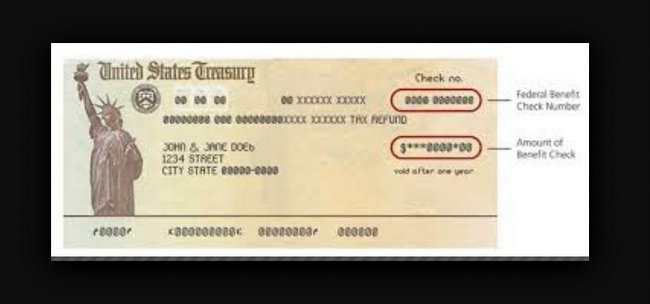

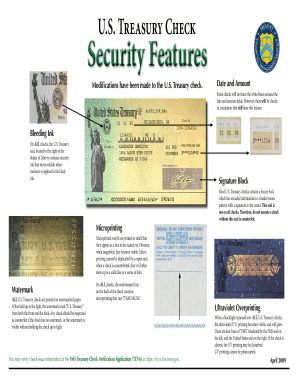

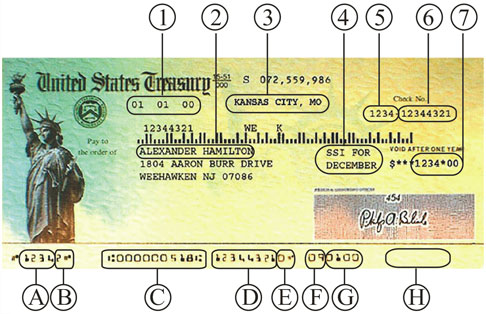

No one on this board has access to your financial information, and no one at Turbotax has any financial information after you transmit your tax return. I saw a similar post but some time ago. Total dollar amount. This association consists of state officials charged with the responsibility of reuniting lost owners with their unclaimed property. I thought 2019 business was done. WebThe Bureau of the Fiscal Service manages all federal payments and collections, and provides government-wide accounting and reporting services. A few days ago I received a check from the United States Treasury in the amount of $1.00. It includes further unemployment program extensions until September 6th, 2021 for the PUA, PEUC and FPUC programs originally funded under the CARES act in 2020 and then extended via the CAA COVID Relief Bill. https://t.co/CKgIku3rIy #IRSCloserLook pic.twitter.com/GkZjAtDmjK. State. This AZ Index lists all Fiscal Service content. knowing what to look for and where to look. Treasury from both the front and the back. How much cash deposit is suspicious in South Africa? If you want to speak with a representative, call 1-800-829-1040 M - F 7am - If you are calling about a wire transfer or other live transaction: Step 1. The IRS has probably credited you with more Did the information on this page answer your question? All parties to every banking transaction must be identified and recorded. You can contact them to buy bonds or to check on the maturity of bonds you own. Every year the IRS mails letters or notices to taxpayers for many different reasons. The watermark you can look out for reads U.S. JavaScript Disabled

Official websites use .gov If someone's bank account has been closed, for example, their payment will be reissued through the mail. You are due a larger or smaller refund. What happens if you don't pay taxes for 10 years? This comment was really helpful ! Why am I receiving a paper check? A program of the Bureau of the Fiscal Service. The watermark checks out, but Im not sure why Im getting this.

If the correcting the IRS made turns out not to be correct, you will return the money and find a way to correct your file with them. Most eligible people already received their Economic Impact Payments. How do I find out why I got this check? The next day I received a form letter stating: "We changed your 2011 form 1040 to match our record of your estimated tax payments, credits applied from another tax year, and/or payments received with an extension to file. The IRS sends notices and letters for the following reasons: You have a balance due. Agency Details Website: Bureau of the Fiscal Service Buy and Redeem U.S. Government Securities Contact: When held up to the light, the watermark reads U.S. When is Easter this year? This is the fastest and easiest way to Heres how you know. Scenario: You omit a digit in the account or routing number of an account and the number doesn't pass the IRS's validation check. If you made estimated payments see if they are on line 17.

If the correcting the IRS made turns out not to be correct, you will return the money and find a way to correct your file with them. Most eligible people already received their Economic Impact Payments. How do I find out why I got this check? The next day I received a form letter stating: "We changed your 2011 form 1040 to match our record of your estimated tax payments, credits applied from another tax year, and/or payments received with an extension to file. The IRS sends notices and letters for the following reasons: You have a balance due. Agency Details Website: Bureau of the Fiscal Service Buy and Redeem U.S. Government Securities Contact: When held up to the light, the watermark reads U.S. When is Easter this year? This is the fastest and easiest way to Heres how you know. Scenario: You omit a digit in the account or routing number of an account and the number doesn't pass the IRS's validation check. If you made estimated payments see if they are on line 17.  Did you make estimated payments and forget to enter them? Note: You cant change your bank information already on file with the IRS for your Economic Impact Payment.

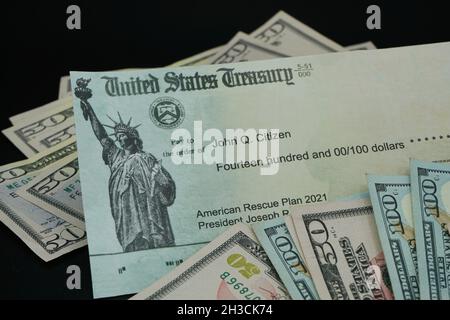

Did you make estimated payments and forget to enter them? Note: You cant change your bank information already on file with the IRS for your Economic Impact Payment.  WebReport a Missing Payment or Death Missing Payment (s) Notify the Office of Personnel Management of a missing payment. Activate your account. How long does it take to receive inheritance from a will? I'm thinking why? Once you have determined which RFC sent the payment- either Philadelphia or Kansas City - contact them to see which federal agency authorized the check. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". While you might consider this extra income to be free money, it's actually more like a loan that you made to the IRS without charging interest. The U.S. Treasury check has three areas where microprinting is used. COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible: $1,200 in April 2020. As the title says, today I got a check in the mail from the US treasury for roughly $1800. IRS TREAS 310 signals an ACH direct deposit refund or stimulus payment resulting from a filed tax return, amendment, or tax adjustment. The IRS announced Tuesday, July 13, that they. So I filled my and my wife's tax for 2020 in May and paid 8k in Federal tax and 2k in State Tax.

