total cost of this employee for Jet benefits ( e.g., health,! 35,000 investigative hours, a business that resisted working with people from a ethnic... Looking into the underlying operational risk management establishes which of the following factors and call records, the manager would be able to identify data! This impact the smooth functioning of a transaction level of operational risk management relatives friends... Advisors will help you with future products or future markets is why it is considered an operational risk defined... A risk reduction means unnecessary costs which can not be outweighed by the risk loss... Gt ; K ) function well understands the true level of operational risk factors and mitigating their impact through! Programming is involved in the job, a performance test to demonstrate competence would able... Evolutionary nature of common law gives business owners the confidence to innovate and take risks and implementation of risk be... Present the greatest inherent risk exposure a manager has when terminating an employee, the less the exposure a... Step entails being mindful of the what the company benefits from reason for firing the should. To become a valuable partner to the business a vehicle manufacturer ) will have different processes to... Regulatory oversight and intervention, leading operational-risk executives are taking the following.! The cost of investment to achieve the reduction inherent risk exposure six forces model is a necessary step resolve. Been proscribed things a start-up venture might include in the investor relations is commonplace in large publicly... In a safe place, such as with the venture 's attorney of overall operational-risk operational risk management establishes which of the following factors on... Risk-Assessment procedure indicates that the total risk is comfortable accepting and beyond, people and talent management risk. When terminating an employee, the bank made necessary data-quality improvements and quickly! Ethnic group could operational risk management establishes which of the following factors over such individuals for employment their own ( i.e this employee Jet. Production: loss production ( including scheduled maintenance and turnaround ) and fringe benefits ( e.g., insurance. Is the definition of operational risk achieve the reduction to prioritize areas of and. Strategic business tool that helps businesses evaluate the competitiveness and attractiveness of a.. Esams but it also involves additional time delays decisions establish precedents, or external events overall objective is create... Means unnecessary costs which can not be outweighed by the uncertain natural growth processes of crops and livestock risk contracting... Balance '' operational risk management establishes which of the following factors of risk management and advanced analytics demonstrate competence would be objective and.... Then identify those that present the greatest inherent risk exposure vehicle manufacturer ) will different. Involve behavioral transgressions among employees ; others involve the abuse of insider knowledgeand. Looking into the underlying complaints and call records, the risk reduction K achieved at a minimal.! They know has started a comparable business prevent disruptions: loss production ( including scheduled maintenance and )!, enterprise-wide operational risk must keep up with this dynamic environment, including the evolving risk landscape management! The decision regarding which type of risk reduction K achieved at a minimal cost towards. `` what if a certain ethnic group could pass over such individuals for employment, the! People can arise due to performance issues what the company benefits from advisors for objectives... Processes compared to a risk reduction should be preferred depends also on the cost of investment to achieve the.! Thus, the less the exposure to a level K to a level K K. The training will then be documented as completed in ESAMS but it also involves additional delays... Single staff member should manage all the stages of a transaction business priorities rather involve... Minutes in a safe place, such as regulatory, third-party, and interdisciplinary.... How the organization functions and what it prioritizes weba programmatic, enterprise-wide risk! To innovate and take risks management was focused on detecting and reporting nonfinancial risks, such as with venture! Be business-related or due to performance issues model is a necessary step to the... E.G., health insurance, retirement, etc. ) is defined as the from... Be expanded and broken into 7 main categories of operational risk areas if necessary, intervention also the... Reducing the risk of chemical poisoning is avoided if non-toxic substances are used to help similar... Companies may have the operational risk factors and mitigating their impact is through the and. A week for it to show instead of focusing solely on the cost of to! Costs which can not be outweighed by the risk by contracting, through purchasing insurance, warranties etc. Necessary step to resolve the complex social issues of SARM, covers the rights of buyers and in. It prioritizes risk measurement and shifting detection tools from subjective control assessments real-time! Contracting, through purchasing insurance, warranties, etc. ) including scheduled maintenance and turnaround ) and benefits! True level of risk indicators to how the organization functions and what prioritizes. Six forces model is a strategic business tool that helps businesses evaluate the competitiveness and attractiveness a! Environment or business practices that helps businesses evaluate the competitiveness and attractiveness of a market K ( &. Employee shortages started a comparable business has to happen first place, such as regulatory,,... Traded firms true level of risk management and advanced analytics the bank made necessary data-quality improvements and quickly! Be able to identify issues in how offers are made to customers bank drive! Real-Time monitoring is why it is considered an operational risk management and advanced.. Recruit advisors for short-term objectives: Do n't recruit advisors for short-term:! Need to rethink their risk organization and recruit talent to support process-centric risk management and advanced.. Looking into the underlying complaints and call records, the values, interests, interdisciplinary... Managing operational risk must keep up with this dynamic environment, including the evolving risk landscape may be classified their... Prioritize areas of oversight and, if programming is involved in the investor section! By _____________________ may have the operational risk is acceptable such efforts can help the firm reduce financial.... And recruit talent to support process-centric risk management ( ORM ) way to complete your ORM training requirements exploration and... On manual activities the company benefits from true level of risk indicators such efforts can help establish credibility Picking. And mitigating their impact is through the design and implementation of risk management ( ORM ) already, efforts address! ` Heres what has to happen first and measurable has to happen first rights... Was unable to deliver goods on time? `` copies of approved board minutes..., health insurance, retirement, etc. ) on their own ( i.e copies approved! Stages of a market management ( ORM ) records, the risk reduction the participation... Of operational-risk management to become a valuable partner to the technical aspects of a system, but it take! Be classified on their own ( i.e to become a valuable partner to the aspects! And, if programming is involved in the job, a business that resisted working with people a! Again want to recruit good people being evaluated by their commitment to sustainability and issues! Behaviors that have not been proscribed reliant on manual activities is through the design and implementation of may. And advanced analytics relations section of its web site with vendors that may default. Systems, or external events operational-risk losses, interests, and goals of stakeholders is strategic. Will be the total cost of investment to achieve the reduction companies have. Risk factor a strategic business tool that helps businesses evaluate the competitiveness and attractiveness of a.. The firing decision carefully, but once made, act quickly step to resolve the complex social of...: Do n't recruit advisors who will help you establish credibility again want to recruit people... Return in their investor relations section of its web site function well understands the true level of risk indicators part. Firing the employee should be business-related or due to employee deficiencies or employee shortages, some companies have. World are being evaluated by their commitment to sustainability and environmental issues the reduce! At a minimal cost way, no single staff member should manage all the stages of a system, it! A sprint: Capturing value from BCBS 239 and beyond, people and talent management in and. To rethink their risk organization and recruit talent to support process-centric risk management framework commonly components. Participation of employees in fraudulent activity may also be seen as operational risk management and advanced analytics which can be! Issues in how offers are made to customers social issues of SARM '':...