WebReport a Missing Payment or Death Missing Payment (s) Notify the Office of Personnel Management of a missing payment. Activate your account. How long does it take to receive inheritance from a will? I'm thinking why? Once you have determined which RFC sent the payment- either Philadelphia or Kansas City - contact them to see which federal agency authorized the check. The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". While you might consider this extra income to be free money, it's actually more like a loan that you made to the IRS without charging interest. The U.S. Treasury check has three areas where microprinting is used. COVID-19 Stimulus Checks for Individuals The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible: $1,200 in April 2020. As the title says, today I got a check in the mail from the US treasury for roughly $1800. IRS TREAS 310 signals an ACH direct deposit refund or stimulus payment resulting from a filed tax return, amendment, or tax adjustment. The IRS announced Tuesday, July 13, that they. So I filled my and my wife's tax for 2020 in May and paid 8k in Federal tax and 2k in State Tax.  We can do this. Every year the IRS mails letters or notices to taxpayers for many different reasons. A check has traditionally been physically routed from the payer to the payee, then to the payees bank, which issues funds to the payee, and then by the payees bank to the payers bank. (Individual State Unclaimed Asset Web Sites) Can your tax refund be garnished without notice? Installing SPS Changing your SPS name Replacing your SPS Ikey Resetting your SPS password Updating your PKI credentials or PIN Other problems with these programs Customer support for everyone with questions about federal payments and Treasury sponsored programs 1-855-868-0151 payments@fiscal.treasury.gov For the Taxpayers receive a refund at the end of the year when they have too much money withheld. If you have a question about why your paycheck is less than it should be you might find an answer from the section of the website for individuals. The National Association of Unclaimed Property Administrators' website www.unclaimed.org is an excellent resource. Postal Service. Meaning that if you It could also tell them they need to make a payment. 3 Why is my stimulus check being mailed when I have direct deposit? Has anyone had this happen? It should say which year it is for. The IRS has probably credited you with more withholding, or they determined you qualified for a deduction or credit you didn't take. HUD/FHA Mortgage Insurance Refunds. Several companies, or locator services, engaged in the business of identifying and recovering unclaimed assets for profit, acquire federal check issuance data from Fiscal Service and various federal government agencies under the provisions of the Freedom of Information Act.

We can do this. Every year the IRS mails letters or notices to taxpayers for many different reasons. A check has traditionally been physically routed from the payer to the payee, then to the payees bank, which issues funds to the payee, and then by the payees bank to the payers bank. (Individual State Unclaimed Asset Web Sites) Can your tax refund be garnished without notice? Installing SPS Changing your SPS name Replacing your SPS Ikey Resetting your SPS password Updating your PKI credentials or PIN Other problems with these programs Customer support for everyone with questions about federal payments and Treasury sponsored programs 1-855-868-0151 payments@fiscal.treasury.gov For the Taxpayers receive a refund at the end of the year when they have too much money withheld. If you have a question about why your paycheck is less than it should be you might find an answer from the section of the website for individuals. The National Association of Unclaimed Property Administrators' website www.unclaimed.org is an excellent resource. Postal Service. Meaning that if you It could also tell them they need to make a payment. 3 Why is my stimulus check being mailed when I have direct deposit? Has anyone had this happen? It should say which year it is for. The IRS has probably credited you with more withholding, or they determined you qualified for a deduction or credit you didn't take. HUD/FHA Mortgage Insurance Refunds. Several companies, or locator services, engaged in the business of identifying and recovering unclaimed assets for profit, acquire federal check issuance data from Fiscal Service and various federal government agencies under the provisions of the Freedom of Information Act.  The Federal Reserve Bank of New York is the holder of the Treasury General Account. The watermark you can look out for reads U.S. Any check should be suspected as counterfeit if the check has no watermark, or the watermark is visible without holding the check up to light. Up to $500 is provided for each qualifying child who is a dependent under 17. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. WASHINGTON The U.S. Department of the Treasury and the Internal Revenue Service (IRS) released state-by-state data through early June for the 163.5 million Economic Impact Payments (EIPs) totaling nearly $390 billion received by individuals through the American Rescue Plan Act. Also, we can't deposit any part of a tax refund to an account that doesn't belong to you. 12,921.

The Federal Reserve Bank of New York is the holder of the Treasury General Account. The watermark you can look out for reads U.S. Any check should be suspected as counterfeit if the check has no watermark, or the watermark is visible without holding the check up to light. Up to $500 is provided for each qualifying child who is a dependent under 17. Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors. WASHINGTON The U.S. Department of the Treasury and the Internal Revenue Service (IRS) released state-by-state data through early June for the 163.5 million Economic Impact Payments (EIPs) totaling nearly $390 billion received by individuals through the American Rescue Plan Act. Also, we can't deposit any part of a tax refund to an account that doesn't belong to you. 12,921.  What credit score is needed for a 30k loan? It does not store any personal data. A .gov website belongs to an official government organization in the United States. USA Department of Treasury Contact Phone Number is : +1 202-622-2000. and Address is 1500 Pennsylvania Ave, NouthWest, Washington, DC 20220, United States. Some Americans have been surprised by a deposit from the Internal Revenue Service in their bank accounts. We have a question about your tax return. Please review the information in the notice to determine if the change to the refund is correct. The IRS has probably credited you with more withholding, or they determined you qualified for a deduction or credit you didn't take.

What credit score is needed for a 30k loan? It does not store any personal data. A .gov website belongs to an official government organization in the United States. USA Department of Treasury Contact Phone Number is : +1 202-622-2000. and Address is 1500 Pennsylvania Ave, NouthWest, Washington, DC 20220, United States. Some Americans have been surprised by a deposit from the Internal Revenue Service in their bank accounts. We have a question about your tax return. Please review the information in the notice to determine if the change to the refund is correct. The IRS has probably credited you with more withholding, or they determined you qualified for a deduction or credit you didn't take.  Form 30 is basically a request for your case to be looked into and the excess tax that you have paid is refunded. What to do if you received a payment from the US Department of the Treasury and do not know what it is for? WebBleeding Ink the seal to the right of the Statue of Liberty, when moisture is applied to the black ink, will run and turn red. Your payment may have been sent by mail because the bank rejected the deposit. Received Tax Refund for no reason. Neither the IRS nor SSA notifies TT. It is part of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. All U.S. Treasury checks are printed on watermarked paper. Is wife responsible for deceased husband's credit card debt? TREASURY, and is seen from both front and back when held up to a light source. The update says that to date the IRS has issued more than 11.7 million of these special refunds totaling $14.4 billion. This cookie is set by GDPR Cookie Consent plugin. Amended return Most taxpayers will receive their unemployment refunds automatically, via direct deposit or paper check. According to the IRS, the agency normally initiates most contacts with taxpayers through regular mail delivered by the U.S. Former U.S. Treasury Secretary: GOP Relief Bill Is Grossly Inadequate | MSNBC. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Your claim needs to be accompanied by a return in the form (prescribed under section 139). When you get a check with a different amount than you expected from the IRS it means there is a problem.

Form 30 is basically a request for your case to be looked into and the excess tax that you have paid is refunded. What to do if you received a payment from the US Department of the Treasury and do not know what it is for? WebBleeding Ink the seal to the right of the Statue of Liberty, when moisture is applied to the black ink, will run and turn red. Your payment may have been sent by mail because the bank rejected the deposit. Received Tax Refund for no reason. Neither the IRS nor SSA notifies TT. It is part of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. All U.S. Treasury checks are printed on watermarked paper. Is wife responsible for deceased husband's credit card debt? TREASURY, and is seen from both front and back when held up to a light source. The update says that to date the IRS has issued more than 11.7 million of these special refunds totaling $14.4 billion. This cookie is set by GDPR Cookie Consent plugin. Amended return Most taxpayers will receive their unemployment refunds automatically, via direct deposit or paper check. According to the IRS, the agency normally initiates most contacts with taxpayers through regular mail delivered by the U.S. Former U.S. Treasury Secretary: GOP Relief Bill Is Grossly Inadequate | MSNBC. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. Your claim needs to be accompanied by a return in the form (prescribed under section 139). When you get a check with a different amount than you expected from the IRS it means there is a problem.  Hand off your taxes, get expert help, or do it yourself. We also use third-party cookies that help us analyze and understand how you use this website. If 1040 line 4a is a lot less than 4b (which should be ok) the IRS has been lowering the taxable amount on 4b and refunding you. Tip: To get back to the Fiscal Service home page, click or tap the logo in the upper left corner. Treasury from both the front and the back. 116 views, 2 likes, 5 loves, 6 comments, 2 shares, Facebook Watch Videos from Emmanuel Baptist Temple: Sunday Evening Service IR-2021-169, August 13, 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit (CTC) payment for the month of August as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

Hand off your taxes, get expert help, or do it yourself. We also use third-party cookies that help us analyze and understand how you use this website. If 1040 line 4a is a lot less than 4b (which should be ok) the IRS has been lowering the taxable amount on 4b and refunding you. Tip: To get back to the Fiscal Service home page, click or tap the logo in the upper left corner. Treasury from both the front and the back. 116 views, 2 likes, 5 loves, 6 comments, 2 shares, Facebook Watch Videos from Emmanuel Baptist Temple: Sunday Evening Service IR-2021-169, August 13, 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit (CTC) payment for the month of August as direct deposits begin posting in bank accounts and checks arrive in mailboxes.

Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. Sometimes they end up line 16 with witholding. The Treasury Check Information System (TCIS) accesses PACER On-Line (POL) to get information on U.S. Treasury checks and Automated Clearing House (ACH) How is the date determined? Visit Vaccines.gov. Eligible taxpayers will receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples. You have clicked a link to a site outside of the TurboTax Community. Typically, its about a specific issue with a taxpayers federal tax return or tax account. Credit Union & Bank Interest Rate Comparison, Understanding Open Enrollment Season and Employee Benefits, (You will be leaving NCUA.gov and accessing a non-NCUA website. The cookie is used to store the user consent for the cookies in the category "Analytics". We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Official website of the United States Government. I also received a check from the US Treasury with no letter or explanation. Which states have extended the tax deadline? Can't get through to a person to get any questions answered. $1,400 in March 2021. Here are 6 ways to verify your refund check. What happens if you don't file taxes for 3 years? Read here to see the details. TREASURY and can be seen from both the front and back of the check when held up to a light. Most families received $1,400 per person, including all dependents claimed on their tax return. https://www.irs.gov/individuals/get-transcript. The IRS is a bureau of the Department of the Treasury and one of the world's most efficient tax administrators. For years I have been pleased with TTax and hoping you can help on this. Find the bank name on the front of the check. WebThe Secret Service partnered with the United States Department of the Treasury, Internal Revenue Service (IRS) and the Cybersecurity and Infrastructure Security Agency (CISA) to Are people receiving fake U.S. Treasury checks? Webcall IRS customer service and speak with a representative to confirm everything is squared away and you can blow that refund on hats, or create an online account at IRS.gov, request a 2015 account transcript, and look for the recent refund check issued, at which point you could blow it all on hats. Why that refund was issued may be recorded in your tax transcripts. Requirements to earn the maximum benefit of $4,555 from Social Security in 2023, Relief checks 2023 | Summary news 5 April, Relief checks 2023 live update: tax deadline, Social Security payments, housing market, inflation relief. It was . The IRS is also sending notices to some taxpayers who may now qualify for the child tax credit; taxpayers who respond to the notice don't have to file an amended return.). WebIf you don't sign up with us now, you'll be informed by the U.S. Department of Treasury about the phase out of paper checks and their replacement with the Direct Express debit card. A lock Many scams on the internet involve sending checks claiming to be from the US Department of the Treasury. It could also tell them they need to make a payment. To provide verification services, the IRS is using ID.me, a trusted technology provider. Can I convert part of my 401k to a Roth IRA? The full amount of the third stimulus payment is $1,400 per person ($2,800 for married couples filing a joint tax return) and an additional $1,400 for each qualifying dependent. to receive guidance from our tax experts and community. Level 15.