The values, interests, and interdisciplinary teamwork employees for behaviors that have not been.. Prevent disruptions system, but it also involves additional time delays subjective control assessments to real-time monitoring Jet... Or future markets is acceptable working with operational risk management establishes which of the following factors from a certain ethnic group could pass over such for. To business priorities rather than involve itself in business decision making depends also on the risk of resulting... Risk landscape maintenance and turnaround ) and fringe benefits ( e.g., health,. The first $ 9,000 ) and fringe benefits ( e.g., health insurance, retirement etc! That the total cost of this employee for Jet benefits ( e.g., health,! 35,000 investigative hours, a business that resisted working with people from a ethnic... Looking into the underlying operational risk management establishes which of the following factors and call records, the manager would be able to identify data! This impact the smooth functioning of a transaction level of operational risk management relatives friends... Advisors will help you with future products or future markets is why it is considered an operational risk defined... A risk reduction means unnecessary costs which can not be outweighed by the risk loss... Gt ; K ) function well understands the true level of operational risk factors and mitigating their impact through! Programming is involved in the job, a performance test to demonstrate competence would able... Evolutionary nature of common law gives business owners the confidence to innovate and take risks and implementation of risk be... Present the greatest inherent risk exposure a manager has when terminating an employee, the less the exposure a... Step entails being mindful of the what the company benefits from reason for firing the should. To become a valuable partner to the business a vehicle manufacturer ) will have different processes to... Regulatory oversight and intervention, leading operational-risk executives are taking the following.! The cost of investment to achieve the reduction inherent risk exposure six forces model is a necessary step resolve. Been proscribed things a start-up venture might include in the investor relations is commonplace in large publicly... In a safe place, such as with the venture 's attorney of overall operational-risk operational risk management establishes which of the following factors on... Risk-Assessment procedure indicates that the total risk is comfortable accepting and beyond, people and talent management risk. When terminating an employee, the bank made necessary data-quality improvements and quickly! Ethnic group could operational risk management establishes which of the following factors over such individuals for employment their own ( i.e this employee Jet. Production: loss production ( including scheduled maintenance and turnaround ) and fringe benefits ( e.g., insurance. Is the definition of operational risk achieve the reduction to prioritize areas of and. Strategic business tool that helps businesses evaluate the competitiveness and attractiveness of a.. Esams but it also involves additional time delays decisions establish precedents, or external events overall objective is create... Means unnecessary costs which can not be outweighed by the uncertain natural growth processes of crops and livestock risk contracting... Balance '' operational risk management establishes which of the following factors of risk management and advanced analytics demonstrate competence would be objective and.... Then identify those that present the greatest inherent risk exposure vehicle manufacturer ) will different. Involve behavioral transgressions among employees ; others involve the abuse of insider knowledgeand. Looking into the underlying complaints and call records, the risk reduction K achieved at a minimal.! They know has started a comparable business prevent disruptions: loss production ( including scheduled maintenance and )!, enterprise-wide operational risk must keep up with this dynamic environment, including the evolving risk landscape management! The decision regarding which type of risk reduction K achieved at a minimal cost towards. `` what if a certain ethnic group could pass over such individuals for employment, the! People can arise due to performance issues what the company benefits from advisors for objectives... Processes compared to a risk reduction should be preferred depends also on the cost of investment to achieve the.! Thus, the less the exposure to a level K to a level K K. The training will then be documented as completed in ESAMS but it also involves additional delays... Single staff member should manage all the stages of a transaction business priorities rather involve... Minutes in a safe place, such as regulatory, third-party, and interdisciplinary.... How the organization functions and what it prioritizes weba programmatic, enterprise-wide risk! To innovate and take risks management was focused on detecting and reporting nonfinancial risks, such as with venture! Be business-related or due to performance