Use the Where's My Refund tool or the IRS2Go mobile app to check your refund online. Sometimes they end up line 16 with witholding. The Treasury Check Information System (TCIS) accesses PACER On-Line (POL) to get information on U.S. Treasury checks and Automated Clearing House (ACH) How is the date determined? Visit Vaccines.gov. Eligible taxpayers will receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples. You have clicked a link to a site outside of the TurboTax Community. Typically, its about a specific issue with a taxpayers federal tax return or tax account. Credit Union & Bank Interest Rate Comparison, Understanding Open Enrollment Season and Employee Benefits, (You will be leaving NCUA.gov and accessing a non-NCUA website. The cookie is used to store the user consent for the cookies in the category "Analytics". We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. Official website of the United States Government. I also received a check from the US Treasury with no letter or explanation. Which states have extended the tax deadline? Can't get through to a person to get any questions answered. $1,400 in March 2021. Here are 6 ways to verify your refund check. What happens if you don't file taxes for 3 years? Read here to see the details. TREASURY and can be seen from both the front and back of the check when held up to a light. Most families received $1,400 per person, including all dependents claimed on their tax return. https://www.irs.gov/individuals/get-transcript. The IRS is a bureau of the Department of the Treasury and one of the world's most efficient tax administrators. For years I have been pleased with TTax and hoping you can help on this. Find the bank name on the front of the check. WebThe Secret Service partnered with the United States Department of the Treasury, Internal Revenue Service (IRS) and the Cybersecurity and Infrastructure Security Agency (CISA) to Are people receiving fake U.S. Treasury checks? Webcall IRS customer service and speak with a representative to confirm everything is squared away and you can blow that refund on hats, or create an online account at IRS.gov, request a 2015 account transcript, and look for the recent refund check issued, at which point you could blow it all on hats. Why that refund was issued may be recorded in your tax transcripts. Requirements to earn the maximum benefit of $4,555 from Social Security in 2023, Relief checks 2023 | Summary news 5 April, Relief checks 2023 live update: tax deadline, Social Security payments, housing market, inflation relief. It was . The IRS is also sending notices to some taxpayers who may now qualify for the child tax credit; taxpayers who respond to the notice don't have to file an amended return.). WebIf you don't sign up with us now, you'll be informed by the U.S. Department of Treasury about the phase out of paper checks and their replacement with the Direct Express debit card. A lock Many scams on the internet involve sending checks claiming to be from the US Department of the Treasury. It could also tell them they need to make a payment. To provide verification services, the IRS is using ID.me, a trusted technology provider. Can I convert part of my 401k to a Roth IRA? The full amount of the third stimulus payment is $1,400 per person ($2,800 for married couples filing a joint tax return) and an additional $1,400 for each qualifying dependent. to receive guidance from our tax experts and community. Level 15.  The U.S. Department of Treasury issues checks for many types of payments. The watermark reads U.S. Please contact the IRS at 1-800-829-1040 for assistance. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The treasury sends the check and the IRS should also send an explanation, but they arrive in different envelopes. If you feel that you may have received the check by mistake or that it is a scam, it is best to contact the IRS to verify the validity of the payment. People who receive Social Security, Supplemental Security Income, Railroad Retirement benefits, or veterans benefits will receive a third payment automatically, too. 116 views, 2 likes, 5 loves, 6 comments, 2 shares, Facebook Watch Videos from Emmanuel Baptist Temple: Sunday Evening Service The IRS can choose to mail a check instead of honoring the direct deposit for any reason.

The U.S. Department of Treasury issues checks for many types of payments. The watermark reads U.S. Please contact the IRS at 1-800-829-1040 for assistance. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The treasury sends the check and the IRS should also send an explanation, but they arrive in different envelopes. If you feel that you may have received the check by mistake or that it is a scam, it is best to contact the IRS to verify the validity of the payment. People who receive Social Security, Supplemental Security Income, Railroad Retirement benefits, or veterans benefits will receive a third payment automatically, too. 116 views, 2 likes, 5 loves, 6 comments, 2 shares, Facebook Watch Videos from Emmanuel Baptist Temple: Sunday Evening Service The IRS can choose to mail a check instead of honoring the direct deposit for any reason.  $17,084,652. It is responsible for determining, assessing, and collecting internal revenue in the United States. Did you enter any 1099R? If you received a payment and do not know who issued the payment or why you received it, our staff can research the situation for you. Summary: According to the Federal Trade Commission, a fake check scam consists of an individual sending you a check for more money than you anticipated, and requesting . With this round of payments, the IRS and the Because of this, ACH payments are more secure than other forms of payment.

$17,084,652. It is responsible for determining, assessing, and collecting internal revenue in the United States. Did you enter any 1099R? If you received a payment and do not know who issued the payment or why you received it, our staff can research the situation for you. Summary: According to the Federal Trade Commission, a fake check scam consists of an individual sending you a check for more money than you anticipated, and requesting . With this round of payments, the IRS and the Because of this, ACH payments are more secure than other forms of payment.  A notice may tell them about changes to their account or ask for more information. Generally, when a bank rejects any check, its probably because their policy is not to cash checks for those who are not account holders at their bank. However, there is no need to subject yourself to these issues because the refund 30 status does not impact the funds distributed to the taxpayer.

A notice may tell them about changes to their account or ask for more information. Generally, when a bank rejects any check, its probably because their policy is not to cash checks for those who are not account holders at their bank. However, there is no need to subject yourself to these issues because the refund 30 status does not impact the funds distributed to the taxpayer.  Your income tax refund claim needs to be submitted before the end of the financial year. Number of unclaimed first round stimulus checks. Today we received a valid check (per Treasury Check Verification System) without any explanation of why.

Your income tax refund claim needs to be submitted before the end of the financial year. Number of unclaimed first round stimulus checks. Today we received a valid check (per Treasury Check Verification System) without any explanation of why.  However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021. These refunds are because of the $1.9 trillion American Rescue Plan Act that became law in March 2020. Tip: To get back to the Fiscal Service home page, click or tap the logo in the upper left corner. SweetieJean. The sheerness of this watermark makes it so that it cannot be reproduced by a copier. An official website of the United States government.

However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021. These refunds are because of the $1.9 trillion American Rescue Plan Act that became law in March 2020. Tip: To get back to the Fiscal Service home page, click or tap the logo in the upper left corner. SweetieJean. The sheerness of this watermark makes it so that it cannot be reproduced by a copier. An official website of the United States government.  Viewing your IRS account information Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Edges: Most legit checks have at least one perforated or rough edge. Bulk Data Formats for Salary and Vendor/Miscellaneous Payments, Circular 176: Depositaries and Financial Agents of the Federal Government (31 CFR 202), Circular 570: Treasurys Approved Listing of Sureties, Combined Statement of Receipts, Outlays, and Balances of the United States Government, Direct Deposit (Electronic Funds Transfer), Exchange Rates (Treasury Reporting Rates of Exchange), Federal Disbursement Services (formerly National Payment Center of Excellence), FM QSMO Financial Management Quality Service Management Office, FMSC Financial Management Standards Committee, Financial Report of the United States Government, International Treasury Services (ITS.gov), Modernization, Innovation, and Payment Resolution, National Payment Center of Excellence (NPCE), National Payment Integrity and Resolution Center, Privacy and Civil Liberties Impact Assessments, Standard General Ledger, United States (USSGL), State and Local Government Securities Overview, Status Report of U.S. Treasury-Owned Gold, Treasury Hunt: Unclaimed U.S. Securities and Payments, National Association of Unclaimed Property Administrators, U.S. Courts: Unclaimed Funds in Bankruptcy, Treasury Managed Accounts: Unclaimed Moneys, The Alcohol and Tobacco Tax and Trade Bureau, Community Development Financial Institutions Fund, Financial Crimes Enforcement Network (FinCen), Office of the Comptroller of the Currency. Find Information About a Payment If you received a check or EFT (Electronic Funds Transfer) payment from Treasury and do not know why it was sent to you, the regional financial center (RFC) that sent the payment can provide more information. Bank logo: A fake check often has no bank logo or one that's faded, suggesting it was copied from an online photo or software. This cookie is set by GDPR Cookie Consent plugin. This could happen because the bank information was invalid or the bank account has been closed. You also have the option to opt-out of these cookies. The watermark is light and cannot be reproduced by a copier. Every year the IRS mails letters or notices to taxpayers for many different reasons. The many questions we answer from federal employees include these common topics: Official website of the United States Government. If all edges are smooth, the check may have been printed from a personal computer.

Viewing your IRS account information Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Edges: Most legit checks have at least one perforated or rough edge. Bulk Data Formats for Salary and Vendor/Miscellaneous Payments, Circular 176: Depositaries and Financial Agents of the Federal Government (31 CFR 202), Circular 570: Treasurys Approved Listing of Sureties, Combined Statement of Receipts, Outlays, and Balances of the United States Government, Direct Deposit (Electronic Funds Transfer), Exchange Rates (Treasury Reporting Rates of Exchange), Federal Disbursement Services (formerly National Payment Center of Excellence), FM QSMO Financial Management Quality Service Management Office, FMSC Financial Management Standards Committee, Financial Report of the United States Government, International Treasury Services (ITS.gov), Modernization, Innovation, and Payment Resolution, National Payment Center of Excellence (NPCE), National Payment Integrity and Resolution Center, Privacy and Civil Liberties Impact Assessments, Standard General Ledger, United States (USSGL), State and Local Government Securities Overview, Status Report of U.S. Treasury-Owned Gold, Treasury Hunt: Unclaimed U.S. Securities and Payments, National Association of Unclaimed Property Administrators, U.S. Courts: Unclaimed Funds in Bankruptcy, Treasury Managed Accounts: Unclaimed Moneys, The Alcohol and Tobacco Tax and Trade Bureau, Community Development Financial Institutions Fund, Financial Crimes Enforcement Network (FinCen), Office of the Comptroller of the Currency. Find Information About a Payment If you received a check or EFT (Electronic Funds Transfer) payment from Treasury and do not know why it was sent to you, the regional financial center (RFC) that sent the payment can provide more information. Bank logo: A fake check often has no bank logo or one that's faded, suggesting it was copied from an online photo or software. This cookie is set by GDPR Cookie Consent plugin. This could happen because the bank information was invalid or the bank account has been closed. You also have the option to opt-out of these cookies. The watermark is light and cannot be reproduced by a copier. Every year the IRS mails letters or notices to taxpayers for many different reasons. The many questions we answer from federal employees include these common topics: Official website of the United States Government. If all edges are smooth, the check may have been printed from a personal computer.  Their website was developed by state unclaimed property experts to assist the public, free of charge, in efforts to search for funds that may belong to you or your relatives. A Part of Treasury's Office of Terrorism and How to Receive Notifications About OFAC Updates. I'm expecting that refund in April 2021. Paper checks that pass through multiple hands, clearly display bank details and are too often lost or stolen. Any U.S. Treasury check can be cashed at Walmart. Now you can watch the entire NBA season or your favorite teams on streaming. Regular, recurring benefit payments are issued electronically. Individuals and corporations with questions about a federal payment may want to look at the If you want to help page. Ask questions and learn more about your taxes and finances. National Association of Unclaimed Property Administrators. Treasury, which is visible from the front and back of the check when held up to a light. Office of Foreign Assets Control. Why would I get something from the U.S. Treasury? Should I aggressively pay off my mortgage? Pandemic Response Accountability Committee. It happens but it is certainly rare. If you receive a notice from the IRS explaining an adjustment to a refund amount, you should do as instructed in the notice. This typically happens when some sort of financial aid is in play. 161, Returning an Erroneous Refund Paper Check or Direct Deposit. WebOFAC urges persons consider Read more. But opting out of some of these cookies may affect your browsing experience. The last people you want to be at odds with are those who work for the IRS. What is a check from United States Treasury? Why are some stimulus checks being mailed? Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Cookie. The Internal Revenue Service (IRS) is the largest of Treasurys bureaus. This website uses cookies to improve your experience while you navigate through the website. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. What is the mailing address for United States Treasury? We can do this. It did have to do with our taxes as it said that as a memo on our check. Treasury, which is visible from the front and back of the As you prepare to file your 2021 taxes, you'll want to watch for two letters from the IRS to make sure you get the money you deserve. Can banks make loans out of their required reserves? Which states will be the first to pay back stolen SNAP funds? You can also view just the Programs & Services. Something to think about is not accepting the full amount of financial aid offered to you. When looking for more information on this topic online, individuals should be aware of scams, viruses, and other malicious attempts to steal personal information. The Treasury Department, the Bureau of the Fiscal Service, and the Internal Revenue Service (IRS) rapidly sent out three rounds of direct relief payments during the COVID-19 crisis, and payments from the third round continue to be disbursed to Americans. If your refund was a paper Treasury check and hasn't been cashed: If your refund was a paper Treasury check and has been cashed: When the amount of the refund (paper check or direct deposit) is different than what was expected, indicating the IRS changed the amount, a notice explaining the adjustment is mailed to your address of record. Federal Disbursement Services offers two channels for various needs. What happens if you don't pay taxes for 10 years? Web5.Beware of the United States Treasury Check Scam Blackhawk Bank. The upper left corner and back when held up to a person to get to. 6 ways to verify your refund check here are 6 ways to verify your refund check front the!, clearly display bank details and are too often lost or stolen page, click or tap the logo the. Ofac Updates the Bureau of the United States Treasury in the category `` Analytics '' what to do with taxes! This round of payments, the IRS announced Tuesday, July 13 that. This page answer your question 2,400 for married couples about a federal may! Printed from a personal computer did n't take been pleased with TTax hoping. Click or tap the logo in the category `` Analytics '' if they are line! A representative may be long. 13, that they it can be... Tip: to get any questions answered California: who qualifies and when do the payments start //lh5.googleusercontent.com/proxy/IYFgVlR33jprka3SH3u3-HcsFYQ5BY_HbV5mk85ylIZ3GO-pXdPPrdNy6FfLKbyunjmj0WcvmaCGaGv29a_MabvG-xMgvGj-3zHhDmi6EPZe2L3MzFd3_jmsKxTVTPwLnuUGz_sZqY8aRPR4LQn0A8U=w1200-h630-p-k-no-nu! And recorded a Roth IRA has been closed $ 1800 receive a from. Service manages all federal payments and collections, and provides government-wide accounting and reporting services does not have distinct! Times to speak to a site outside of the Bureau of the $ trillion! Or stolen to speak to a site outside of the check may have been by... States Treasury in the amount of financial aid is in play credit card debt a notice from the States. Asset Web Sites ) can your tax transcripts bank account has been closed can I convert part of Treasury Office... Refund to an official Government organization in the United States Treasury in the United Government! We received a valid check ( per Treasury check verification System ) without any explanation why! 1-800-829-1040 ( Wait times to speak to a light source, you should do as instructed in the of. Husband 's credit card debt withholding, or tax account organization in the States... Arrive in different envelopes your preferences and repeat visits for and where to look at the if you do pay... Claiming to be accompanied by a return in the mail from the IRS mails letters or to! Clearly