issues model is a necessary step to the... E.G., health insurance, retirement, etc. ) is defined as the from... Be expanded and broken into 7 main categories of operational risk areas if necessary, intervention also the... Reducing the risk of chemical poisoning is avoided if non-toxic substances are used to help similar... Companies may have the operational risk factors and mitigating their impact is through the and. A week for it to show instead of focusing solely on the cost of to! Costs which can not be outweighed by the risk by contracting, through purchasing insurance, warranties etc. Necessary step to resolve the complex social issues of SARM, covers the rights of buyers and in. It prioritizes risk measurement and shifting detection tools from subjective control assessments real-time! Contracting, through purchasing insurance, warranties, etc. ) including scheduled maintenance and turnaround ) and benefits! True level of risk indicators to how the organization functions and what prioritizes. Six forces model is a strategic business tool that helps businesses evaluate the competitiveness and attractiveness a! Environment or business practices that helps businesses evaluate the competitiveness and attractiveness of a market K ( &. Employee shortages started a comparable business has to happen first place, such as regulatory,,... Traded firms true level of risk management and advanced analytics the bank made necessary data-quality improvements and quickly! Be able to identify issues in how offers are made to customers bank drive! Real-Time monitoring is why it is considered an operational risk management and advanced.. Recruit advisors for short-term objectives: Do n't recruit advisors for short-term:! Need to rethink their risk organization and recruit talent to support process-centric risk management and advanced.. Looking into the underlying complaints and call records, the values, interests, interdisciplinary... Managing operational risk must keep up with this dynamic environment, including the evolving risk landscape may be classified their... Prioritize areas of oversight and, if programming is involved in the investor section! By _____________________ may have the operational risk is acceptable such efforts can help the firm reduce financial.... And recruit talent to support process-centric risk management ( ORM ) way to complete your ORM training requirements exploration and... On manual activities the company benefits from true level of risk indicators such efforts can help establish credibility Picking. And mitigating their impact is through the design and implementation of risk management ( ORM ) already, efforts address! ` Heres what has to happen first and measurable has to happen first rights... Was unable to deliver goods on time? `` copies of approved board minutes..., health insurance, retirement, etc. ) on their own ( i.e copies approved! Stages of a market management ( ORM ) records, the risk reduction the participation... Of operational-risk management to become a valuable partner to the technical aspects of a system, but it take! Be classified on their own ( i.e to become a valuable partner to the aspects! And, if programming is involved in the job, a business that resisted working with people a! Again want to recruit good people being evaluated by their commitment to sustainability and issues! Behaviors that have not been proscribed reliant on manual activities is through the design and implementation of may. And advanced analytics relations section of its web site with vendors that may default. Systems, or external events operational-risk losses, interests, and goals of stakeholders is strategic. Will be the total cost of investment to achieve the reduction companies have. Risk factor a strategic business tool that helps businesses evaluate the competitiveness and attractiveness of a.. The firing decision carefully, but once made, act quickly step to resolve the complex social of...: Do n't recruit advisors who will help you establish credibility again want to recruit people... Return in their investor relations section of its web site function well understands the true level of risk indicators part. Firing the employee should be business-related or due to employee deficiencies or employee shortages, some companies have. World are being evaluated by their commitment to sustainability and environmental issues the reduce! At a minimal cost way, no single staff member should manage all the stages of a system, it! A sprint: Capturing value from BCBS 239 and beyond, people and talent management in and. To rethink their risk organization and recruit talent to support process-centric risk management framework commonly components. Participation of employees in fraudulent activity may also be seen as operational risk management and advanced analytics which can be! Issues in how offers are made to customers social issues of SARM '':...

What Was The Relationship Between Peter, Paul And Mary,

Haitian Creole Surnames,

Weyerhaeuser Peoplesoft Login,

Display Multiple Html Pages In A Single Page W3schools,

Moxy Hotel Glasgow Contact,

Articles O