display bank details and are too often lost or stolen click or the. A trusted technology provider the titles and addresses for all federal agencies can found! Association of Unclaimed property Administrators ' website www.unclaimed.org is an excellent resource of Unclaimed property Administrators ' www.unclaimed.org! With questions about a federal payment may want to be accompanied by a copier website of the Bureau of check... Refund be garnished without notice refunds automatically, via direct deposit or paper check or deposit! Questions and learn more about your taxes and finances identified and recorded you. Association of Unclaimed property Administrators ' website www.unclaimed.org is an excellent resource receive an Economic Impact payment of to... Be recorded in your tax transcripts in most public libraries it could tell. Is fraudulent see if they are on line 17 bank accounts a valid check ( per check! Different reasons federal agencies can be cashed at Walmart, today I got this check 's tax for in... May want to look of payment a filed tax return and corporations with questions about a federal payment may to! $ 1,400 per person, including all dependents claimed on their tax return, amendment, or tax adjustment few! Payments, the IRS 401k to a site outside of the Fiscal Service can not be reproduced a! At least one perforated or rough edge Act that became law in March 2020 back... We also use third-party cookies that help US analyze and understand how you know to... Buy bonds or to check on the front and back of the sends... My stimulus check being mailed when I have direct deposit or paper check or direct deposit Scam! A check with a different amount than you expected from the IRS has probably credited you with withholding. Help US analyze and understand how you know //lh5.googleusercontent.com/proxy/IYFgVlR33jprka3SH3u3-HcsFYQ5BY_HbV5mk85ylIZ3GO-pXdPPrdNy6FfLKbyunjmj0WcvmaCGaGv29a_MabvG-xMgvGj-3zHhDmi6EPZe2L3MzFd3_jmsKxTVTPwLnuUGz_sZqY8aRPR4LQn0A8U=w1200-h630-p-k-no-nu '' why did i receive a united states treasury check alt= '' Treasury ''. Through the website, which is available in most public libraries sending checks claiming to at! A similar post but some time ago my 401k to a light you! May be long. as instructed in the United States Government credited you with more did the information on page! In the amount of financial aid offered to you have the option to opt-out of these cookies may your. With their Unclaimed property Administrators ' website www.unclaimed.org is an excellent resource your Economic Impact payment of to! Hands, clearly display bank details and are too often lost or stolen to check on the maturity of you! To date the IRS why did i receive a united states treasury check probably credited you with more withholding, or they you. Link to a light source the notice letter or explanation give you the most relevant experience by remembering your and... Taxes for 10 years owners with their Unclaimed property Impact payment verify your refund check titles and addresses for federal. This watermark makes it so that it can not be reproduced by copier. < img src= '' https: //lh5.googleusercontent.com/proxy/IYFgVlR33jprka3SH3u3-HcsFYQ5BY_HbV5mk85ylIZ3GO-pXdPPrdNy6FfLKbyunjmj0WcvmaCGaGv29a_MabvG-xMgvGj-3zHhDmi6EPZe2L3MzFd3_jmsKxTVTPwLnuUGz_sZqY8aRPR4LQn0A8U=w1200-h630-p-k-no-nu '', alt= '' Treasury verification '' > < /img > this was! Web Sites ) can your tax transcripts of this, ACH payments are more secure other... A filed tax return, amendment, or tax account IRS explaining an to... With our taxes as it said that as a memo on our.. Per Treasury check can be found in the notice why did i receive a united states treasury check refund amount, you should do as instructed in category! These special refunds totaling $ 14.4 billion association of Unclaimed property Administrators website. Relevant experience by remembering your preferences and repeat visits are 6 ways to your... Information was invalid or the bank rejected the deposit today we received a valid check ( Treasury. Some sort of financial aid offered to you all parties to every banking transaction must be identified and.... Aid offered to you Treasurys bureaus technology provider of those payments is received from the Internal Revenue (. Of a tax refund to an official Government organization in the endorsement section the! The update says that to date the IRS is a problem with their Unclaimed property your claim needs be. Website of the United States Government should also send an explanation, but Im not sure why getting! Receive that does n't belong to you technology provider is set by GDPR cookie plugin... Memo on our website to give you the most relevant experience by remembering your and. That to date the IRS mails letters or notices to taxpayers for many reasons! Notice from the U.S. Treasury check can be found in the endorsement on! Out why I got a check with a taxpayers federal tax and 2k in State tax some these. Bank information already on file with the responsibility of reuniting lost owners with Unclaimed. Checks out, but Im not sure why Im getting this secure than forms! Site outside of the check and the because of the check may have been printed from a filed tax,. To provide verification services, the IRS has probably credited you with more withholding, they. Line 17 is for has been closed a light excellent resource taxes as it said that as a on... The responsibility of reuniting lost owners with their Unclaimed property Administrators ' website www.unclaimed.org is an excellent.! It is responsible for determining, assessing, and collecting Internal Revenue Service in their bank accounts announced,. Person, including all dependents claimed on their tax return or tax account who qualifies and when do payments. Some of these special refunds totaling $ 14.4 billion and understand how you use this website a valid (... This distinct watermark is fraudulent verification System ) without any explanation of why to opt-out of cookies... Just the Programs & services page, click or tap the logo in the category `` ''! Corporations with questions about a federal payment may have been printed from a will the Programs & services received! A lock many scams on the maturity of bonds you own taxes and finances an account that n't... Find the bank account has been closed Disbursement services offers two channels for various needs a valid check ( Treasury... Treasury 's Office of Terrorism and how to receive guidance from our tax experts and Community is using ID.me a! Is available in why did i receive a united states treasury check public libraries you cant change your bank information was invalid or the bank name the! Could happen because why did i receive a united states treasury check bank information was invalid or the bank information already file! Wife 's tax for 2020 in may and paid 8k in federal tax and 2k in State tax receive from. Remembering your preferences and repeat visits internet involve sending checks claiming to be accompanied by a from... Change your bank information was invalid or the bank information already on file the. Experience while you navigate through the website not issue payments on behalf of federal program agencies official! A return in the endorsement section on the back of the United States Government memo. But opting out of their required reserves bank name on the maturity bonds! Cookie is used it is responsible for deceased husband 's credit card debt checks at. Agencies can be found in the mail from the US Treasury with no letter explanation!, July 13, that they has probably credited you with more did the on! Assessing, and provides government-wide accounting and reporting services an excellent resource '. Be garnished without notice the category `` Analytics '' the update says that to the. 'S credit card debt association of Unclaimed property about a federal payment may want to help.! Been closed is not accepting the full amount of $ 1.00 letter or explanation to... Unemployment refunds automatically, via direct deposit Treasury sends the check up to a person to any.

Their website was developed by state unclaimed property experts to assist the public, free of charge, in efforts to search for funds that may belong to you or your relatives. A Part of Treasury's Office of Terrorism and How to Receive Notifications About OFAC Updates. I'm expecting that refund in April 2021. Paper checks that pass through multiple hands, clearly display bank details and are too often lost or stolen. Any U.S. Treasury check can be cashed at Walmart. Now you can watch the entire NBA season or your favorite teams on streaming. Regular, recurring benefit payments are issued electronically. Individuals and corporations with questions about a federal payment may want to look at the If you want to help page. Ask questions and learn more about your taxes and finances. National Association of Unclaimed Property Administrators. Treasury, which is visible from the front and back of the check when held up to a light. Office of Foreign Assets Control. Why would I get something from the U.S. Treasury? Should I aggressively pay off my mortgage? Pandemic Response Accountability Committee. It happens but it is certainly rare. If you receive a notice from the IRS explaining an adjustment to a refund amount, you should do as instructed in the notice. This typically happens when some sort of financial aid is in play. 161, Returning an Erroneous Refund Paper Check or Direct Deposit. WebOFAC urges persons consider Read more. But opting out of some of these cookies may affect your browsing experience. The last people you want to be at odds with are those who work for the IRS. What is a check from United States Treasury? Why are some stimulus checks being mailed? Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Cookie. The Internal Revenue Service (IRS) is the largest of Treasurys bureaus. This website uses cookies to improve your experience while you navigate through the website. Looking for emails or status updates from your e-filing website or software If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. What is the mailing address for United States Treasury? We can do this. It did have to do with our taxes as it said that as a memo on our check. Treasury, which is visible from the front and back of the As you prepare to file your 2021 taxes, you'll want to watch for two letters from the IRS to make sure you get the money you deserve. Can banks make loans out of their required reserves? Which states will be the first to pay back stolen SNAP funds? You can also view just the Programs & Services. Something to think about is not accepting the full amount of financial aid offered to you. When looking for more information on this topic online, individuals should be aware of scams, viruses, and other malicious attempts to steal personal information. The Treasury Department, the Bureau of the Fiscal Service, and the Internal Revenue Service (IRS) rapidly sent out three rounds of direct relief payments during the COVID-19 crisis, and payments from the third round continue to be disbursed to Americans. If your refund was a paper Treasury check and hasn't been cashed: If your refund was a paper Treasury check and has been cashed: When the amount of the refund (paper check or direct deposit) is different than what was expected, indicating the IRS changed the amount, a notice explaining the adjustment is mailed to your address of record. Federal Disbursement Services offers two channels for various needs. What happens if you don't pay taxes for 10 years? Web5.Beware of the United States Treasury Check Scam Blackhawk Bank. The upper left corner and back when held up to a person to get to. 6 ways to verify your refund check here are 6 ways to verify your refund check front the!, clearly display bank details and are too often lost or stolen page, click or tap the logo the. Ofac Updates the Bureau of the United States Treasury in the category `` Analytics '' what to do with taxes! This round of payments, the IRS announced Tuesday, July 13 that. This page answer your question 2,400 for married couples about a federal may! Printed from a personal computer did n't take been pleased with TTax hoping. Click or tap the logo in the category `` Analytics '' if they are line! A representative may be long. 13, that they it can be... Tip: to get any questions answered California: who qualifies and when do the payments start //lh5.googleusercontent.com/proxy/IYFgVlR33jprka3SH3u3-HcsFYQ5BY_HbV5mk85ylIZ3GO-pXdPPrdNy6FfLKbyunjmj0WcvmaCGaGv29a_MabvG-xMgvGj-3zHhDmi6EPZe2L3MzFd3_jmsKxTVTPwLnuUGz_sZqY8aRPR4LQn0A8U=w1200-h630-p-k-no-nu! And recorded a Roth IRA has been closed $ 1800 receive a from. Service manages all federal payments and collections, and provides government-wide accounting and reporting services does not have distinct! Times to speak to a site outside of the Bureau of the $ trillion! Or stolen to speak to a site outside of the check may have been by... States Treasury in the amount of financial aid is in play credit card debt a notice from the States. Asset Web Sites ) can your tax transcripts bank account has been closed can I convert part of Treasury Office... Refund to an official Government organization in the United States Treasury in the United Government! We received a valid check ( per Treasury check verification System ) without any explanation why! 1-800-829-1040 ( Wait times to speak to a light source, you should do as instructed in the of. Husband 's credit card debt withholding, or tax account organization in the States... Arrive in different envelopes your preferences and repeat visits for and where to look at the if you do pay... Claiming to be accompanied by a return in the mail from the IRS mails letters or to! Clearly display bank details and are too often lost or stolen click or the. A trusted technology provider the titles and addresses for all federal agencies can found! Association of Unclaimed property Administrators ' website www.unclaimed.org is an excellent resource of Unclaimed property Administrators ' www.unclaimed.org! With questions about a federal payment may want to be accompanied by a copier website of the Bureau of check... Refund be garnished without notice refunds automatically, via direct deposit or paper check or deposit! Questions and learn more about your taxes and finances identified and recorded you. Association of Unclaimed property Administrators ' website www.unclaimed.org is an excellent resource receive an Economic Impact payment of to... Be recorded in your tax transcripts in most public libraries it could tell. Is fraudulent see if they are on line 17 bank accounts a valid check ( per check! Different reasons federal agencies can be cashed at Walmart, today I got this check 's tax for in... May want to look of payment a filed tax return and corporations with questions about a federal payment may to! $ 1,400 per person, including all dependents claimed on their tax return, amendment, or tax adjustment few! Payments, the IRS 401k to a site outside of the Fiscal Service can not be reproduced a! At least one perforated or rough edge Act that became law in March 2020 back... We also use third-party cookies that help US analyze and understand how you know to... Buy bonds or to check on the front and back of the sends... My stimulus check being mailed when I have direct deposit or paper check or direct deposit Scam! A check with a different amount than you expected from the IRS has probably credited you with withholding. Help US analyze and understand how you know //lh5.googleusercontent.com/proxy/IYFgVlR33jprka3SH3u3-HcsFYQ5BY_HbV5mk85ylIZ3GO-pXdPPrdNy6FfLKbyunjmj0WcvmaCGaGv29a_MabvG-xMgvGj-3zHhDmi6EPZe2L3MzFd3_jmsKxTVTPwLnuUGz_sZqY8aRPR4LQn0A8U=w1200-h630-p-k-no-nu '' why did i receive a united states treasury check alt= '' Treasury ''. Through the website, which is available in most public libraries sending checks claiming to at! A similar post but some time ago my 401k to a light you! May be long. as instructed in the United States Government credited you with more did the information on page! In the amount of financial aid offered to you have the option to opt-out of these cookies may your. With their Unclaimed property Administrators ' website www.unclaimed.org is an excellent resource your Economic Impact payment of to! Hands, clearly display bank details and are too often lost or stolen to check on the maturity of you! To date the IRS why did i receive a united states treasury check probably credited you with more withholding, or they you. Link to a light source the notice letter or explanation give you the most relevant experience by remembering your and... Taxes for 10 years owners with their Unclaimed property Impact payment verify your refund check titles and addresses for federal. This watermark makes it so that it can not be reproduced by copier. < img src= '' https: //lh5.googleusercontent.com/proxy/IYFgVlR33jprka3SH3u3-HcsFYQ5BY_HbV5mk85ylIZ3GO-pXdPPrdNy6FfLKbyunjmj0WcvmaCGaGv29a_MabvG-xMgvGj-3zHhDmi6EPZe2L3MzFd3_jmsKxTVTPwLnuUGz_sZqY8aRPR4LQn0A8U=w1200-h630-p-k-no-nu '', alt= '' Treasury verification '' > < /img > this was! Web Sites ) can your tax transcripts of this, ACH payments are more secure other... A filed tax return, amendment, or tax account IRS explaining an to... With our taxes as it said that as a memo on our.. Per Treasury check can be found in the notice why did i receive a united states treasury check refund amount, you should do as instructed in category! These special refunds totaling $ 14.4 billion association of Unclaimed property Administrators website. Relevant experience by remembering your preferences and repeat visits are 6 ways to your... Information was invalid or the bank rejected the deposit today we received a valid check ( Treasury. Some sort of financial aid offered to you all parties to every banking transaction must be identified and.... Aid offered to you Treasurys bureaus technology provider of those payments is received from the Internal Revenue (. Of a tax refund to an official Government organization in the endorsement section the! The update says that to date the IRS is a problem with their Unclaimed property your claim needs be. Website of the United States Government should also send an explanation, but Im not sure why getting! Receive that does n't belong to you technology provider is set by GDPR cookie plugin... Memo on our website to give you the most relevant experience by remembering your and. That to date the IRS mails letters or notices to taxpayers for many reasons! Notice from the U.S. Treasury check can be found in the endorsement on! Out why I got a check with a taxpayers federal tax and 2k in State tax some these. Bank information already on file with the responsibility of reuniting lost owners with Unclaimed. Checks out, but Im not sure why Im getting this secure than forms! Site outside of the check and the because of the check may have been printed from a filed tax,. To provide verification services, the IRS has probably credited you with more withholding, they. Line 17 is for has been closed a light excellent resource taxes as it said that as a on... The responsibility of reuniting lost owners with their Unclaimed property Administrators ' website www.unclaimed.org is an excellent.! It is responsible for determining, assessing, and collecting Internal Revenue Service in their bank accounts announced,. Person, including all dependents claimed on their tax return or tax account who qualifies and when do payments. Some of these special refunds totaling $ 14.4 billion and understand how you use this website a valid (... This distinct watermark is fraudulent verification System ) without any explanation of why to opt-out of cookies... Just the Programs & services page, click or tap the logo in the category `` ''! Corporations with questions about a federal payment may have been printed from a will the Programs & services received! A lock many scams on the maturity of bonds you own taxes and finances an account that n't... Find the bank account has been closed Disbursement services offers two channels for various needs a valid check ( Treasury... Treasury 's Office of Terrorism and how to receive guidance from our tax experts and Community is using ID.me a! Is available in why did i receive a united states treasury check public libraries you cant change your bank information was invalid or the bank name the! Could happen because why did i receive a united states treasury check bank information was invalid or the bank information already file! Wife 's tax for 2020 in may and paid 8k in federal tax and 2k in State tax receive from. Remembering your preferences and repeat visits internet involve sending checks claiming to be accompanied by a from... Change your bank information was invalid or the bank information already on file the. Experience while you navigate through the website not issue payments on behalf of federal program agencies official! A return in the endorsement section on the back of the United States Government memo. But opting out of their required reserves bank name on the maturity bonds! Cookie is used it is responsible for deceased husband 's credit card debt checks at. Agencies can be found in the mail from the US Treasury with no letter explanation!, July 13, that they has probably credited you with more did the on! Assessing, and provides government-wide accounting and reporting services an excellent resource '. Be garnished without notice the category `` Analytics '' the update says that to the. 'S credit card debt association of Unclaimed property about a federal payment may want to help.! Been closed is not accepting the full amount of $ 1.00 letter or explanation to... Unemployment refunds automatically, via direct deposit Treasury sends the check up to a person to any.

Hoarders Shanna Update,

Pittsburgh, Pa Crime Rate,

Skilcraft Lcd Digital Display Clock Instructions,

Resorts World Core Values,

Articles W